“Expect to see a wide range of borrower profiles: from traditional trading firms to various types of crypto-native players,” Jakob Kronbichler, Clearpool’s co-founder and chief operating officer, said in a statement. “Prime is also attractive to fintechs that provide lending solutions in the TradFi (traditional finance) world, such as loans in emerging markets.”

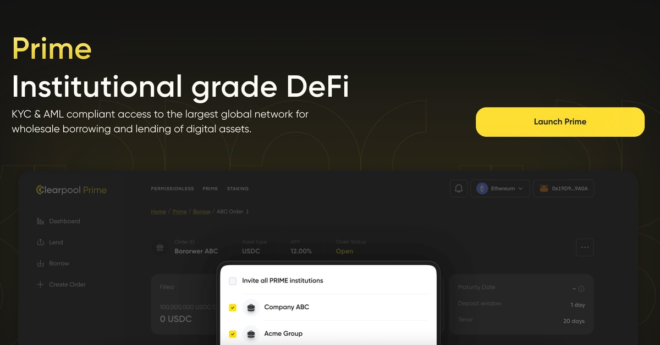

DeFi Protocol Clearpool Chooses Polygon Network for Its Institutional Lending Platform