Bitcoin (BTC) fell further pre-Wall Street on Feb. 3 as analysis revealed old resistance levels had returned to haunt bulls.

$38,600 is back

Data from Cointelegraph Markets Pro and TradingView painted another uninspiring picture for BTC/USD Thursday, with the pair meeting new lows of $36,275 on Bitstamp.

After shock tech stock moves during Wednesday’s trading session, the knock-on effect for crypto remained palpable as major tokens struggled to stabilize.

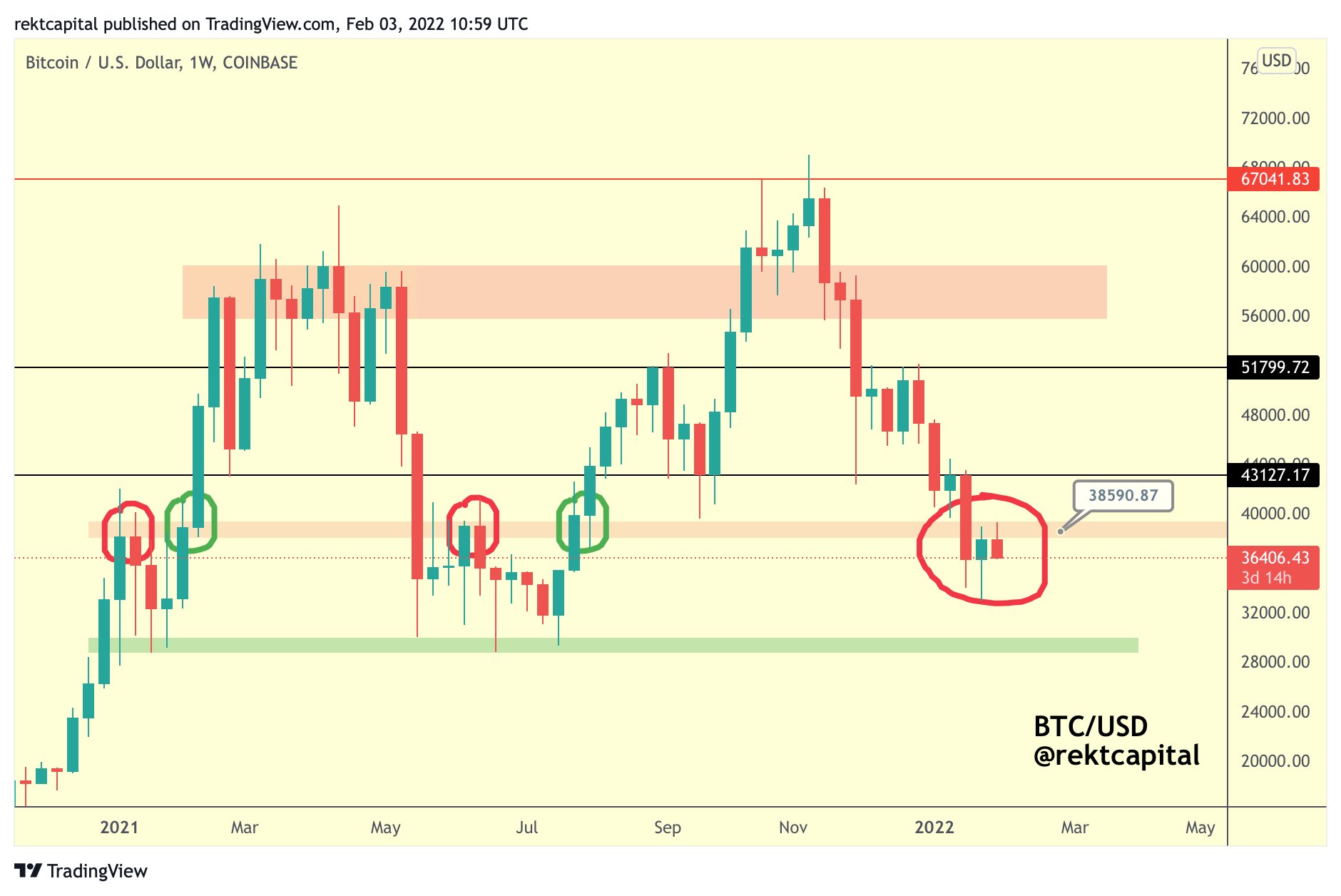

Zooming out, popular trader and analyst Rekt Capital revealed the area at $38,600 — a stumbling block at several points in 2021 — was once again acting as a line in the sand for bulls to cross.

“Indeed, BTC produced an upside wick into resistance on its latest recovery,” he tweeted.

“For the time being, this ~$38600 area continues to figure as resistance.”

For others, including fellow trader Anbessa, it was a case of “the lower, the better” for Bitcoin, this chiming with existing expectations of a more significant breakdown occurring before a full recovery.

#BTC Update

– dead cat inside LTF rising wedge, breakout & continuation

– current support levels mid range, M-neckline & downtrending channel (since Nov21)The lower we go the better r:r ratio for a new #midterm LONG entry. Eg nuke scenario (right) crowded greedy entry pic.twitter.com/nCJVcHiQjc

— AN₿ESSA (@Anbessa100) February 3, 2022

Tech stock trouble meanwhile erased positive sentiment from other macro cues, with Russia’s proposal to allow banks to sell Bitcoin and India’s new crypto tax proposal taking a back seat.

Puell Multiple returns to classic oversold territory

Turning to on-chain metrics, it was the turn of the Puell Multiple this week to follow Bitcoin’s relative strength index (RSI) in printing a major “oversold” signal.

Related: Bitcoin whales buy at $38K as BTC supply per whale hits 10-year high

Created by David Puell, the popular indicator uses miner revenues relative to spot price to determine when the latter is overly high or low.

Currently, the Puell Multiple is trending down, and already at its lowest since June 2021, the mid-point of a previous retracement after China banned mining.