Bitcoin (BTC) recovered above $41,000 at the Dec. 13 Wall Street open as eyes focused on the United States Federal Reserve.

PPI target beat comes hours before Fed rate move

Data from Cointelegraph Markets Pro and TradingView showed BTC price strength gaining momentum on the latest U.S. macro data releases.

November’s Producer Price Index (PPI) print came in below expectations, further bolstering the extant narrative of declining inflation. The Consumer Price Index (CPI) print, while less encouraging, did not induce fresh pain for risk assets.

“This is the lowest PPI inflation reading since December 2021,” trading resource The Kobeissi Letter wrote in part of a reaction on X (formerly Twitter).

“Since the last Fed meeting, we have seen multiple favorable inflation prints. All eyes are on the Fed today and a potential hint of a ‘Fed pivot.’”

Kobeissi referenced the week’s main macro event, the Federal Open Market Committee (FOMC) gathering and decision on interest rate changes. The decision is due at 2pm Eastern time, with Fed Chair Jerome Powell giving a press conference at 2.30pm.

Both events are apt to spark temporary volatility in crypto and beyond, while Bitcoin’s own reactions to the macro data remained muted.

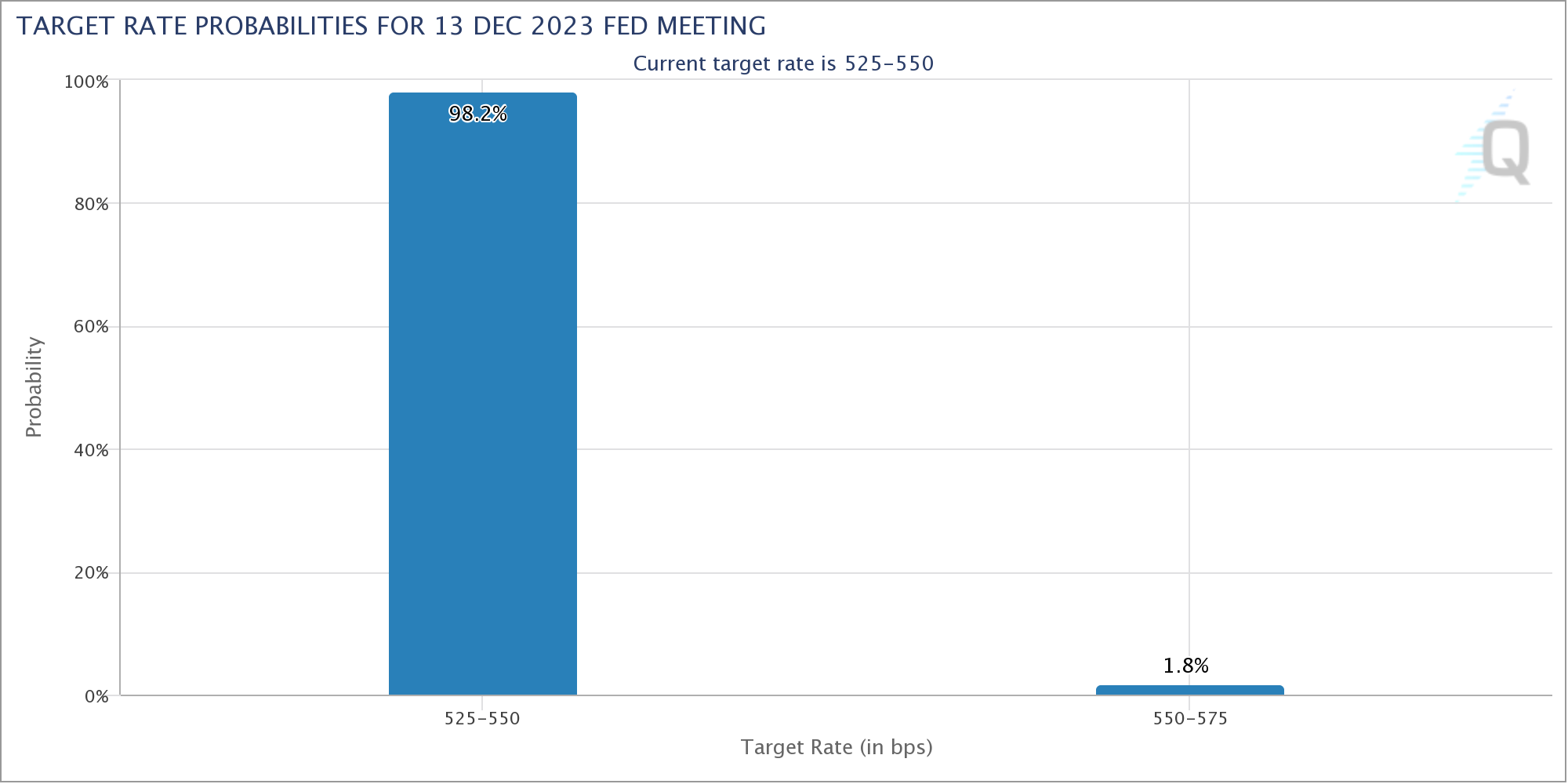

Per data from CME Group’s FedWatch Tool, at the time of writing, markets remained convinced that no rate changes would occur as a result of the FOMC meeting.

