As a result of this significant development, the ether implied volatility curve, which shows market expectations of future volatility across different strike prices and expirations, flattened as 25-delta risk reversals hit YTD highs above 18%, and traders heavily bought $4000 calls for 24 May 2024 and 31 May, Presto Research analysts wrote in a note shared with CoinDesk.

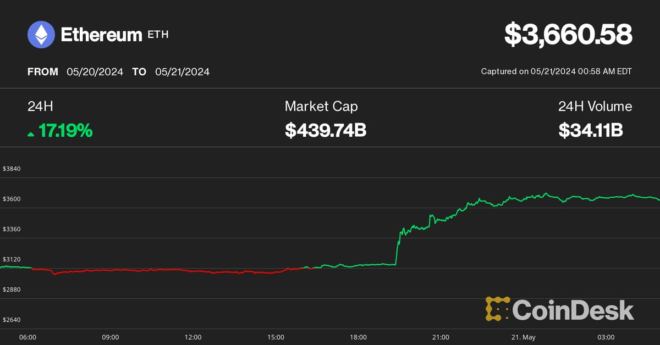

Ether (ETH) Surges 17%, Polymarket Approval Chances Rocket, as ETF Makes Regulatory Progress