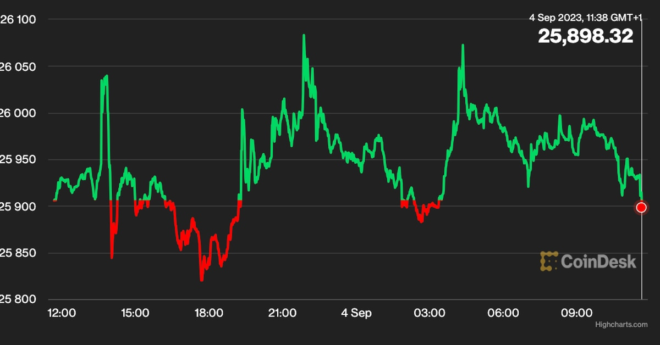

Bitcoin traded in a tight range in the past 24 hours, staying between $25,800 and $26,000 after a price spike last week when the cryptocurrency topped $28,000 after a federal appeals court ruled the SEC must review its rejection of Grayscale Investments’ attempt to convert its GBTC into an ETF. Bitcoin retreated as the SEC delayed key ETF decisions that were expected on Friday, damping traders’ hopes of a long-term recovery. “As we enter September, the cryptoasset market remains on the edge of its seat as various macroeconomic and regulatory narratives continue to leave investors guessing,” said Simon Peters, an analyst at eToro. “With the route to lower rates still unclear and bitcoin spot ETF approvals still waiting, the market will continue its guessing game on major cryptoassets’ direction of travel.” Stellar’s XLM was the only digital asset which saw notable gains on Monday, advancing 10% on the day.

Bitcoin (BTC) Hovers Below $26K; Stellar’s XLM Rallies