Aminhossein “Amin” Rad runs an over-the-counter trading desk in Dubai, United Arab Emirates. Searching for a business after dropping out of university, he started to style himself as a Bitcoin broker in 2016. Starting with his first deal after five months of wading through scammers and tire-kickers, Rad went on to found Crypto Desk, a business-to-business exchange that now deals millions of dollars of private crypto transactions among its 2,500 clients every day.

But why do people use OTC desks when centralized exchanges offer lower fees, and what dangers come with the business? Rad spills the beans on a sector of the crypto world that flies under the radar for most retail traders.

The devil is in the deal-tails

The crypto asset industry has its share of rampant unethical behavior that is encouraged by anonymity and a lack of regulation or enforcement. Having come across all types of scams over his years in the industry, Rad differentiates between what he calls soft scams and hard scams. The former are things such as indirect and impersonal rug-pulls, while the latter are more direct and targeted.

He says most buyers see “shitcoins and memecoins as a joke or a game,” and relatively few experience much emotional trauma when the game ends and prices take a nosedive. However, getting scammed is far from a joke when a serious investor is looking to invest a portion of their hard-earned wealth into the crypto market or cashing out to buy real estate.

“The psychological effects of hard scams are much more deteriorating” in part because they are direct, playing on the mark’s trust rather than greed, and the money is not always an amount that the victim can afford to lose. Rad goes on to explain the common scams.

Third-party scam

A third-party scam involves a cybercriminal who finds a buyer and seller, introduces themselves as a broker, and offers an attractive deal to both. Rad explains that after building trust and “playing mind games,” the scammer will convince both the buyer and seller to meet in person for the exchange, with perhaps the buyer arriving at the seller’s office with cash.

Between these transacting parties will be a broker, or, more commonly at least, what appears to be a chain of brokers. The buyer will share their address with the broker, who will instead forward their own address to the seller. The seller then “transfers the coins to the address without thinking twice because the cash is right in front of him, and the coins will arrive in the cybercriminal’s wallet,” Rad explains. With a suitcase of money on the table, chaos will ensue as the BTC fails to arrive.

“Huge volumes of money can disappear in a second — even professional people who get scammed once can sometimes get distracted and lose focus, only to fall victim again.”

Fake crypto coin scam

A fake crypto coin scam involves the scammer sending a different, usually worthless cryptocurrency to the buyer who mistakes it for the real thing. This could be as simple as sending Bitcoin Cash or Ethereum Classic instead of BTC or ETH. Often, it involves the creation of an entirely new token that looks like the real thing when it arrives in the buyer’s MetaMask wallet. This is easily done because “Ethereum is an open platform, and anyone can create any coin they want, like USDTx in place of USDT,” Rad stresses. To be sure, one should check the smart contract — don’t trust, verify.

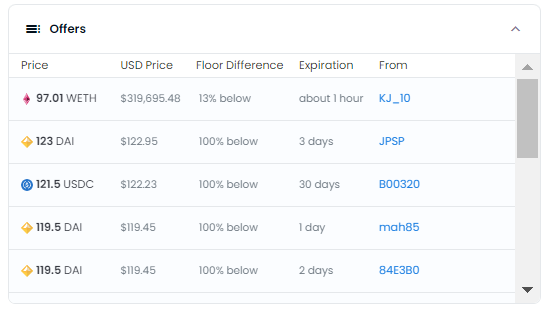

A variant of this has been seen on NFT marketplace OpenSea, where buyers can bid in Ether or stablecoins USDC or Dai, both of which are worth $1 each. As the Dai symbol can be mistaken for that of Ether’s, an inexperienced or tired user might accept a bid of 79 Dai on their 80-ETH NFT, only to realize too late that they are down by a quarter of a million dollars. While it can be argued whether such a transaction is a scam in the legal sense since there is no direct misrepresentation, those making such offers in bad faith are surely bankrupt in terms of morality.

Transfer recall scam

A transfer recall scam works by way of chargebacks, where a dishonest buyer of a cryptocurrency sends funds to the seller, receives cryptocurrency, and goes on to file a fraudulent complaint with their bank or payment provider, alleging that they themselves have fallen victim to a scam.

“Some banks immediately return the money,” Rad says. “This is actually one of the most difficult types of scams to follow up on” because neither banks nor the police are likely to understand much about cryptocurrency.

“Let’s say this case goes to court — you will end up having to pay the government to hire a specialist to make sure that you transferred cryptocurrency to that guy. It is very difficult unless you have powerful lawyers and are willing to spend a lot of money,” Rad describes.

Wallet import scam

A wallet import scam happens when a seller of cryptocurrency says that they cannot send directly to the buyer’s wallet by way of a public address but insists that the Bitcoin must be imported. “They import a watch-only address to your wallet,” Rad says, referring to a setting that allows the wallet to mirror an address it does not control.

