Africa’s fintech startups are reported to have raised $2 billion in the past year alone. This amount dwarfs the $231 million that was raised in the year 2020. Nigerian startups continue to account for the biggest share of funds raised by the continent’s fintechs in 2021.

2021 Has Highest Number of Reported Deals

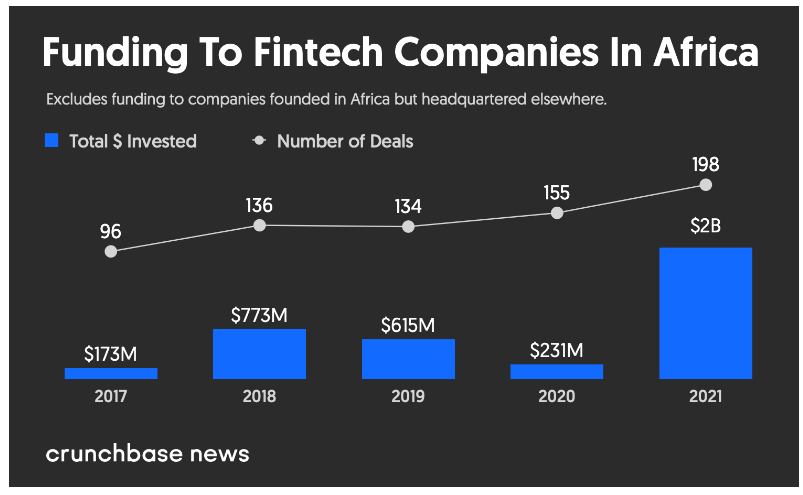

The capital raised by Africa-based fintech startups in 2021 shot to $2 billion, a figure that is almost ten times the $231 million that was raised in 2020, data from Crunchbase News has shown. The figure, which is also the new all-time high, dwarfs the previous high of $773 million that was recorded in 2018.

In terms of the number of deals that were concluded, the Crunchbase data also shows that 2021 has the highest number of deals recorded in a single year — about 198. This is an increase of almost 30% from the 155 deals that were recorded in 2020, the data suggests. The 2021 deals are also more than double the 96 that were recorded in 2017.

A further breakdown of the data suggests that Nigerian payments infrastructure giant Flutterwave is now one of the African continent’s most valued fintech startups. The startup’s valuation of $3 billion follows Flutterwave’s successful funding rounds that culminated with the announcement of a $250 million capital raise in early 2022. Still, in its report, Crunchbase News clarifies that Flutterwave’s latest capital raise is excluded from the $2 billion that was raised in 2021.

Main Sources for Africa’s Fintech Funding Activity

As the data also shows, another Nigerian startup, Opay, was able to top Flutterwave’s raise after it raked in $570 million. The funding rounds give the Lagos-based mobile payments fintech startup a valuation of $2 billion.

Senegal-based Wave Mobile Money is one of the few non-Nigerian fintech startups that also reported successful funding rounds in 2021. According to the data, the company was able to raise $200 million in 2021 thus giving it a valuation of $1.7 billion.

Meanwhile, another report said the main sources for Africa’s fintech funding activity during the past year were U.S. venture capital (VC) funds, large corporations, and Asian investors.

What are your thoughts on this story? Tell us what you think in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.