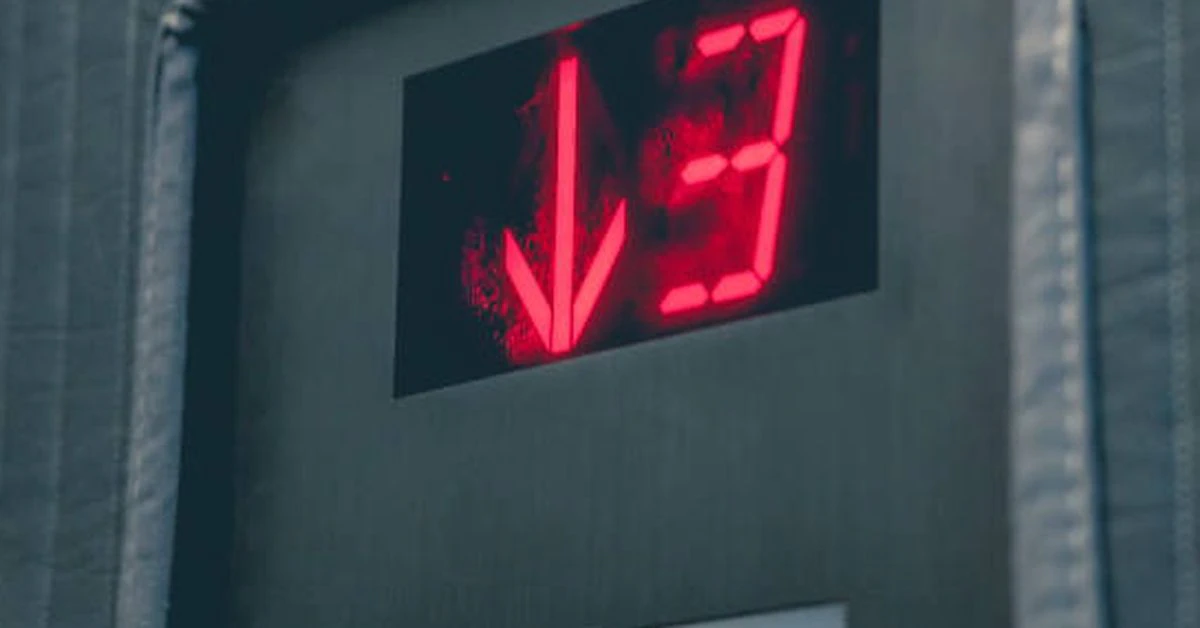

After climbing promisingly earlier this week, equity markets returned to a more familiar slog with the Nasdaq, S&P 500 and Dow Jones Industrial Average (DJIA) falling 0.7, 1% and 1.1%, respectively. Investors will be eyeing Friday’s U.S. unemployment and labor participation reports for September, although the former is widely expected to remain in the neighborhood of its current 3.7% rate, increasing the likelihood of the U.S. central bank continuing its current monetary hawkishness and a so-called hard economic landing.

The Crash of Three Arrows Capital’s Starry Night Portfolio Shows NFTs Lack of Staying Power; Bitcoin Regains $20K After Earlier Drop