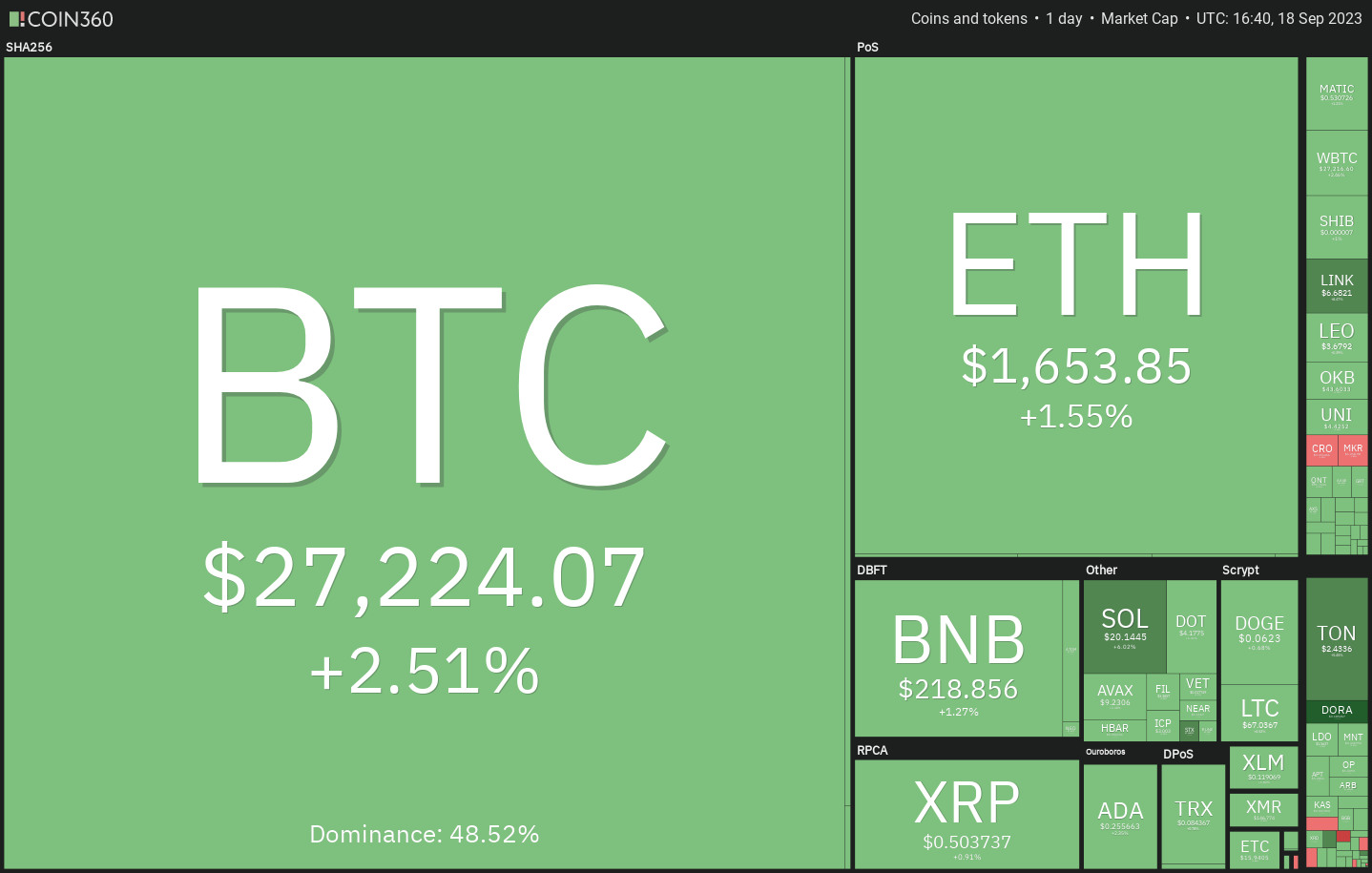

Bitcoin and select altcoins are attempting to make a comeback as traders expect the Fed to hold rates steady during its meeting this week.

The failure of the bears to sink Bitcoin’s price below $25,000 support ignited buying interest last week. The positive momentum picked up further at the start of the new week, and buyers are trying to sustain Bitcoin’s (BTC) price above $27,000.

Market participants seem to be buoyant on expectations that the Federal Reserve will not hike rates again this year. The CME FedWatch Tool shows a 58% probability that the Fed funds rate will remain at the current level even in the December meeting.

That could be one of the reasons why the strength in the United States Dollar Index (DXY) has not adversely impacted the price of Bitcoin. However, traders need to be careful, as the last 10 days in September are known to favor the bears. According to the Carson Group, the S&P 500 Index (SPX) has been positive on average only for two days between Sept. 20 and 30 since 1950.

Could Bitcoin and select altcoins extend their recovery further, or will bears pull the price lower? Let’s analyze the charts to find out.

S&P 500 Index price analysis

The S&P 500 Index broke above the moving averages on Sept. 14, but the bulls could not keep up the momentum and clear the overhead hurdle at the downtrend line.

The bears sold aggressively at the downtrend line and pulled the price back below the moving averages on Sept. 15. Sellers will try to further strengthen their position by pulling the price below the next support.

If bulls want to gain the upper hand, they will have to quickly drive the price above the downtrend line. There is a minor resistance at 4,542, but if this level is crossed, the index could sprint toward 4,607.

