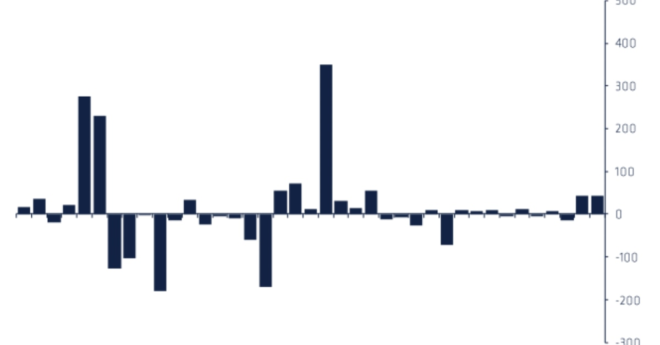

Short investment products, which bet on the price of an asset to drop, accounted for 75% of all inflows, a report by digital asset investment and trading group CoinShares found. Inflows for bitcoin (BTC) totaled $14 million, but considering the popularity of short-term investment vehicles, net flows added up to a negative $4.3 million.

Investors Short Crypto Assets as Industry Scrutiny Intensifies