Bitcoin’s price has surpassed $65,000 after the cryptocurrency dropped below $57,000 last week.

Bitcoin (BTC) reached $65,500 at the moment, but according to CoinMarketCap data, it had fallen again to $63,500 at the time of writing.

The coin’s asset dominance regained some positions alongside a BTC price jump. The indicator reflects the share of Bitcoin’s market capitalization in the total market capitalization of all cryptocurrencies, reaching 54.8%.

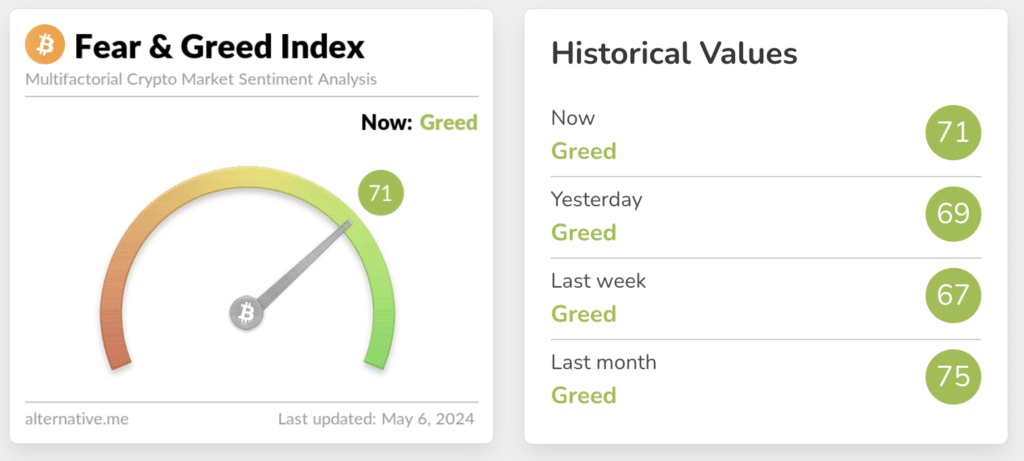

In addition, the Fear and Greed Index has risen two basis points over the past 24 hours.

The last issue of the U.S. labor market report consolidated Bitcoin above $60,000 on May 3. The rise happened shortly after the publication of the U.S. jobs report, which shifted expectations of the Federal Reserve’s key rate cut from November to September.

Additionally, investors have steadily withdrawn funds from Bitcoin spot ETFs since last month. From April 24 to May 2, $1.2 billion flowed out. However, on the last trading day, the negative trend finally stopped. On May 3, spot Bitcoin ETFs saw a $378 million inflow.

Since January of this year, total inflows into BTC ETFs have exceeded $11.5 billion.

Moreover, on April 30, spot ETFs for Bitcoin and Ethereum (ETH) were traded in Hong Kong. Even though the ETFs are very far from their American counterparts in terms of trading volume, the appearance of such an instrument in the Asian market is a positive factor contributing to the wider acceptance of cryptocurrencies.