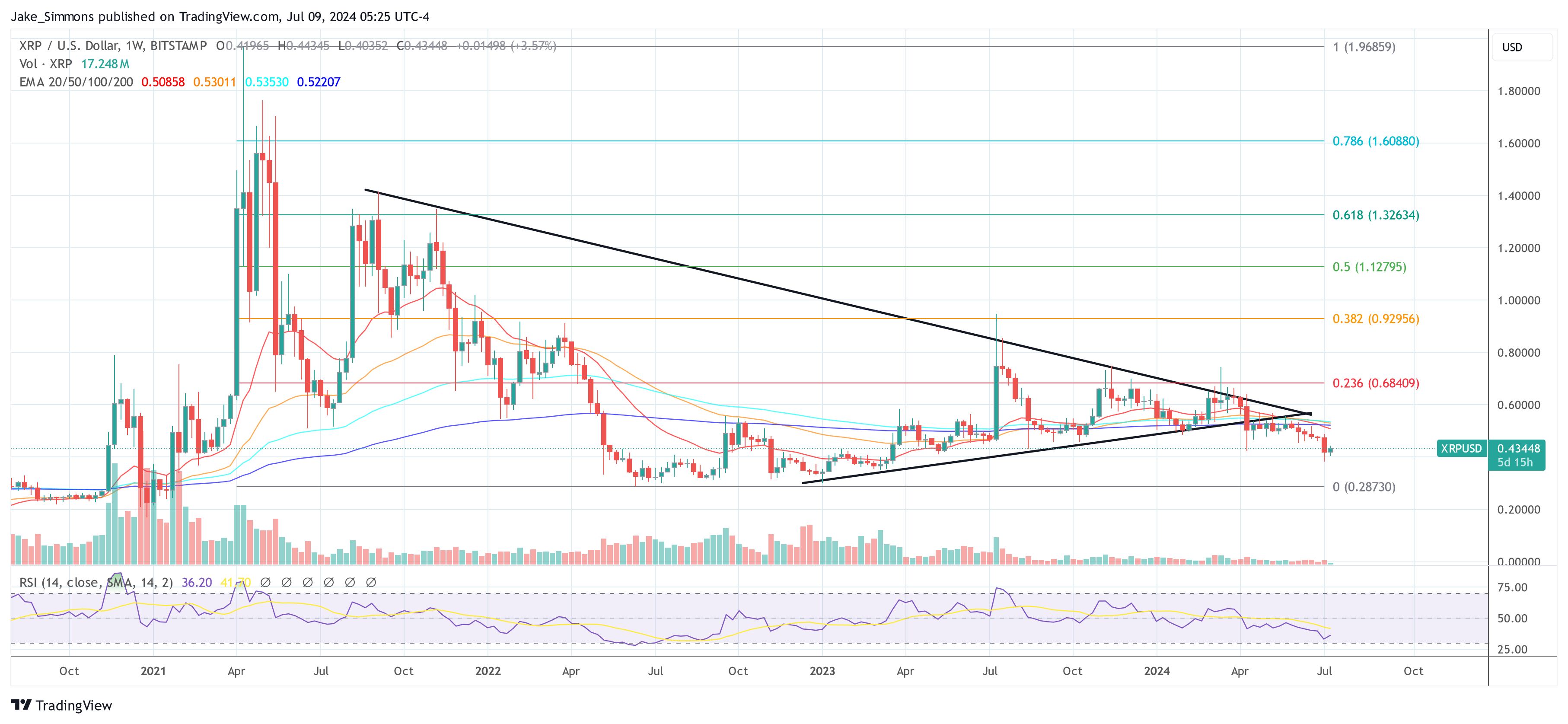

Crypto analyst @Ripple_Effect11 predicts an imminent XRP price crash in a new technical analysis shared via X. His prediction is underpinned by a bearish breakout from a major triangle pattern that has been forming since the $3.84 all-time high on January 4, 2018. The analysis paints a dark picture for XRP in the coming months, with a potential drop to as low as $0.07, contingent on certain technical events.

Why The XRP Price Could Crash To $0.07

Elliott Wave Theory, which forms the basis of @Ripple_Effect11’s analysis, is a form of technical analysis that predicts future price movements by identifying recurring wave patterns linked to investor psychology. The theory posits that market movements primarily unfold in five ‘impulse’ waves followed by three ‘corrective’ waves.

In the case of XRP, the analyst identifies that the cryptocurrency has been in a corrective phase since its peak in 2018, marked by an A-B-C correction pattern. Wave A saw a sharp decline as low as $0.105 in March 2020. Wave B experienced a partial retracement upwards to $1.96 in April 2021. Wave C, where XRP is currently, is typically the final leg and involves another downward move, often completing the corrective phase.

Related Reading

The analysis suggests that within this final Wave C, XRP is undergoing its sub-waves. It’s currently in the third wave which traditionally is significant in terms of the depth and length of the price movement.

Notably, the chart also shows a large triangle formation which has encapsulated the price action of XRP over several years. A triangle in technical analysis often represents a period of consolidation before the price breaks out decisively in one direction.

According to @Ripple_Effect11, last week’s close below $0.42 confirmed a bearish breakout from this pattern and further supports the theory of a massive price crash. “No one is talking about this MASSIVE XRP triangle breakdown. A weekly close below $0.42 is extremely bearish,” he stated.

Related Reading

The analyst’s first target is at $0.33 where minor psychological support may exist. A second, more significant target at $0.18, which could represent a firmer historical support zone. The third target ranges between $0.12 and $0.14, possibly acting as interim support before more substantial selling. This price represents the end of the third wave.

Amidst the fourth wave, the crypto analyst predicts that the XRP price could rebound above $0.18 before the final wave 5 pushes XRP even further down. The final target is between $0.07 and $0.08, translating into a more than 80% crash from the current price level.

These targets are corroborated by technical indicators on the chart. The MACD is trending below its signal line, highlighting bearish momentum. The RSI is near 45, suggesting a lack of strong buying pressure and potential for further decline.

Ripple Ruling Could Start The Trend Reversal

Adding context to the technical analysis is the ongoing Ripple vs. SEC lawsuit, which the analyst notes is expected to conclude by July 2026. The outcome of the legal battle is anticipated to have significant implications for the XRP price.

“Smart money sees buy targets 3 and 4 as attractive before the big utility pump from 2026 to 2030. Ripple Vs SEC started in 2020. XRP was classified as NOT a security in 2023. Ripple wins the case and XRP pumps hard 2026. Will you be patient?,” the crypto analyst concludes.

At press time, XRP traded at $0.43448.

Featured image from Shutterstock, chart form TradingView.com