U.S. Dollar Index price analysis

The U.S. Dollar Index has continued to grind higher in the past few days, but it is likely to face stiff resistance at 106.

If buyers do not allow the price to dip below the 20-day exponential moving average (EMA) at 104, it will enhance the prospects of a rally above 106. If that happens, the index could pick up momentum and soar to 108.

Alternatively, if the price turns down sharply from 106, it will suggest that bears are defending this level aggressively. A drop below the 20-day EMA could sink the price to the 50-day simple moving average (SMA) of 102. That could keep the price stuck between 101 and 106 for some more time.

Bitcoin price analysis

Bitcoin has maintained above the 20-day EMA ($26,394) since Sept. 14, indicating that the bulls have flipped the level into support. Buyers are trying to strengthen their position further by pushing the price above the 50-day SMA ($27,255).

The bears are expected to pose a strong challenge in the zone between the 50-day SMA and the overhead resistance at $28,143. If the price turns down sharply from this zone, it will indicate that the BTC/USDT pair may stay range-bound between $24,800 and $28,143 for a few days.

On the other hand, if bulls drive the price above $28,143, it will clear the path for $30,000 and $31,000 as the next targets.

Overall, time is running out for the bears. If they want to regain control, they will have to quickly yank the price back below the 20-day EMA.

Ether price analysis

After struggling near the 20-day EMA ($1,639) for the past few days, the bulls succeeded in pushing Ether (ETH) above the overhead resistance on Sept. 18.

The 20-day EMA is flattening out and the relative strength index (RSI) is near the midpoint, indicating that the bulls are on a comeback. If buyers sustain the price above the 20-day EMA, the ETH/USDT pair could first rise to the 50-day SMA ($1,712) and thereafter to $1,750. A break above this level will signal a short-term double bottom. The pattern target of this bullish setup is $1,959.

However, the bears are likely to have other plans. They will try to tug the price back below the 20-day EMA and trap the aggressive bulls. A break below $1,600 could start a downward move toward presumably strong support at $1,531.

BNB price analysis

BNB (BNB) rose above the 20-day EMA ($215) on Sept. 17, indicating that the bearish momentum is weakening. The price could next reach the 50-day SMA ($224).

The bears are likely to offer stiff resistance in the zone between the 50-day SMA and $235. If the price turns down from this zone, it will signal that the BNB/USDT pair could remain range-bound between $200 and $235 for a while. The flattish 20-day EMA and the RSI near the midpoint also suggest a consolidation in the near term.

Instead, if the bears sink the price below the 20-day EMA, the pair could again retest the vital support near $200. The repeated retest of a support level within a short interval tends to weaken it. If this level cracks, the pair may tumble to $183.

XRP price analysis

XRP’s (XRP) recovery is facing selling near the 20-day EMA ($0.50), but the bulls have not given up and are trying to push the price above the resistance.

If buyers kick the price above the 20-day EMA, the XRP/USDT pair could attempt a rally to $0.56. This level could prove to be a difficult barrier for the bulls to overcome.

Contrarily, if the price turns down from the current level, it will suggest that the bears are fiercely protecting the 20-day EMA. There is a minor support at the uptrend line but if this level cracks, the pair risks sliding to $0.45 and eventually to $0.41.

Cardano price analysis

Cardano (ADA) continues to be squeezed between the 20-day EMA ($0.25) and the critical support at $0.24. This tight-range trading is unlikely to continue for long, and a breakout may be around the corner.

The positive divergence on the RSI suggests that the selling pressure is reducing. If the uncertainty resolves to the upside, it will pave the way for a possible rally to the overhead resistance at $0.28.

On the contrary, if the price plummets below $0.24, it will signal that the bears have asserted their supremacy. That could signal the start of the next leg of the downtrend. The ADA/USDT pair may then slump to $0.22.

Related: BTC price hits $27.4K as Bitcoin open interest matches Grayscale peak

Dogecoin price analysis

Dogecoin (DOGE) has been stuck between the 20-day EMA ($0.06) and the horizontal support at $0.06 for the past few days.

Generally, a squeeze in volatility is followed by a range expansion. If the DOGE/USDT pair soars and closes above the 20-day EMA, it will suggest that bulls are attempting a comeback. The pair could then rally to $0.07. Buyers will have to overcome this roadblock to start an up move to $0.08.

This positive view will be invalidated if the price turns down and dives below the $0.06 support. That could pull the price down to the next support at $0.055. The bulls are expected to guard this level with vigor.

Toncoin price analysis

The long wick on Toncoin’s (TON) Sept. 16 and 17 candlesticks shows that traders are booking profits near the overhead resistance at $2.59.

The overbought level on the RSI suggests a possible correction or range formation in the near term. However, the bulls have not given up and are again trying to propel the TON price above $2.59. If they can pull it off, TON/USDT could pick up momentum and skyrocket to $3.

The important support to watch for on the downside is $2.25. If this level gives way, the pair could start a deeper correction to the next support at $2.07.

Solana price analysis

After trading near the 20-day EMA ($19.47) for the past few days, Solana (SOL) broke above the resistance on Sept. 18.

The 20-day EMA is flattening out and the RSI is near the midpoint, indicating that the bears may be losing their grip. Buyers will try to cement their position further by pushing the price to the overhead resistance at $22.30. This level is likely to attract sellers.

If the bulls fail to hold the price above the 20-day EMA, it will suggest that bears are selling at higher levels. The first support on the downside is $18.50, and if this level is violated, SOL risks descending toward the next major support at $17.33.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.