Chainlink (LINK) price has stagnated since breaking above the $20 mark on Feb. 10, as on-chain data trends suggest that whale investors booking profits could trigger a pullback.

Chainlink price has been on an uptrend in recent months thanks to the LINK token’s systemic importance to the burgeoning asset tokenization and Real World Assets (RWA) sectors.

An unusually rapid selling trend spotted among whale investors holding LINK threatens to scuttle the rally.

Whale investors offloaded 7 million LINK tokens in last 10 days

Institutional interest in the asset tokenization wave has heightened since the Bitcoin spot ETF approval in mid-January gave the cryptocurrency sector an air of legitimacy. By providing off-chain price feeds to blockchain protocols, Chainlink is at the center of the growing Real World Asset sector.

Between Feb. 1 and Feb. 12, Chanlink’s price increased by 35%, breaking the $20 barrier for the first time since January 2022. However, many major stakeholders have held at a loss of nearly 24 months, and many appear to have started taking profits in the past week.

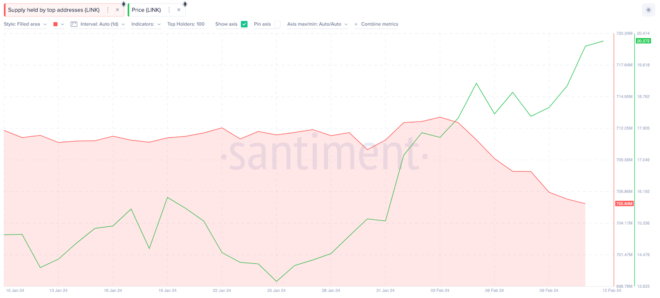

The Santiment chart illustrates the real-time changes in LINK token balances held by the largest investors within the Chainlink ecosystem. It shows that the top 100 largest Chainlink whale wallets have been on a selling spree since the LINK price crossed $18 on Feb. 3.

Between Feb. 3 and press time on Feb. 12, the Chainlink whales have offloaded 6.9 million tokens, cutting balances from 712.7 to 705.8 million LINK.

Valued at the 10-day Simple Moving Average (SMA) price of $18.9 per token, the recently offloaded 6.9 million LINK is worth $130.4 million. When whales make such a large sell-off within a short period, it puts the price rally at risk.

Firstly, such a high-volume sell-off dilutes market supply, making it harder for the prices to swing upward in the short term.

Secondly, if the largest stakeholders within an ecosystem enter a prolonged sell-off, it could also spook retail investors or trigger copy-trading bots into entering bearish positions. These critical factors could combine to trigger a short-term Chainlink price pull-back.

Forecast: Can Chainlink price stay above $20?

Based on the on-chain data trends analyzed, Chainlink holders can expect a price downswing below the $20 support if the whales’ sell-off does not abate in the coming days.

However, considering the growing asset tokenization buzz and the bullish headwinds from Bitcoin (BTC) breaking above $50,000 on Feb. 12, LINK price could find a relatively high support level around $16.

IntoTheBlock’s global in/out of the money chart further affirms this outlook. It shows that 63,270 addresses had acquired 147.2 million LINK at an average price of $16.30.

If the critical $16 support level fails to hold, the LINK price could be at risk of a downswing below $15.

The bulls still stand a chance of staging a rally toward $25, especially if the whales can curtail their ongoing selling trend.

But in this scenario, the bears could mount an initial sell-wall around the $24 territory. In that territory, 74,160 addresses bought 34.1 million LINK at the average price of $24.3. If they opt to exit early, LINK price could enter another pullback.