Bitcoin, Ethereum and XRP gain slightly on Wednesday as traders gear for the U.S. FOMC rate decision at 2 PM ET. Unlike previous bear markets, traders are seeing shorter bear cycles followed by sharp price rallies.

The upcoming FOMC meeting could usher higher volatility in the prices of top three cryptocurrencies and present buy the dip opportunities or offer opportunities for traders to take profits, amidst the prolonged bear market.

Bitcoin, Ethereum and XRP trader sentiment turn risk-off

Bitcoin (BTC), Ethereum (ETH) and XRP (XRP) traders have reduced their activity in the derivatives market in the past 24 hours. Derivatives data from Coinglass shows a decline in trade volume, BTC and ETH trade volume declined nearly 11% and 7%. XRP noted a nearly 14% decline in trade volume in the same timeframe.

Coinglass shows that traders have turned risk-averse following nearly $89 million in liquidations in the past 24 hours in the top three cryptocurrencies.

Open Interest, another key derivatives metric, the combined value of all open contracts in a given token climbed by 1.42%, 4.90% and 1.49% respectively for the top three cryptos BTC, ETH and XRP.

BTC, ETH, XRP on-chain analysis

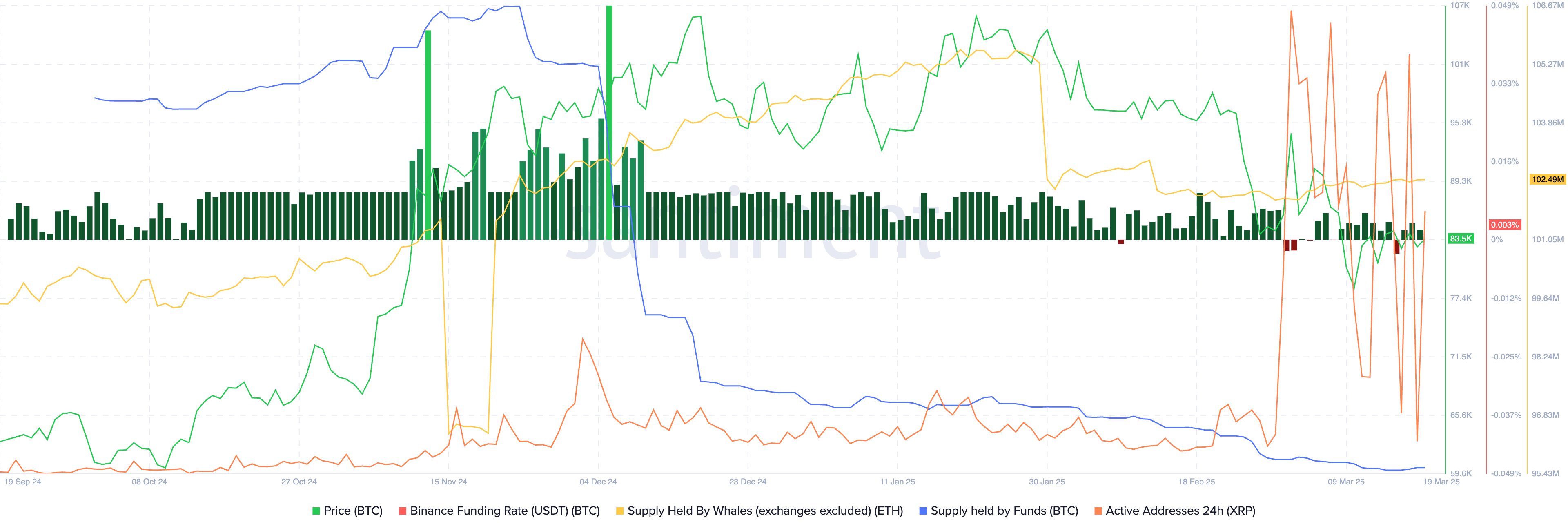

On-chain analysis for the top three cryptocurrencies on Santiment shows that Binance funding rate for Bitcoin has been positive for three consecutive days in a row. Meaning Bitcoin derivatives traders expect price to appreciate, even as they reduce their activity in the token, as gathered by Coinglass data.

Ethereum supply held by whales, excluding exchanges, sees no significant change, while Bitcoin supply held by funds has reduced consistently. The active addresses in XRP, on the daily timeframe have climbed on Wednesday, after a negative spike on Tuesday, as noted by Santiment.

The mixed on-chain data suggests a slightly bullish outlook for Bitcoin and XRP and Ethereum price could remain stable or unchanged in the face of upcoming volatility in the prices of the top three cryptocurrencies with the looming FOMC interest rate decision.

