After the collapse of Terra’s once-stable coin terrausd (UST), a number of people wondered where the Luna Foundation Guard’s (LFG) bitcoin went, as the funds were supposed to be used to defend the UST’s $1 parity. On Friday, the blockchain intelligence and analytics firm, Elliptic, published a blog post that summarizes where the bitcoin was sent, according to the firm’s network surveillance tools.

LFG Bitcoin Stash Deposited Into 2 Digital Currency Exchanges According to Elliptic’s Blockchain Analytics Software

While reflecting on the recent crypto market chaos and the Terra stablecoin implosion, a great number of people on forums and social media asked the question: “Where is LFG’s Bitcoin reserve?” For instance, this weekend on Twitter one individual wrote:

Luna Foundation Guard (LFG) had a bitcoin reserve that was worth over $3B before the UST and Luna crisis began. But the LFG reserve wallet is now empty but it was reported that Bitcoins weren’t used to calm the crisis. Then where did the Bitcoins go to? People need answers.

Furthermore, on May 13, Terra’s founder Do Kwon told the public that the team was planning to update the crypto community on the subject of the bitcoin (BTC) reserves.

“We are currently working on documenting the use of the LFG BTC reserves during the de-pegging event,” Kwon said. “Please be patient with us as our teams are juggling multiple tasks at the same time.” Following Kwon’s Twitter thread, the blockchain analytics company Elliptic published a blog post that explains the LFG’s BTC moves in more detail.

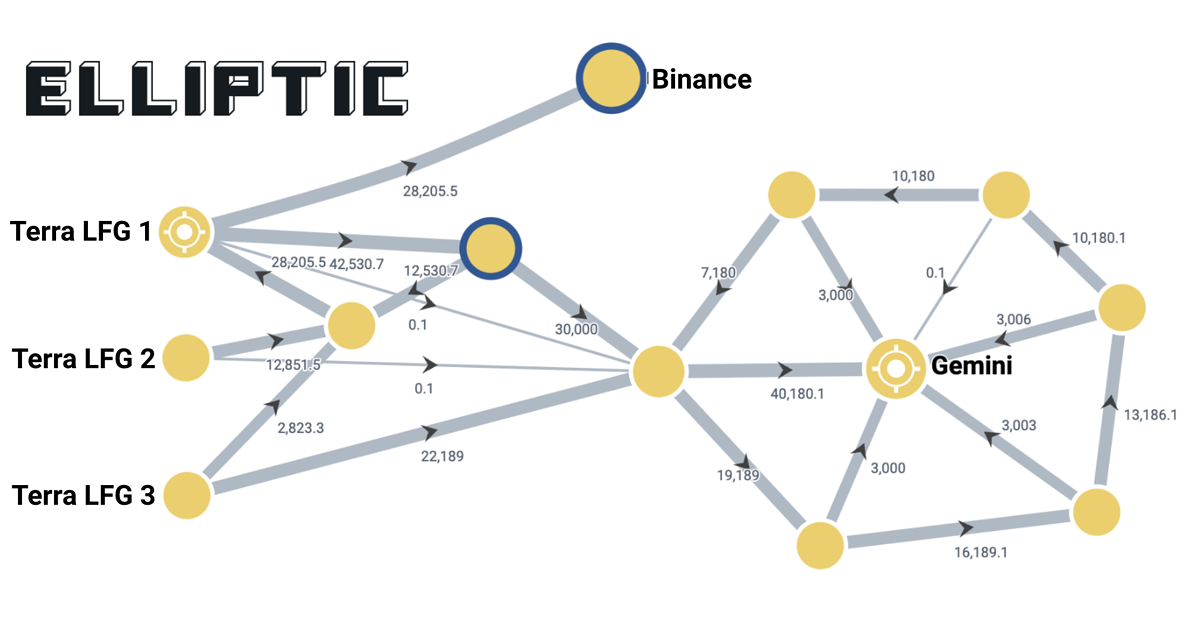

When the nonprofit organization LFG decided to move the bitcoin on May 9, Elliptic’s blockchain analytics software monitored the situation. After LFG revealed it would loan $750 million in BTC to market makers, Elliptic’s blog post details that Kwon clarified LFG would use the BTC “to trade.” Then Elliptic’s software caught two transactions worth 52,189 BTC sent to a new address tied to the LFG stash.

80,394 Bitcoin Moved From LFG’s Stash

In addition to the 52,189 BTC, LFG held another wallet with 28,205 BTC, and LFG’s entire bitcoin reserve added up to approximately 80,394 bitcoin (BTC) total. According to Elliptic, all the funds were sent to Binance and Gemini amid the market chaos.

“The entirety of this 52,189 BTC was subsequently moved to a single account at Gemini, the US-based cryptocurrency exchange – across several bitcoin transactions,” Elliptic said on Friday. “It is not possible to trace the assets further or identify whether they were sold to support the UST price.” The blog post adds:

This left 28,205 BTC in Terra’s reserves. At 1 a.m. UTC on May 10th, this was moved in its entirety, in a single transaction, to an account at the cryptocurrency exchange Binance. Again it is not possible to identify whether these assets were sold or subsequently moved to other wallets.

Bitcoin.com News also looked into the onchain movements and confirmed that Elliptic’s summary was accurate. For instance, the LFG bitcoin wallet interacted with this bitcoin address, and the wallet is flagged as a Binance hot wallet. Oxt.me data has an annotation written by Ergobtc that says it’s the trading platform’s “central hot wallet.” The wallet was created on October 8, 2021, and 9.5 million BTC has passed through the wallet.

LFG’s bitcoin wallet also interacted with this address which also has an oxt.me annotation that says it’s a Gemini exchange address. The address created on June 13, 2017, has seen a total of 1,284,918 BTC pass through the bitcoin wallet. While the Binance hot wallet still contains BTC for hot wallet services, the Gemini exchange address has a zero balance on May 14, 2022.

What do you think about Elliptic’s summary of the LFG bitcoin stash and movements? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Elliptic

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.