In the last 24 hours, the crypto market lost more than $96 billion as major cryptocurrencies, including Bitcoin (BTC) and Ethereum (ETH), faced corrections.

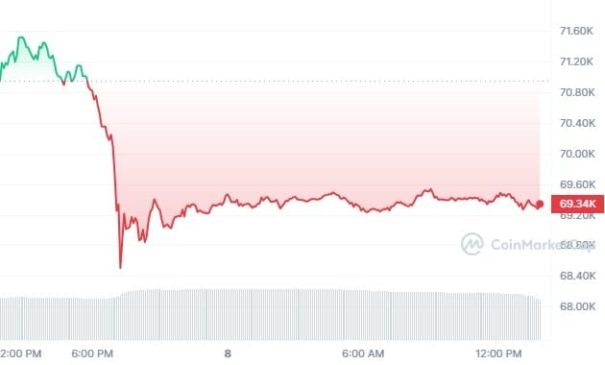

Bitcoin, the leading cryptocurrency, saw a sharp drop to an intraday low of $68,507. At the time of going to press, the cryptocurrency was priced at $69,321 — a 2.57% dip from the previous 24 hours.

Additionally, Bitcoin’s 24-hour trading volume went down by more than 4% to $28.1 billion.

The correction came on the back of Bitcoin hitting a multi-week high of $72,000 on June 7, after staying above $70,000 for several days.

Following the dip, Bitcoin’s market capitalization fell to $1.366 trillion, though its dominance over altcoins increased to 53.8% as they took much bigger hits.

Altcoins in the red

Among the top 100 cryptocurrencies, there were no notable gainers, with most of them registering losses between 1.03% and 14.52%.

Ethereum is down 3.11% to below $3,700. BNB, the fourth-largest crypto by market cap, has dropped from over $710 to just above $683, and Solana (SOL) has fallen by more than 6%.

The number one meme coin by market value:

- Dogecoin (DOGE), is down 8.85%

- Avalanche (AVAX) is down by 9.95%

- Chainlink (LINK) lost 9.16% from its price.

- Polkadot (DOT) dropped 10.24%

- NEAR Protocol (NEAR) shaved 9.01%

- Uniswap (UNI) went down 5.31%

- Polygon (MATIC) dropped by 9.01%.

Overall, the cumulative market cap of all crypto assets has shed over $96 billion since yesterday’s peak. It’s now sitting at $2.54 trillion on CoinMarketCap.

Analysts have suggested the drop may have been influenced by a stronger-than-expected U.S. non-farm payroll (NFP) report for May, which added 272,000 new jobs and strengthened the U.S. dollar.

The report reduced hopes for a Federal Reserve interest rate cut, negatively impacting Bitcoin’s price and overall market sentiment.

Double bullish thesis for BTC

Elsewhere, Bitcoin advocate Samson Mow took to X to suggest a new bullish scenario for Bitcoin.

He proposed that gaming merchandise retailer GameStop should add Bitcoin to its corporate treasury, which, in his opinion, could create a “double bullish thesis” that could lead to significant price increases for both Bitcoin and GameStop shares.

Mow’s sentiment coincided with analyst and social media personality Keith Gill, also known as “Roaring Kitty,” hosting his first livestream in three years, focusing on GameStop’s future.