According to a crypto analyst, Bitcoin (BTC) may be heading towards a capitulation due to tightening on-chain liquidity. However, this capitulation could be followed by a “full bull” market.

Bitcoin Headed Lower Before Higher

In a detailed thread on X about BTC price analysis, crypto analyst Cole Garner stated that capitulation might be on the horizon for the leading digital asset. Garner attributes the potential downturn to tightening on-chain liquidity.

Related Reading

Tracking global liquidity from central banks worldwide, the analyst said he sees a “buy signal” for digital assets. However, more downsides for cryptocurrencies could come before liquidity-enhancing measures undertaken by central banks buoy them.

In his analysis, Garner stated that “if China doesn’t ring that bell, the Fed or Japan should do the job,” likely pointing toward the recent economic stimulus injected by the Chinese central bank in a bid to boost the country’s grim economic outlook.

Garner referenced the recent economic stimulus from China’s central bank but noted that this week, the People’s Bank of China (PBoC) refrained from injecting additional liquidity, tempering expectations for risk-on assets like crypto.

Garner emphasized the low supply of stablecoins compared to the beginning of October 2024.

Analyzing the “Bitfinex grail,” which is essentially the total supply of two leading stablecoins on the exchange – USDT and USDC – Garner noted its quarterly rate of change is declining, potentially leading to lower prices for digital assets in the short term.

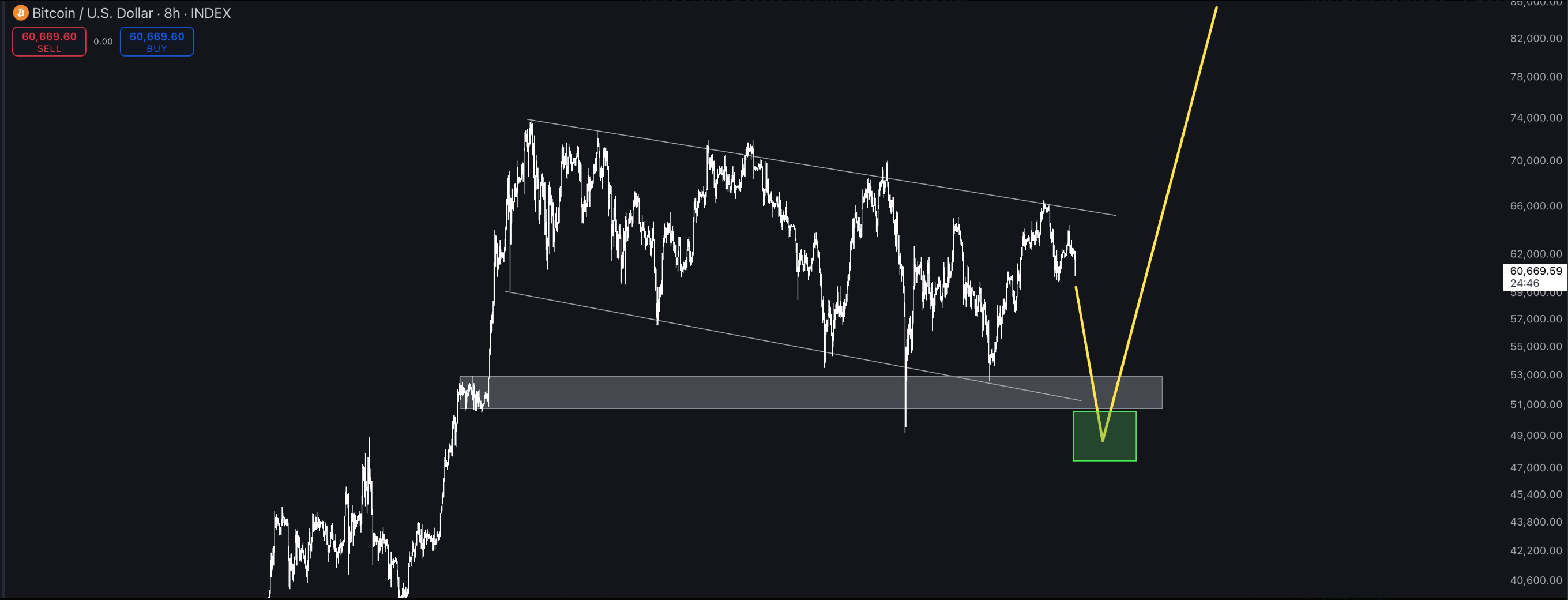

Despite these concerns, Garner pointed out that Bitcoin has printed a higher high on the 8-hour chart, and the market structure remains bullish. Even if BTC dips to its range lows in the high $40k range, the overall price action is still considered positive.

Garner suggested that should BTC hit its range of lows, traders and investors can consider buying at that price. Even if they are low on liquid cash, they must ensure they don’t get spooked by the market and panic-sell their current holdings.

Another crypto analyst, Ali, seemed to echo Garner’s outlook, stating that Bitcoin is stuck in a descending parallel channel and runs the risk of sliding to channel lows of around $52,000. The analyst stressed that BTC must overcome the $66,000 level for a bullish breakout.

Can Bitcoin Hit New All-Time Highs In 2024?

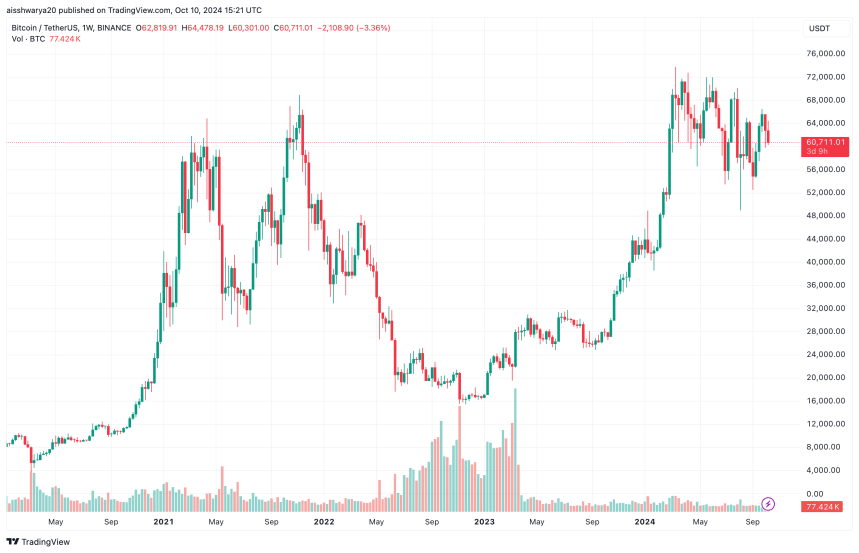

With the remainder of 2024 ahead, Bitcoin bulls anticipate interest rate cuts by the US Federal Reserve (Fed) to fuel a new rally. However, BTC must clear several hurdles to sustain its bullish momentum.

Related Reading

Crypto analyst Carl Runefelt recently noted that BTC must overcome the $64,000 resistance level to trigger a rally in Q4 2024. Failure to break through this price level could lead to further downside.

Further, Bitcoin’s price finally turned green in October, giving bulls hopes of another “uptober” for the asset, which was marked by significant price increases. BTC trades at $60,711 at press time, down 2.4% in the last 24 hours.

Featured Image from Unsplash.com, Charts from X and TradingView.com