Trader eyes key BTC price levels for “action”

Low-timeframe BTC price action meanwhile lacked a clear trend.

Related: Bitcoin ‘sodlers’ dump $4B in two days as BTC sales hit 18-month high

Existing support and resistance levels remained in place, with popular trader Jelle likewise reiterating the significance of $48,000 overhead.

“While the lower timeframes look choppy, Bitcoin seems to be flipping the mid-range level. $48,000 is still the main level to overcome — after which price discovery is within an arms reach,” he told X subscribers on the day.

The day’s analysis contained a prediction of further sideways behavior, with Jelle betting on “most of the downside” already having passed for Bitcoin.

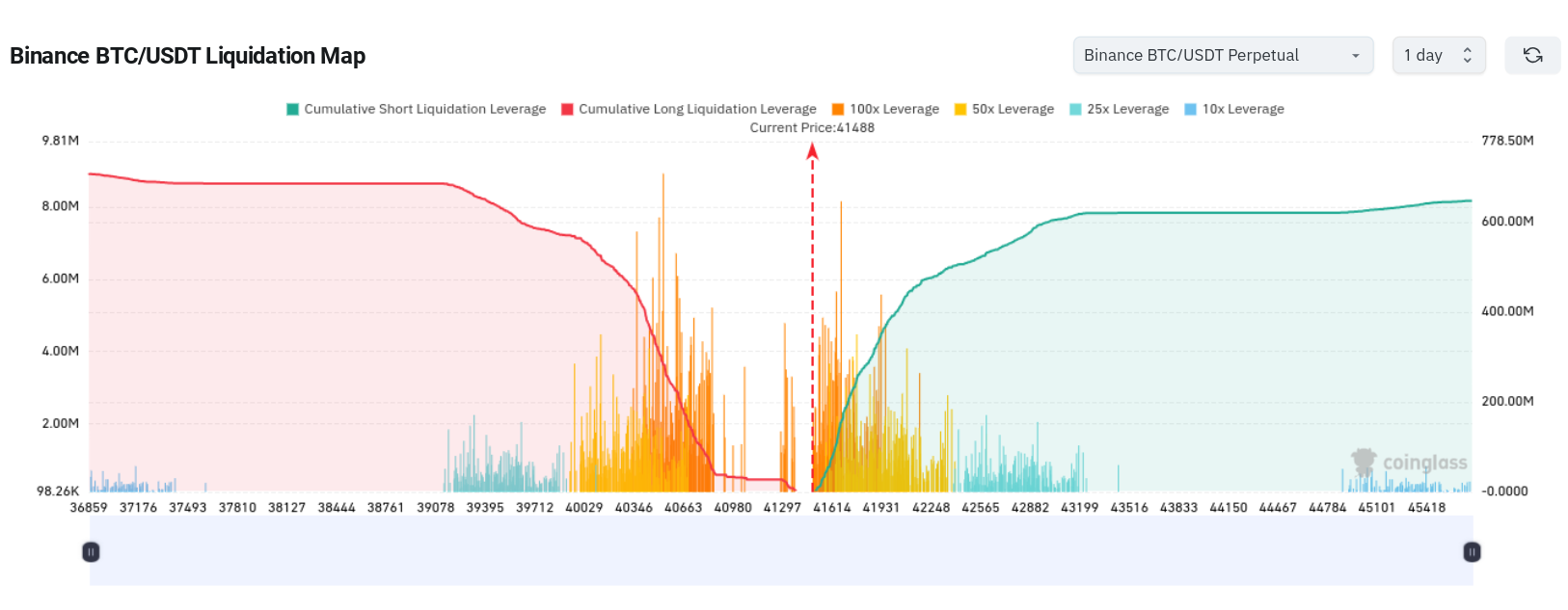

Looking at liquidation levels, fellow trader Daan Crypto Trades eyed increasing leveraged bets in a zone that spot price was now in the process of clearing.

“Building some big liquidation clusters as it’s chopping sideways,” he wrote alongside data from statistics resource CoinGlass.

“Most notably: $40.5K & $41.4K. Expect some action around those levels.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.