“If you are not experienced, you will open your wallet and think, ‘Ooh, I have 100 Bitcoins here in my wallet,’ and you will hand over the cash, but later on, when you try to sell the Bitcoins, you understand that the coins are not transferable.”

In order to pull off this scam successfully, the scammer must generally know which Bitcoin wallet the unwitting buyer is using. “You should never tell anyone what wallet you’re using. It’s none of their business. If the cryptocurrency is sent correctly, it will be received correctly,” Rad warns, using the analogy that you do not need to know whether someone is using an iPhone or Nokia in order to call them.

Of course, you should never allow anyone to see your seed phrases or private keys or hand them your wallet for any reason, he adds.

In addition to avoiding scams, Rad recommends that anyone conducting OTC trades should take care to obtain and verify the identity of the other party and, regardless of regulations, sign an agreement stating that they have exchanged cryptocurrency and fiat with each other.

The workings of an OTC desk

Now in his mid-20s, Rad was born to a Middle Eastern family and grew up in Dubai, UAE. In 2012, he enrolled in an electrical engineering program at the American University of Sharjah, just north of Dubai. After studying in Sharjah for three years, he was not entirely satisfied with his prospects and dreamed of moving to America, receiving acceptances to continue his electrical engineering studies at both Stanford and the University of Texas at Austin. Despite what would appear to be a solid opportunity, Rad felt a deeper call to start a business back home in the UAE and decided not to move to the United States. He decided to drop out, as he saw no future in engineering.

“I wanted to get into the technology business, but I didn’t know what to start with,” Rad recalls. It was around then that he heard Bitcoin and blockchain being discussed in his friend circles. “I got curious, so I independently went on to learn about this technology — blockchain and decentralization,” he explains.

“There was no example in this region that I could follow — all the blockchain entrepreneurs were in China and the USA. There was no one here who was doing blockchain entrepreneurship.”

Soon he found an opportunity: There was money to be made by brokering Bitcoin deals. Rad started to seek out contacts who were interested in buying or selling cryptocurrency and connecting them. “A lot of them were non-serious, and a lot of them were scammers,” he recalls, adding that filtering serious traders from time-wasters was a drain. Introducing himself as a broker and getting business through word of mouth, he also used online platforms like LocalBitcoins to find business. Often, he would pass referral fees to those introducing new clients.

“It took five months until I made my first deal. For five months, I kept encountering non-serious people and scammers — a lot of scammers.”

Rad explains that the margins on OTC transactions were higher in the early days, with 2%–3% being common in 2016 and 2017. “Now, there are more competitors in the market,” and rates have gone down, while volume has risen. Exact percentages change constantly according to market demand, but “the golden number is half a percent” for high-volume deals, while lower-volume retail traders can expect to pay double or triple. While he describes $1-million and $2-million transactions as common, “anything over $1 million is considered high volume,” Rad says.

Business was informal at first, and Rad came up with the Crypto Desk name in 2018. The company received a crypto trading license in early 2021, which he says makes the business easier and safer “because we can work in a regulated space instead of a gray one.”

More than margins have changed since the early days. “At the moment, most deals on the OTC market are in USDT,” Amin states, which is a departure from the past when most people looked to buy or sell specific quantities of Bitcoin. USDT is easy to exchange into any cryptocurrency on both centralized and decentralized exchanges or back into fiat. While USDC and Dai appear to be held in higher regard in DeFi and NFT circles, “most people who use USDT are not so familiar with blockchain, and are afraid to change to another stablecoin,” Rad admits. USDT was the first stablecoin, after all.

As Crypto Desk deals only in UAE dirhams, whose exchange rate has been pegged at 3.6725 dirhams to the U.S. dollar since 1997, exchanging USD stablecoins and AED is a relatively straightforward process with little exchange risk.

“My daily turnover is $4 million–$5 million, but that comes from several different transactions,” Rad clarifies, adding that all of his clients are based in the UAE. He explains that there is a natural balance to the business, with UAE locals tending to be buyers looking to allocate money into the crypto sphere, while those from abroad are most often looking to sell cryptocurrency “in order to purchase real estate, cars, and pay their living expense in the UAE,” Rad explains.

“In my opinion, the UAE will be the center of blockchain in the world.”

In the future, Rad foresees his localized model thriving around the world. Though the market is now controlled largely by big players, Rad believes that “local exchanges have better knowledge of the local market’s needs and regulations.”

So, what about the mythical buyer who is looking for $100 million in cryptocurrency?

“They exist. I can facilitate up to $30 million per day, but I don’t find them,” he says, adding that $4 million–$6 million is the maximum he regularly sees from any single client. When a large order comes in, it falls onto Rad to figure out if the deal is real, a process he says takes only two or three minutes.

“When I see them, I understand: Are they a $100-million person or not?” Rad says with marked confidence. For him, conversation is a better marker of seriousness than appearance. “Most scammers have branded items, and most serious people try to keep a low profile,” he concludes.