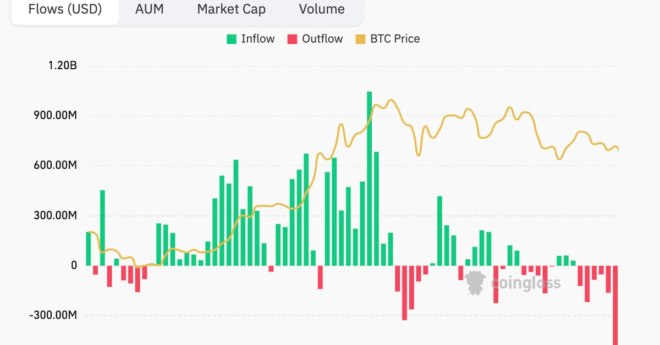

On Wednesday, GBTC witnessed the second-largest outflow of $167.4 million, followed by ARKB’s $98.1 million and IBIT’s $36.9 million. Other funds also bled money even though Powell’s net-dovish approach put a floor under risk assets, including bitcoin. A dovish stance is one where the central bank prefers employment and economic overgrowth over excessive liquidity tightening.

Bitcoin (BTC) U.S. ETFs Bleed Over Half a Billion Dollars Despite Fed Chair Jerome Powell Ruling Out Rate Hike