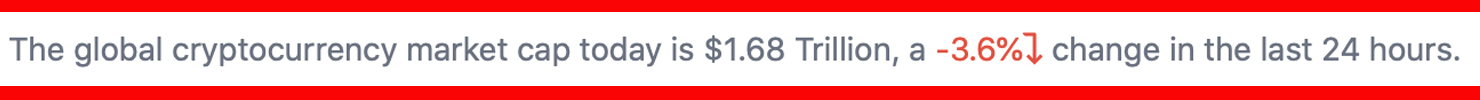

The crypto economy has dropped considerably in value during the last five weeks, slipping 23.28% from $2.19 trillion to today’s $1.68 trillion. Furthermore, both bitcoin and ethereum are awfully close to sinking 50% below the all-time highs recorded six months ago.

Bitcoin Sinks Lower Against the US Dollar, 39% Down in 30 Days

Digital currency markets have been in the red during the last few weeks, as a great number of crypto assets have seen significant percentage losses. During the last 24 hours, the crypto economy has shed 3.6% against the U.S. dollar. Bitcoin (BTC) dropped to a low on Saturday evening around 11:00 p.m. (ET), hitting $34,279 per unit.

Presently, BTC is below the $35K mark and since the all-time high ($69K) on November 10, 2021, BTC has lost 49.6%. At the time of writing, BTC’s market valuation is around $662 billion, which equates to 39.4% of the $1.68 trillion crypto economy.

BTC’s most dominant trading pair today is tether (USDT) with 57.03% of all trades, followed by USD with 13.76% of today’s trades. The stablecoin BUSD represents 7.32% of all BTC-denominated trades on Sunday. $26.7 billion of today’s $99.6 billion in global trades are all bitcoin (BTC) swaps. That means 26.8% of Sunday’s aggregate crypto trade volume derives from BTC trades. Year-to-date statistics show BTC is down 39.3% and during the last month BTC has shed 20% in value against the U.S. dollar.

Ethereum’s Value Falls Losing 20% Since Last Month

Ethereum (ETH) has also shed a significant amount of value in recent times. While BTC hit a low of $34,279 per unit on Saturday evening, ETH slipped to a low of $2,518 per unit at the same time. Currently, ethereum (ETH) is exchanging hands for prices just under $2,600 and it has $17.7 billion in global trades today. Tether (USDT) is ethereum’s top trading pair today with 59.32% of all trades. The USDT/ETH pairs are followed by USD pairs (9.70%) and bitcoin (8.36%) trading pairs.

Since ethereum’s all-time high six months ago at $4,878 per unit, the price has lost 47.3% from the price high. Still, ETH commands a dominance rating of around 18.48% of the $1.68 trillion crypto economy. Ethereum’s market valuation is around $310.12 billion at the time of writing. Year-to-date statistics show ETH has lost 26.5% and 30 day statistics shows ETH is down 20.5%.

While bitcoin, ethereum, and a number of digital assets are down quite a bit this week, four different crypto assets have seen double digit gains during the last seven days. Algorand (ALGO) is up 33.2%, tron (TRX) is up 32.8%, curve (CRV) has gained 20.9%, and helium (HNT) is up 13.8%. Apecoin (APE) suffered the week’s deepest losses losing 39.7%, and cronos (CRO) shed 24.8% against the U.S. dollar this past week.

What do you think about the crypto economy’s current downward spiral? Do you expect prices to rebound in the near future? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.