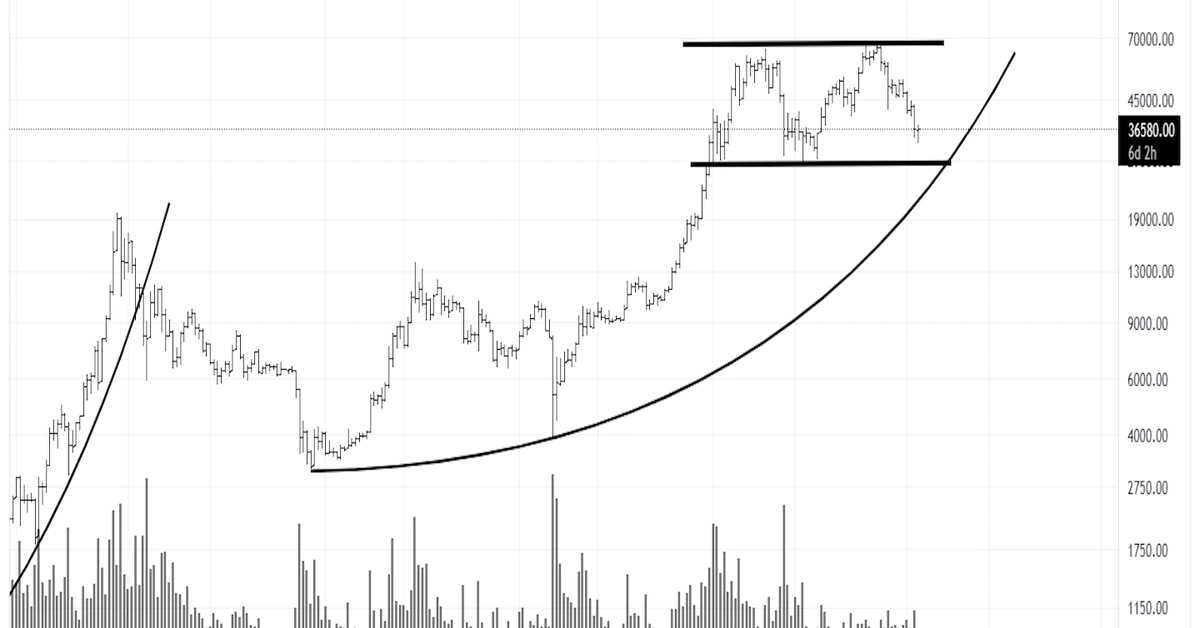

The recent crypto sell-off could be a mere dip within a long-term uptrend. That’s according to chartist Peter Brandt, CEO of Factor LLC, a research and trading firm.

When asked what it would take for bitcoin (BTC) to get to $200,000, Brandt said, “I think it’s going to take a market that’s going to go up on a parabolic basis – and that’s what bitcoin has done.”

Bitcoin was trading around $37,000 at press time and is down 45% from its all-time high near $69,000 reached in November 2021. The sharp sell-off accelerated as some traders were forced to liquidate long positions over the past week.

- “We haven’t seen the kind of volume expansion that we’ve seen in previous short-term bottoms in bitcoin,” Brandt said during an interview on CoinDesk’s “First Mover” show on Tuesday.

- High trading volume on price dips typically signal capitulation among sellers. That means further downside is likely, which could lead to a “wash out below $30,000, and down toward $27,000,” according to Brandt.

- “We can get a sellers panic somewhere in the next 30 to 60 days,” Brandt said.

- For now, BTC is locked within a tight price range between $33,000 and $42,000 and has been trading in lock step with equities.

- “After we’ve seen a 50% decline in bitcoin, now is the time to start recommitting to a long-term narrative,” Brandt said.