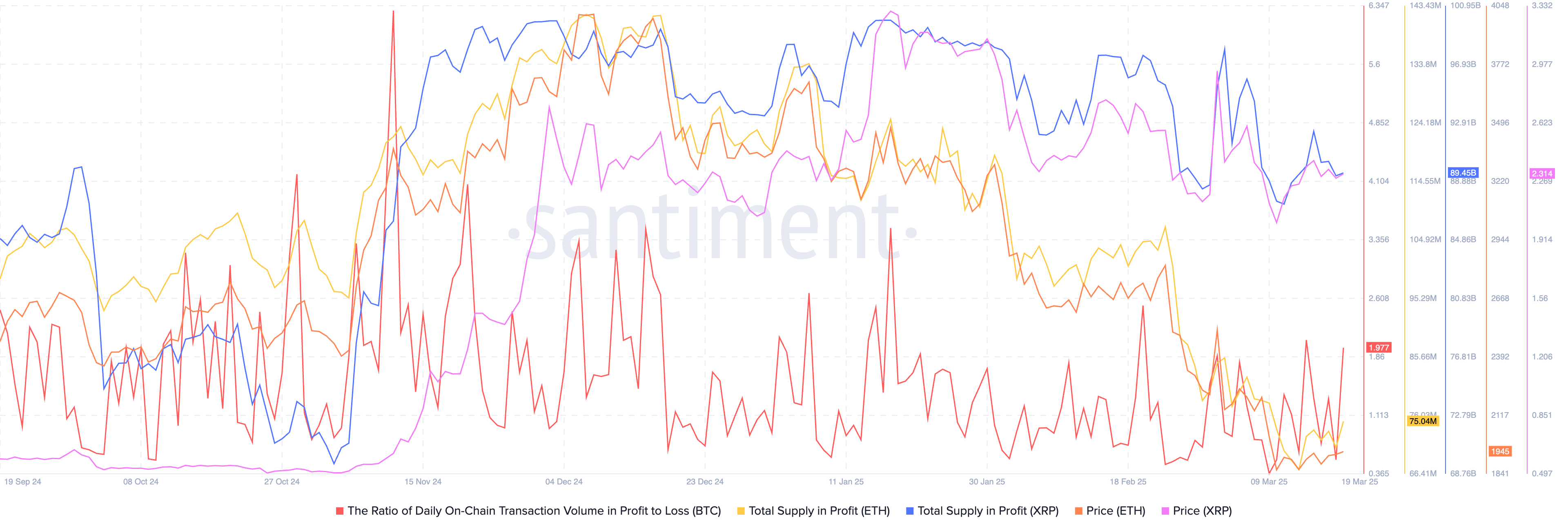

On the Bitcoin blockchain, the ratio of daily on-chain transactions in profits is nearly double that of transactions in losses, there is scope for profit-taking by traders who bought the token lower. In the case of Ethereum, there is a slight uptick in the supply in profit and the same has been observed in XRP.

Ethereum and XRP both offer limited profit-taking opportunities for traders, as seen in the chart below.

Trump push and FOMC rate decision

Bitget CEO Gracy Chen told Crypto.news that Trump’s pro-crypto stance has left many traders puzzled. The idea of a U.S. strategic Bitcoin reserve is gaining traction and while the government is not buying Bitcoin yet, it could soon change.

“The Stablecoin bill is moving through Congress, signaling a major shift toward a blockchain-based financial system. Some big names, Elon Musk included, are exploring their own stablecoins, and Trump’s team sees stablecoins as a way to protect the dollar’s global reserve status.

Then there’s the economy. Scott Bessent’s talk of a “detox period” suggests a controlled downturn might be ahead. If that’s the case, Trump’s playbook seems clear: blame the recession on Biden, use tariffs and crypto narratives to manage costs, and push for lower interest rates to fuel tech and AI growth. Short-term pain, long-term gain — that’s the strategy.”

Chen maintains an optimistic outlook on Bitcoin and predicts no fall under $70,000.

“Bitcoin price drop to possibly 73-78k [is likely], which is a solid time to enter for any buyers on the fence. In the next 1-2 years, BTC at 200k isn’t as far-fetched as most would think.”

The FOMC interest rate decision is looming, with the likelihood of higher volatility and price swings as traders react to the news.

Ryan Lee, Chief Analyst at Bitget Research told Crypto.news in a written note:

“The FOMC meeting on March 19, 2025, is expected to maintain the federal funds rate at 4.25%-4.50%, with the Fed taking a cautious, data-driven approach amid persistent inflation and solid economic growth.

Crypto markets could see a short-term rally if the Fed signals future rate cuts, boosting risk appetite, or a dip if a hawkish stance reinforces tighter financial conditions. However, Bitcoin’s growing resilience and pro-crypto policy tailwinds might temper the broader market impact.”

Lee believes that volatility is likely around the announcement, it could be driven by Federal Reserve chair Powell’s remarks and updated rate projections.

“The crypto market may continue showing increasing independence from Fed decisions. Post-FOMC, Bitcoin is expected to trade within $80,000–$86,000 with 80% confidence, while Ethereum is projected to move between $1,800–$2,100 under the same confidence level. These ranges reflect potential fluctuations tied to macroeconomic signals, investor sentiment, and broader financial conditions.”

Bitcoin eyes return to $87,000, Ethereum could climb to $2,100

Bitcoin could return to the $87,000 level as BTC shows signs of recovery on Wednesday. At the time of writing, Bitcoin trades at $83,517, and technical indicators on the daily timeframe show likelihood of gains in the token.

Bitcoin’s Relative Strength Index (RSI) reads 44 and is sloping upwards, supporting a thesis of positive momentum underlying the token’s price trend. MACD is flashing green histogram bars, the fourth consecutive day in the row, supporting gains in Bitcoin.

Ethereum gained 2.39% on the day, eyeing a retest of the psychologically important $2,000 level before attempting to climb to support at $2,100. This marks a gain of nearly 7% in Ethereum price.

Two key momentum indicators on the Ethereum price chart, RSI and MACD support ETH price recovery on the daily timeframe.

A Bitcoin flashcrash could push Ethereum down to the recent low of $1,754.

XRP price forecast

XRP could rally nearly 7% and test key resistance at the upper boundary of a Fair Value Gap on the daily timeframe at $0.2707. RSI is sloping upwards and reads 47, headed towards neutral at 50.

MACD indicates an underlying bullish momentum in the XRP price trend.

XRP traders are awaiting the next development in the US financial regulator’s lawsuit against Ripple. Another key market mover is XRP’s inclusion in the Strategic Reserve, according to President Trump’s executive order signed on March 6.

The outcomes of these events could impact XRP price in the short-term, in addition to the volatility induced by the FOMC rate decision.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.