An unidentified cryptocurrency whale injected millions of dollars in emergency capital to avoid a potential liquidation of more than $300 million in Ether as markets slumped amid renewed macroeconomic pressure.

The whale is reportedly close to liquidation on a 220,000 Ether (ETH) position on MakerDAO, a decentralized finance (DeFi) lending platform. To stave off liquidation, the investor deposited 10,000 ETH — worth more than $14.5 million — and 3.54 million Dai (DAI) to raise the position’s liquidation price, blockchain analytics firm Lookonchain said in an April 7 post on X.

“If $ETH drops to $1,119.3, the 220,000 $ETH($340M) will be liquidated.”

Source: Lookonchain

The development came hours after another Ether investor was liquidated for over $106 million on the decentralized finance (DeFi) lending platform Sky.

The whale lost more than 67,000 ETH when the asset crashed by around 14% on April 6. Sky’s system employs an overcollateralization ratio, typically 150% or higher, meaning that users need to deposit at least $150 worth of ETH to borrow 100 DAI.

Related: Decentralized exchanges gain ground despite $6M Hyperliquid exploit

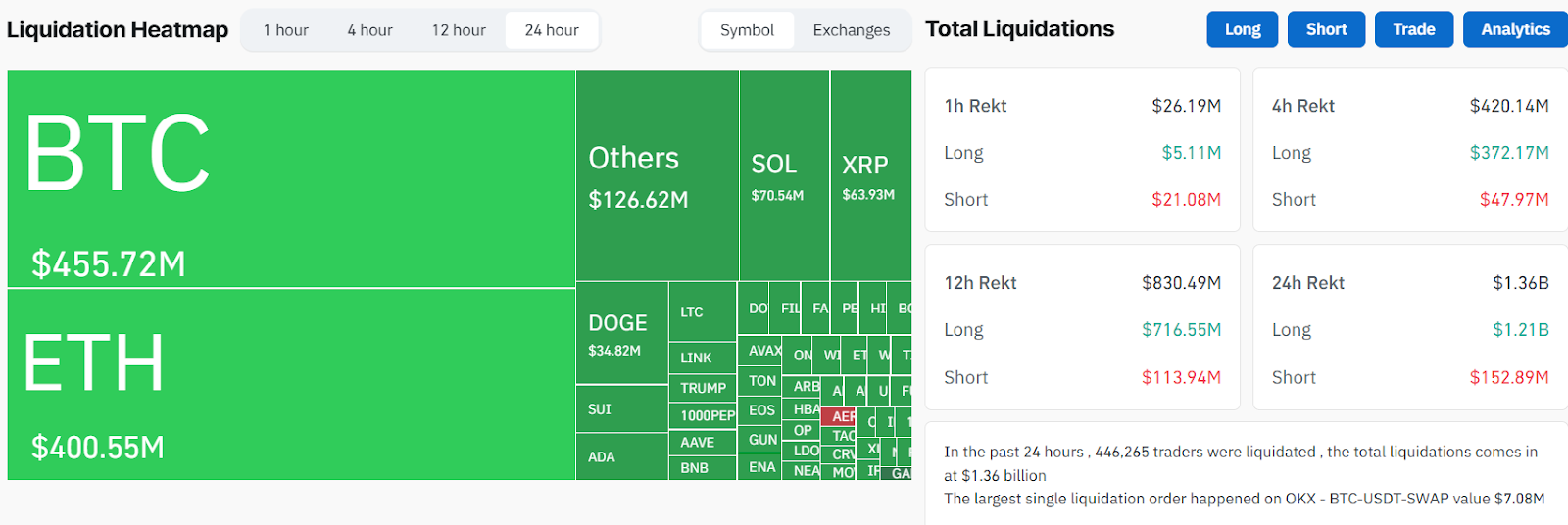

According to data from CoinGlass, more than 446,000 positions have been liquidated in the past 24 hours, with total losses surpassing $1.36 billion. That includes $1.21 billion in long positions and $152 million in shorts.

Crypto market liquidations, 24-hours. Source: CoinGlass

The largest single liquidation was a $7 million Bitcoin (BTC) position on crypto exchange OKX.

Related: Smart money still hunting for memecoins despite end of ‘supercycle’

Crypto markets crash after Trump’s tariff announcement, but 70% recovery chance by June

US President Donald Trump announced his reciprocal import tariffs on April 2, which sent tremors across global markets, leading to a $5 trillion loss by the S&P 500, its largest two-day drop on record.

Still, the tariff announcement may finally end the global uncertainty plaguing traditional and digital markets for the past two months.

“In my opinion, the tariffs are the representation of the uncertainty in the markets,” Michaël van de Poppe, founder of MN Consultancy, told Cointelegraph. “Liberation Day is basically the peak of that period, the climax of uncertainty. Now it’s out in the open. Everybody knows the new playing field.”

The end of tariff-related uncertainty may bring the start of a “rotation toward the crypto markets,” as investors will start buying the dip as digital assets become “undervalued,” said van de Poppe.

Crypto intelligence firm Nansen also estimated a 70% probability that the market may bottom by June, depending on how the tariff negotiations evolve.

Magazine: BTC’s ‘reasonable’ $180K target, NFTs plunge in 2024, and more: Hodler’s Digest Jan 12–18