On Deribit, one options contract represents 1 BTC and 1 ETH. The exchange controls more than 80% of the global crypto options market. Options give traders the right to buy or sell the underlying asset, in this case, bitcoin, at a specific price, known as a strike, by a stated date. Call options give the right to buy, while put options give the right to sell.

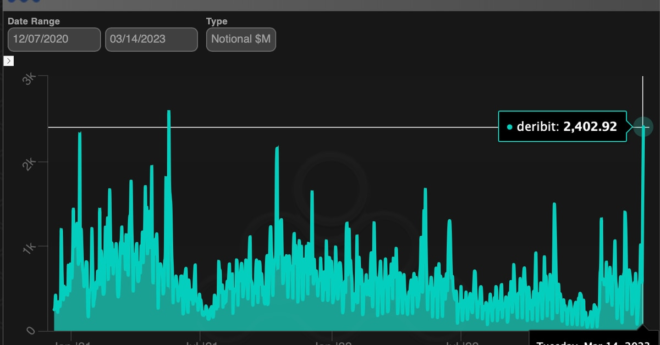

Bitcoin Options Volume on Deribit Hits Highest Level in 22 Months as Bank Failures Breed Volatility