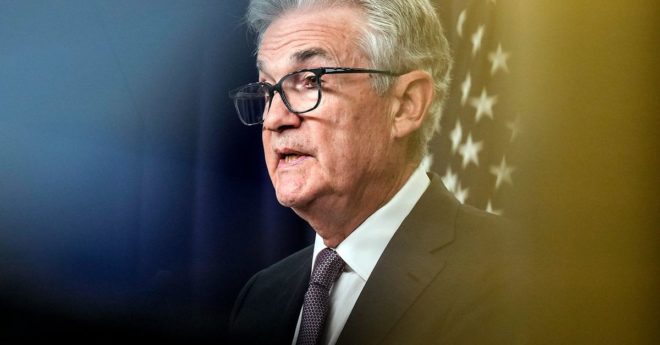

Bitcoin fell to a three-week low Wednesday as Federal Reserve Chairman Jerome Powell’s hawkish testimony to the U.S. Senate Banking Committee on Tuesday spurred traders to price in a higher “terminal rate.” Bitcoin dropped to $21,871 during Asian trading hours, a three-week low, and ether nearly tested Tuesday’s low of $1,535. On Capitol Hill, Powell implied that the Fed is likely to raise rates more than previously expected, warning that the process of pushing inflation down to the central bank’s 2% target has a “long way to go.” Since last year, the Fed has raised rates by 4.5% percentage points, roiling risky assets like cryptocurrencies. Analysts now expect the Fed to eventually raise its benchmark interest to as high as 5.65%. A month ago, the expectation was for the rate to peak at 4.9%.

Bitcoin Belted by Rate Fears