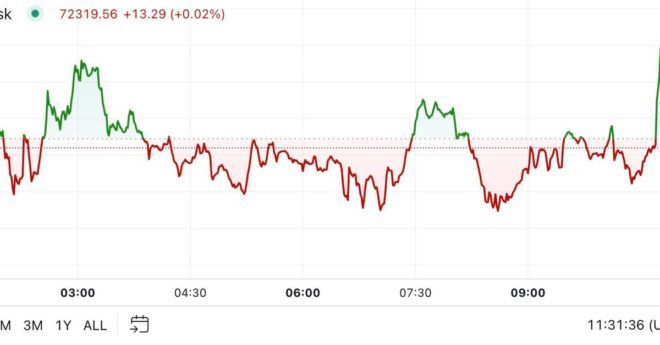

Bitcoin appears to be taking a breather as October draws to a close, trading around $72,500 during the late European morning, about 0.3% higher in the last 24 hours. The broader digital asset market has fallen nearly 0.9%, as measured by the CoinDesk 20 Index, with ETH and SOL lower by 1.15% and 0.3%, respectively. Bitcoin has gained over 6% in the last week, so the temporarily muted price action may point toward profit-taking. Nevertheless, spot bitcoin ETFs registered $893 million of inflows on Wednesday, a second consecutive day of over $850 million. The strong showing was almost entirely attributable to BlackRock’s IBIT, which added $872 million.

Bitcoin Returns to $72.5K in Muted Market Activity