Tiger Global Management posted a 20% loss on its $12.7 billion venture capital fund at the end of 2022.

The news came up shortly after The Wall Street Journal reported that the company had brought down its investment in its venture capital funds by approximately 33%.

Tiger Global marking down assets

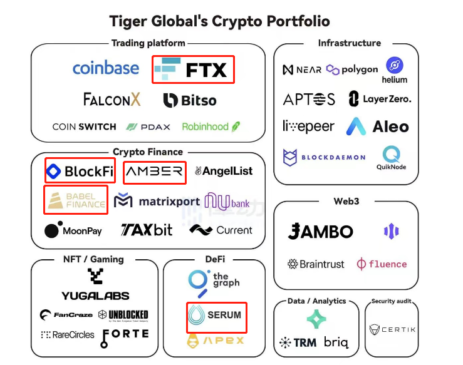

Tiger had partnered with several bankrupt firms, including FTX, Blockfi, and Babel, and others on the verge of collapsing, such as SERUM and Amber. It is unclear if Tiger has active accounts that result in losses in these companies.

The company posted a 20% loss on its $12.7 billion venture capital fund by the end of 2022, according to The Information.

However, Tiger is writing down significant projects such as its Private Investment Partners XV, whose $38 million investment is held at the bankrupt FTX.US and FTX.

Part of the money is held in other web3 and crypto assets such as Moonpur, Bored Ape Yacht Club, an NFT startup, and Helium, a decentralized wireless network company.

Tiger has recorded numerous losses in the past year, the most significant being in the OpenSea marketplace. The company invested $126.8 million in OpenSea in November 2021 and January 2022 and recorded a markdown of 76% to $30.2 million by the end of the year.

ByteDance, the company’s largest holding, has brought a write-down from $144.6 million to $100.8 million by September 2022. Tiger had invested more than $2 billion in the China-based startup in different valuations and times starting from mid-2021 through secondary transactions.

Tiger’s predicaments might affect venture markets

Tiger’s recent report shows that about a quarter of the company’s most recent investments are in the enterprise SaaS industry, with fintech and crypto following as the next most significant investment holding categories.

In addition to the numerous markdowns, Tiger Global has lowered the target size of its latest venture account to $5 billion, a decrease from the $6 billion target set last year.

Tiger Global’s drastic value reduction could affect other crossover investors and companies in venture markets facing similar predicaments.

Despite the venture capital portfolio adjustments, some companies, such as JP Morgan Growth Equity Partners, continually raise considerable funds.

Given the current predicaments, Tiger Global has lowered its investments, with data showing a contrast of 158 deals in the first half of 2022 to only 21 from January this year.

The slowdown could indicate the company reassessing its position in the venture markets, investment strategies, and response to market changes that bring uncertainty.