Bitcoin (BTC) is rapidly regaining its lost dominance in the crypto market so far into 2023.

On Jan. 30, Bitcoin accounted for 44.82% of the total crypto market capitalization, the highest since June. In September, Bitcoin’s dominance index was as low as 38.84%.

The index typically rises when most crypto investors reduce their exposure to smaller tokens and seek safety in Bitcoin. The reasons include Bitcoin’s better liquidity and lower volatility than alternative cryptocurrencies, or altcoins, primarily in a bear market.

Bitcoin’s market dominance to grow further?

As of Jan. 31, Bitcoin is up 38% year-to-date at around $23,000. In comparison, the second-largest cryptocurrency, Ether (ETH), gained 30% in the same period, showing most investors remain gravitated toward Bitcoin so far in 2023.

From a technical perspective, the Bitcoin dominance index may rise further in the coming weeks as it reclaims its 50-week exponential moving average (the red wave in the chart below) as support.

In doing so, the index could rise toward 48.5%, which has acted as resistance since May 2021.

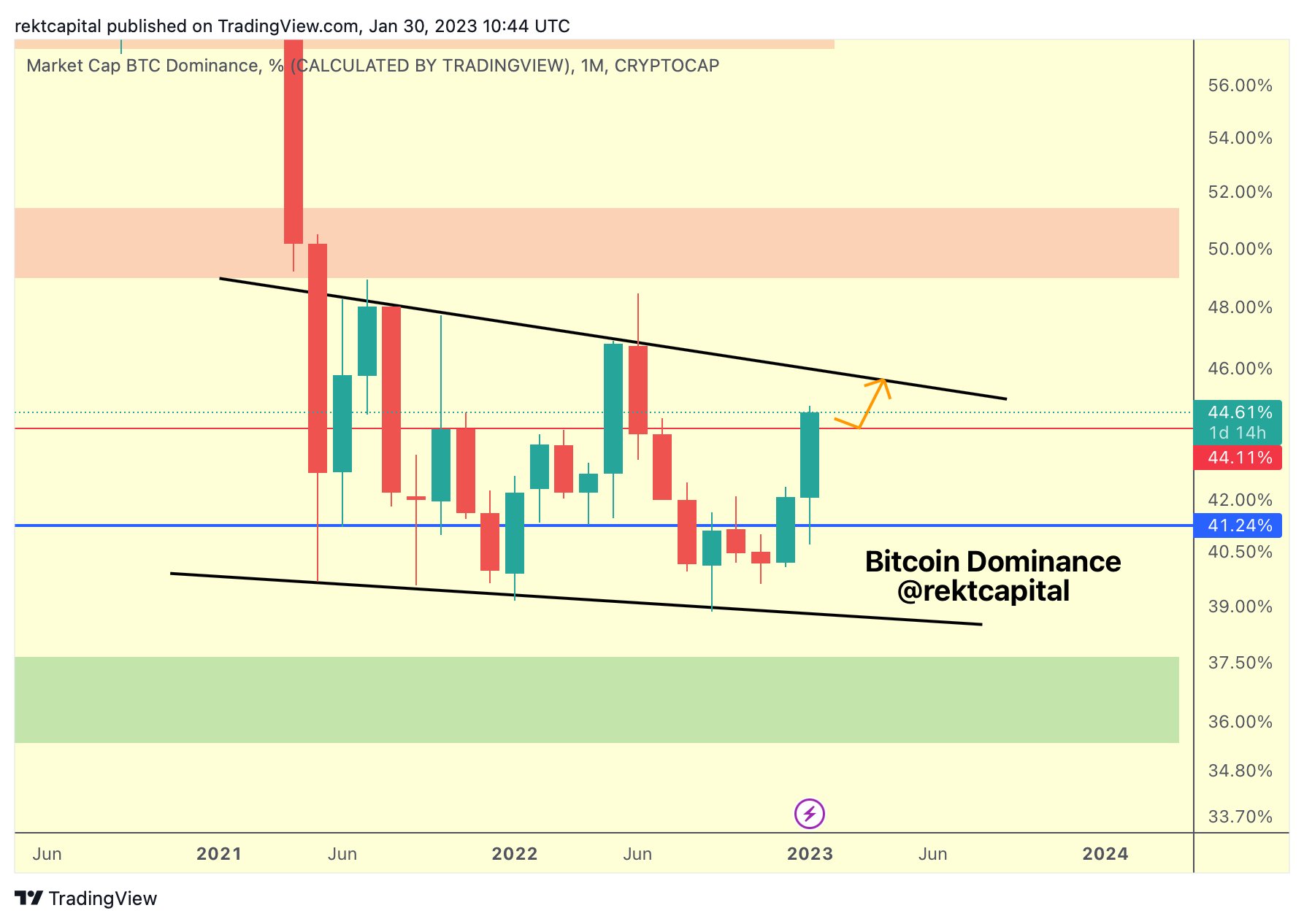

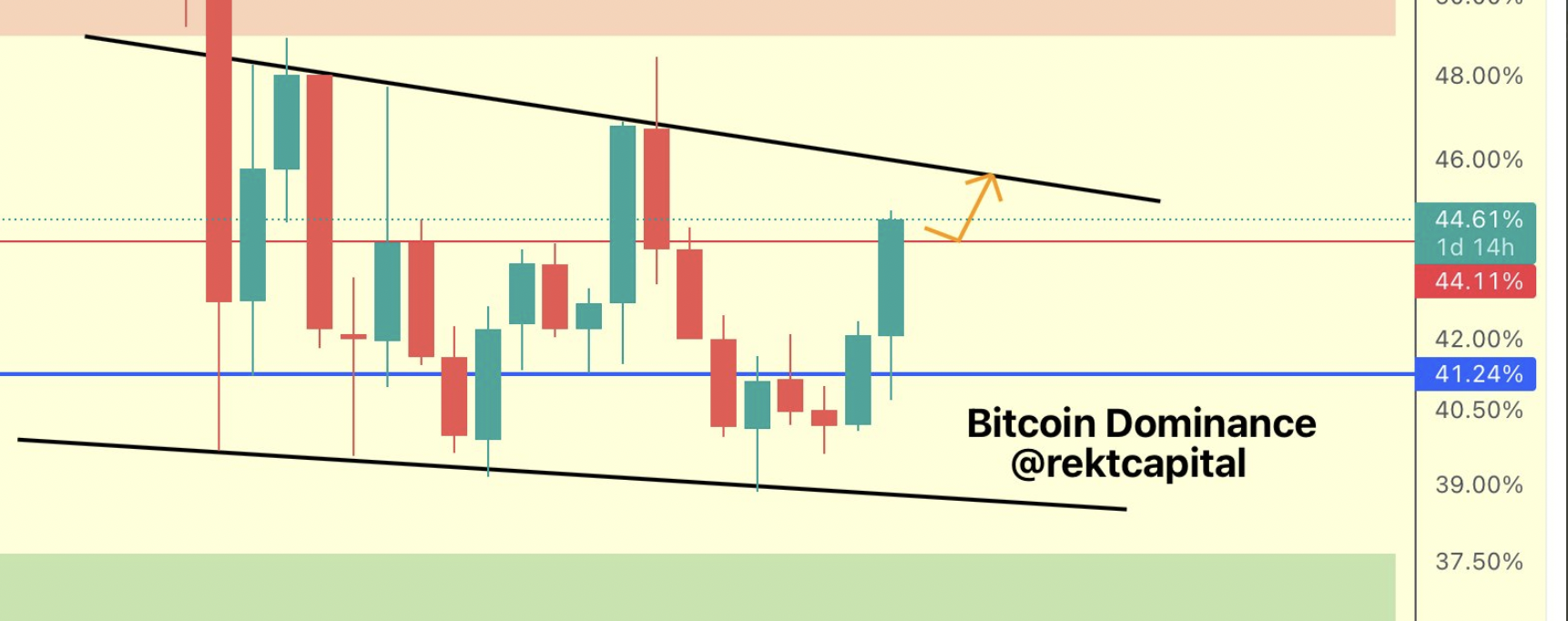

On the other hand, independent market analyst Rekt Capital sees the Bitcoin dominance index rising toward 46%, which coincides with the upper trendline of a giant descending channel pattern, as shown in the monthly-timeframe chart below.

The short-term bullish scenario in the Bitcoin dominance index chart appears in line with a similar upside in the spot Bitcoin market, with bulls eyeing a run-up toward $25,000.

