2022 has been an interesting year for stablecoin assets as the market capitalization of the entire stablecoin economy lost just over $28 billion in value. Moreover, more than $3 billion has been erased from the stablecoin economy during the last 23 days as BUSD shed roughly 23.3% during the last month.

Over $3 Billion in USD Value Has Been Erased From the Stablecoin Economy in 23 Days

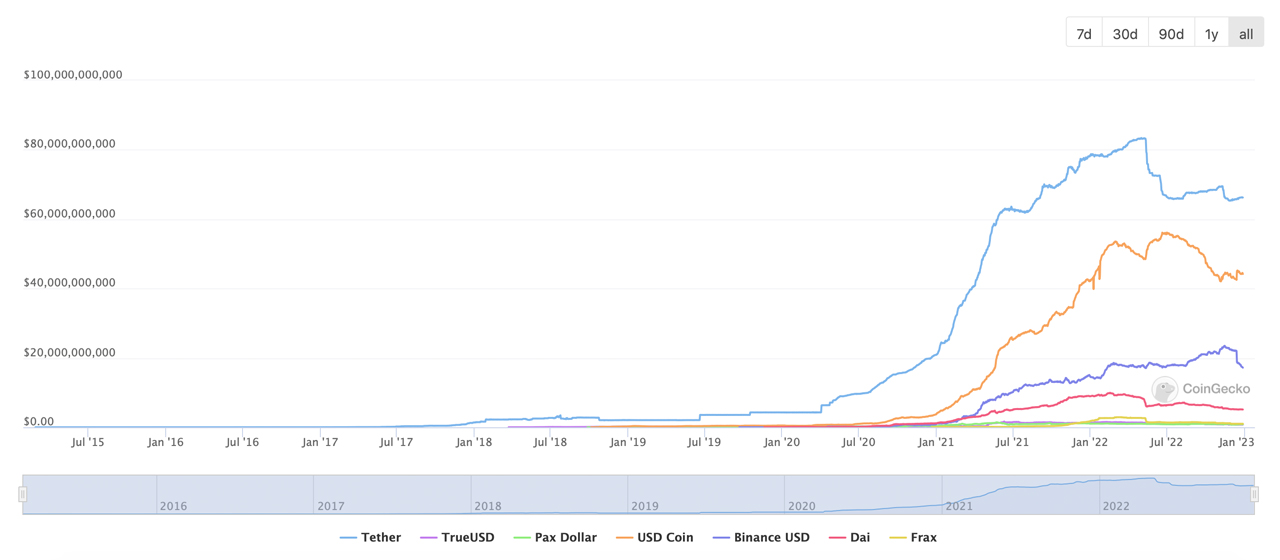

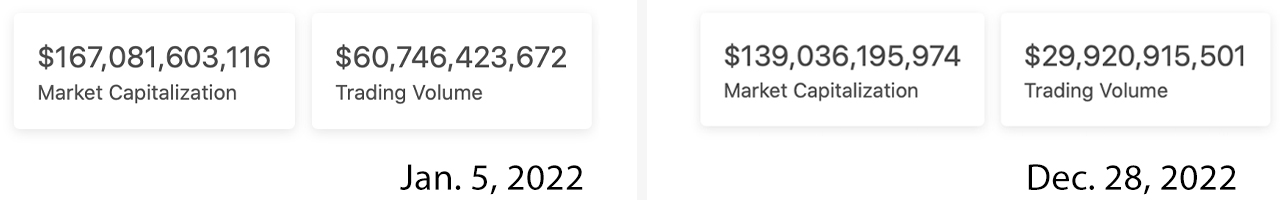

The market valuation of stablecoins has continued to slide and since Jan. 2022, $28.08 billion in U.S. dollar value has left the stablecoin economy. Archived data indicates that the stablecoin economy was valued at $167.08 billion on Jan. 5, 2022, and today it’s valued at $139.06 billion or 16.77% lower than the first week of the year.

The stablecoin economy has not been this low in U.S. dollar value since Oct. 23, 2021, or around 14 months ago. In Jan. 2022, tether (USDT) had a market capitalization of around $77.14 billion, and today it’s down to $66.25 billion.

Usd coin’s (USDC) valuation 14 months ago was $42.74 billion and this week USDC’s market cap is roughly $44.28 billion. BUSD’s market cap was $14.28 billion on Jan. 5, 2022, and terrausd’s (UST) market valuation was roughly $10.19 billion.

On Dec. 28, 2022, BUSD’s market cap is higher at $17.16 billion, but UST’s valuation was obliterated down to the current $215 million. UST was one of many stablecoins that depegged from the U.S. dollar this year.

This month alone the stablecoin economy shed $3.08 billion in value as it slid from $142.07 billion to the current $138.99 billion. On Dec. 5, 2022, BUSD had a market cap of around $22.08 billion which is more than 22% higher than the current $17.16 billion.

356 days ago on Jan. 5, Makerdao’s DAI stablecoin had a market valuation of around $9.07 billion, which is 43.55% higher than DAI’s current $5.12 billion value. Below the stablecoin DAI are the dollar-pegged tokens frax, pax dollar, true usd, usdd, and gemini dollar.

In Addition to Terrausd, Neutrino USD, HUSD, and FLEXUSD Depegged From Their $1 Parity

Stablecoins that have been bumped down a number of positions include dollar-pegged coins like magic internet money, liquity usd, fei usd, and neutrino usd. The once-stable coin neutrino usd (USDN) is currently trading for $0.448 per unit after depegging from the $1 parity on Nov. 7, 2022.

Another former stablecoin that also lost its peg is HUSD, which depegged from the $1 parity on Oct. 27, 2022. A single HUSD token is currently exchanging hands for $0.14 per unit on Dec. 28.

Furthermore, the once-stable coin flex usd (FLEXUSD) also lost its dollar peg this year. FLEXUSD is now trading for $0.25 per unit as it depegged from the $1 parity on June 20, 2022.

On Dec. 5, 2022, stablecoins represented $60.74 billion of the $107.29 billion in 24-hour trade volume recorded that day, which equates to 56.61% of all trades. 23 days later, the global trade volume is much lower at $37 billion, while stablecoins represent $29.92 billion or roughly 80.86% of the trades recorded on Dec. 28, 2022.

What do you think about stablecoins this year losing $28 billion in value and the handful of dollar-pegged tokens that depegged from their $1 parity this year? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.