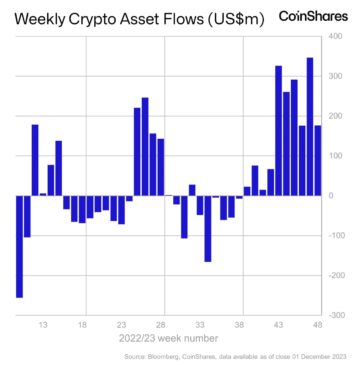

Last week, the inflow of investment products into digital assets reached $176 million, the most significant number since October 2021.

This marked the 10th consecutive week of inflows totaling $1.76 billion, or 4% of assets under management (AuM), according to a CoinShares report.

The inflow of assets into crypto funds was the largest since October 2021, when a crypto futures ETF was launched in the United States.

Additionally, total AuM is up 107% this year, but at $46.2 billion, it remains well below the all-time high of $86.6 billion seen in 2021, according to analysts. ETP trading volumes remain high at $2.6 billion weekly, representing 12% of total Bitcoin (BTC) volume.

Bitcoin was the main beneficiary, receiving inflows of $133 million, although short Bitcoin, after three weeks of outflows, saw inflows of $3.6 million last week.

Ethereum (ETH) saw an additional $31 million in inflows last week, bringing this 5-week period to $134 million. For the first time this year, net flows are now positive at $10 million after a long period of negative sentiment.

Blockchain stocks have seen inflows for seven straight weeks, with the latest week’s $17.4 million inflow being the largest since July 2022.

Last week, analysts reported that the inflow of funds into investment products with digital assets amounted to $346 million in a week. In nine weeks, the crypto market received more funds than at the beginning of the bull market in 2021.