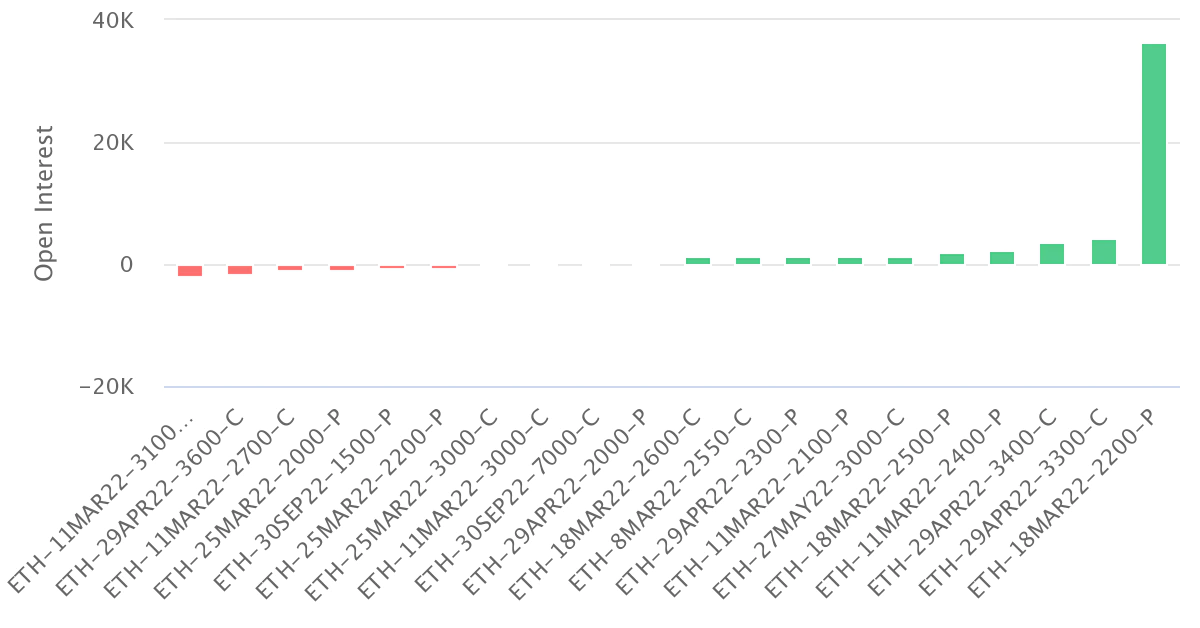

A single trader or several traders bought more than 36,000 contracts of Deribit-listed ether put option expiring on March 18, of which more than 20,000 were blocked on institution-focused over-the-counter tech platform Paradigm, according to Swiss-based data tracking firm Laevitas. The put option buyers would make money if ether drops below $2,200 by March 18. That’s a roughly 13% decline from the current market price of $2,514.

Large Ether Options Flow Guards Against Price Slide Below $2.2K