The strength of #bitcoin on the 4-hour charts continues to be impressive.

While price action has trended sideways for over a week, short term indicators (MACD, RSI) have once again reset… and are now ramping higher.

A price surge to ~$25k is probable.

(Not investment advice) pic.twitter.com/QaPbNrxtxZ

— Dr. Jeff Ross (@VailshireCap) January 29, 2023

Ethereum vs. Bitcoin the main driver of BTC dominance

The bearish argument is that the Bitcoin dominance index may start losing its upside momentum after testing its descending channel resistance, as it had done on several occasions in the recent past.

Related: Bitcoin sees most long liquidations of 2023 as BTC price tags $22.5K

“Bitcoin Dominance is further overextending beyond red on the Monthly TF,” noted Rekt Capital, while citing the index’s horizontal trendline support near 44.11%. The analyst adde:

“A Monthly Close above red could set BTCDOM for another dip into red which would benefit Altcoins.”

The above analysis appears as ETH eyes a potential bullish reversal versus Bitcoin in the coming weeks.

Notably, the ETH/BTC pair has been consolidating near its support area (purpled) inside the 0.0676- 0.0655 BTC range since Jan. 24.

The ETH/BTC pair will likely see a rebound rally toward its descending trendline resistance (blacked) around 0.075 BTC if it continues to hold the support area. That, in turn, would reduce Bitcoin’s dominance in the cryptocurrency market as Ether’s share would rise toward 20%.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.