The turbulence in the crypto market has recently intensified, as bitcoin (BTC) took a nosedive below $28,000, marking a decline of over 9% from its 90-day high of $31,005 on April 14.

As of April 20, BTC hovers around $28,044, leaving investors and traders to ponder the factors contributing to this decline.

Amid this price drop, bitcoin’s mining difficulty has skyrocketed to record levels, creating a fascinating contrast that deserves further exploration.

Factors behind BTC decline

Disappointing first-quarter earnings in the equity markets, including Tesla, have rippled across various sectors, causing the S&P 500 and Nasdaq Composite to fall 0.6% and 0.8%, respectively.

Due to their interconnected nature, poor quarterly earnings in equity stocks can trigger a nosedive in bitcoin’s price.

The decline in traditional markets can make investors more risk-averse, impacting demand for cryptocurrencies. This domino effect and correlations between stock prices and crypto can reduce bitcoin’s value.

Additionally, investors experiencing losses may liquidate BTC holdings, further contributing to the downturn. With less disposable income to invest in riskier assets, reduced capital inflows can amplify the downward pressure on bitcoin’s price.

As a result, investors have adopted a more bearish outlook on bitcoin’s short-term price, with a surge in demand for short-term downside protection.

Record-high mining difficulty and hash rate

Despite the bearish market sentiment, bitcoin’s mining difficulty has risen by 1.72% to a record high of 48.3T.

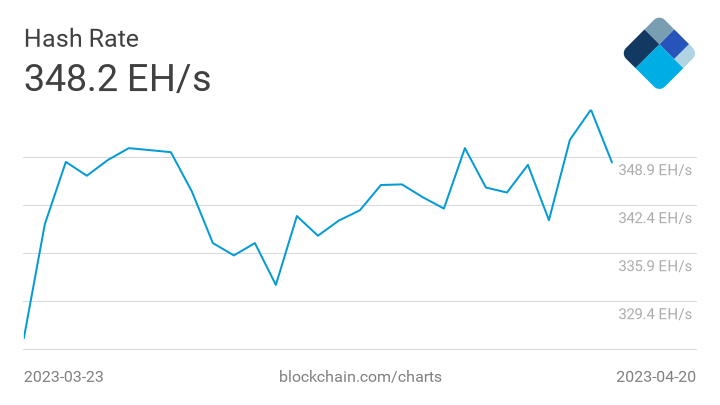

The network’s average hash rate concurrently reached a new high of 348.2 EH/s, reflecting an increase in miner participation.

This resilience in mining activity signals that bitcoin’s long-term health remains strong, even as its price fluctuates.

The impact on the crypto market

Bitcoin’s decline has ripple effect on other major cryptocurrencies, with XRP and MATIC experiencing losses of nearly 5%.

Despite the decline, many investors remain confident in bitcoin’s long-term outlook. Factors like the Fed’s interest rate decisions, on-chain trends, and medium to long-term technical indicators suggest that the cryptocurrency’s future remains promising.

Key levels and stock-to-flow predictions

Bitcoin’s recent dip signals potential trouble as it slides back into the range, surrendering a critical support level.

Market watchers should monitor the $27,600 threshold, which could be breached but necessitates a speedy rebound. Failing to surpass $28,800 may propel the price down to $26,200.

Meanwhile, the stock-to-flow (S2F) model offers guidance for future price points, highlights $32K as the S2F 1 standard deviation band, $60K as the pre-halving S2F model value, and $100K as the lower end of a $100K-$1M range centered around the $532K S2F value expected post-2024 halving.

As BTC grapples with these pivotal price points, investors and traders will scour the market for signals to help determine its direction.