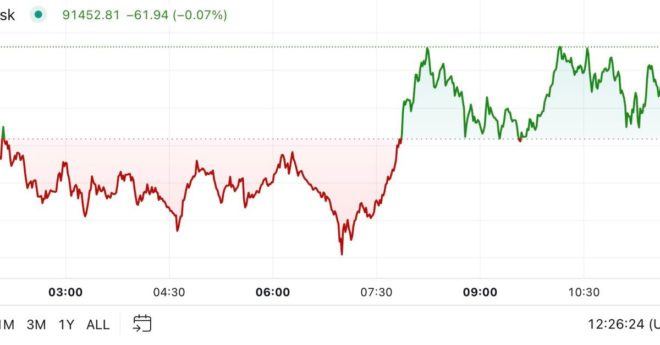

Bitcoin traded either side of $91,000 after recovering from a dip to just above $89,000. BTC is 2% lower than its all-time high of $93,445, which it reached during the U.S. afternoon on Wednesday, but remains over 4% higher in the last 24 hours. Bitcoin ETFs recorded another $510 million of inflows Wednesday, taking the total for the last six days to $4.7 billion. “The Bitcoin ETFs are by far the majority driving force of bitcoin demand right now, soaking up almost all of the selling by Long-Term Holders. CME open interest is not growing meaningfully, reinforcing that this is a spot-driven rally,” analyst Checkmate said in a post on X.

Bitcoin Trades Around $91K as ETF Inflows Remain Strong