Ripple’s price peaked at $0.63 on Feb. 29, capping its February 2024 gains at 30%, but declining BTC Dominance could see leading altcoins score more significant gains in March.

Ripple-backed XRP stands to make significant gains in March 2024 as investors begin to redirect capital towards the altcoin markets.

Bitcoin dominance in decline as altcoins gain traction

Bitcoin dominated crypto headlines in February with multiple price milestones and record-breaking ETF inflows. However, as the month ended, market trends showed that investors increasingly focused on other crypto sectors.

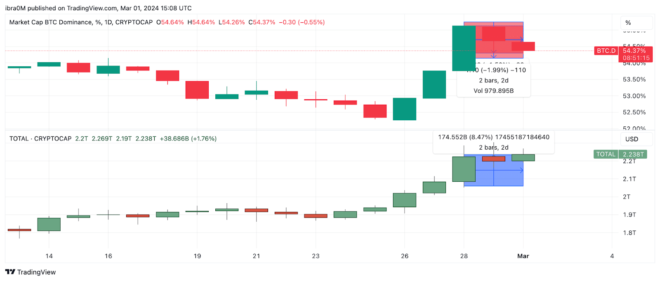

TradingView’s Bitcoin Dominance (BTC.D) chart expresses Bitcoin’s market capitalization as a percentage of the overall cryptocurrency market, providing real-time insights into stakeholders’ risk appetite and investment preferences.

Since Bitcoin price grazed $64,000 on Feb. 28, BTC.D has been downgraded, dropping from 55.2% to 54.3% at press time on Mar. 1.

While the BTC price retreated toward $60,000, altcoin markets pumped during this three-day frenetic period. As seen in the chart, the decline in BTC.D has coincided with a $175 billion inflow into the altcoin market, resulting in an 8.5% increase in the overall crypto market capitalization.

When Bitcoin’s dominance decline coincides with a boom in the crypto market, it is a prime indicator that altcoins are now on the front burner. This rare market dynamic illustrates that investors as the crypto bull market intensifies, investors are growing in confidence and shifting more capital toward the altcoin market.

Bullish XRP traders raise leverage by 120% in 3 days

Bar XRP, each altcoin in the crypto top 10 rankings, including Ethereum (ETH), BNB, Solana (SOL), and Cardano (ADA), have all reached new yearly peaks in the past month.

XRP is currently trading around the $0.60 territory. To attain the same feat, prices must surge by another 9% to reclaim the $0.65 peak last seen on Jan. 2.

Recent trends in the derivatives markets show that speculative traders have increased bullish bets on XRP since Bitcoin dominance began to wane on Feb. 28.

Santiment’s funding rate trend aggregates the total fees paid between futures contract position holders across various trading platforms and exchanges. The funding rate spiked from 0.04% to 0.10% between Feb. 27 and Mar. 1.

Typically, elevated values of favorable funding rates mean that XRP long position holders are paying record fees to short traders to keep their positions open.

August 2023 was the last time XRP’s funding rate soared above 0.08%. Such consistent and prolonged funding rate spikes occur when leveraged long traders are confident that spot prices will rise in the short term and yield outsized profits.

If this bullish scenario plays out, XRP’s price could be on the verge of soaring to a new 2024 peak above $0.65, in keeping with the rest of the altcoin in the top 10 market valuation rankings.