Key points:

-

Bitcoin fails to capitalize on lower-than-expected US CPI data, seeing a Wall Street sell-off for a second day.

-

Traders see BTC/USD buying time before its next move, and a trip below $100,000 is on the cards.

-

Bitcoin is showing “undeniable” momentum against gold and stocks, Binance’s Richard Teng says.

Bitcoin (BTC) saw a repeat sell-off at the May 13 Wall Street open as bears ignored positive US inflation data.

BTC price stagnates after CPI inflation cools

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD again heading lower after failing to reclaim $104,000 as support.

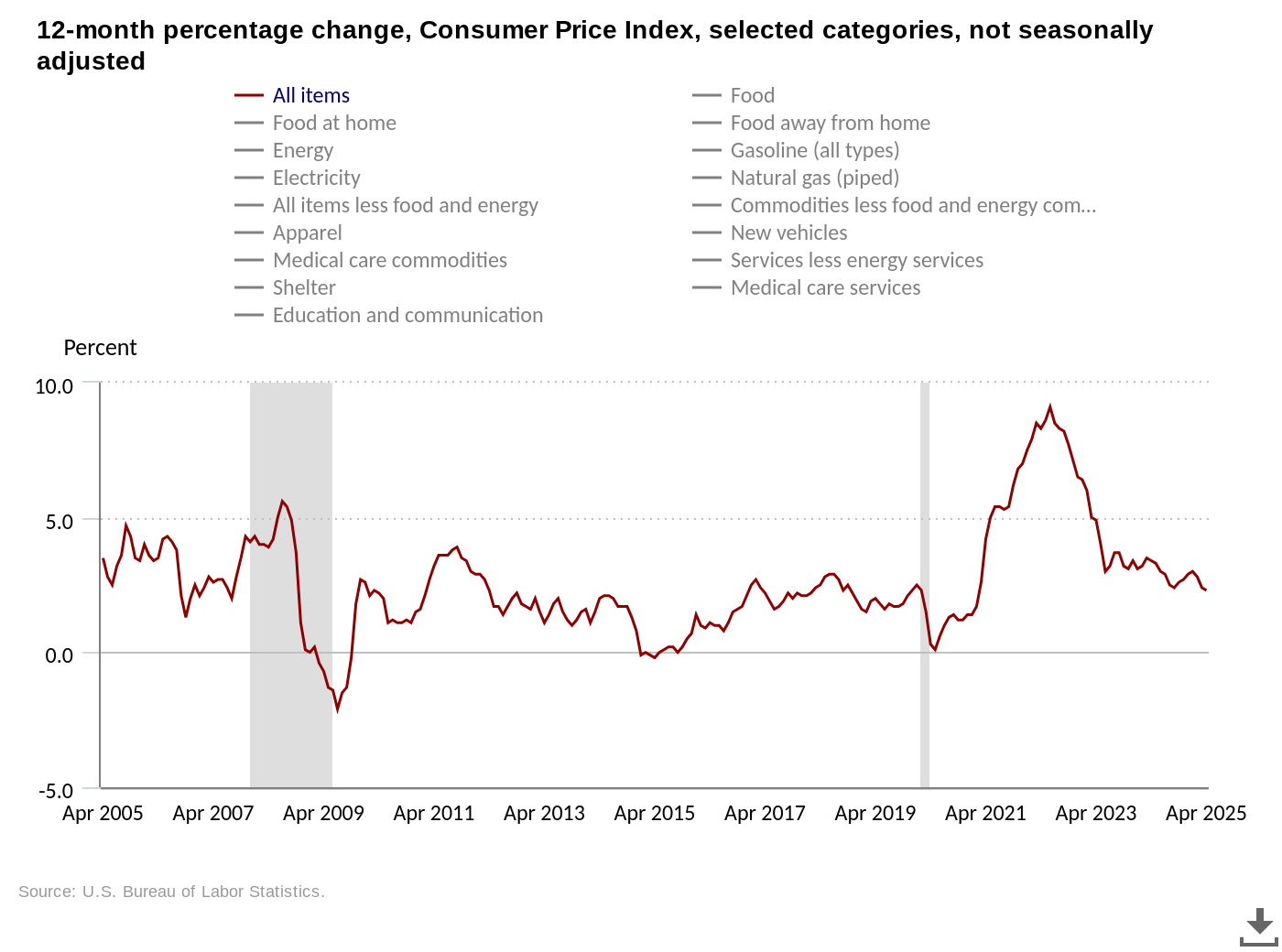

The downside came despite the April print of the US Consumer Price Index (CPI) coming in below expectations in what should be good news for risk assets.

“The all items index rose 2.3 percent for the 12 months ending April, after rising 2.4 percent over the 12 months ending March,” an official release from the US Bureau of Labor Statistics (BLS) confirmed.

“The April change was the smallest 12-month increase in the all items index since February 2021.”

US stocks opened higher, with the S&P 500 and Nasdaq Composite Index up 0.7% and 1.4%, respectively, at the time of writing.

Reacting, trading resource The Kobeissi Letter noted that the S&P 500 had now delivered net upside year-to-date.

“The S&P 500 has technically entered a new bull market, up 20% since April. We are seeing historic moves to both directions in both stocks and commodities,” it wrote in part of a thread on X.

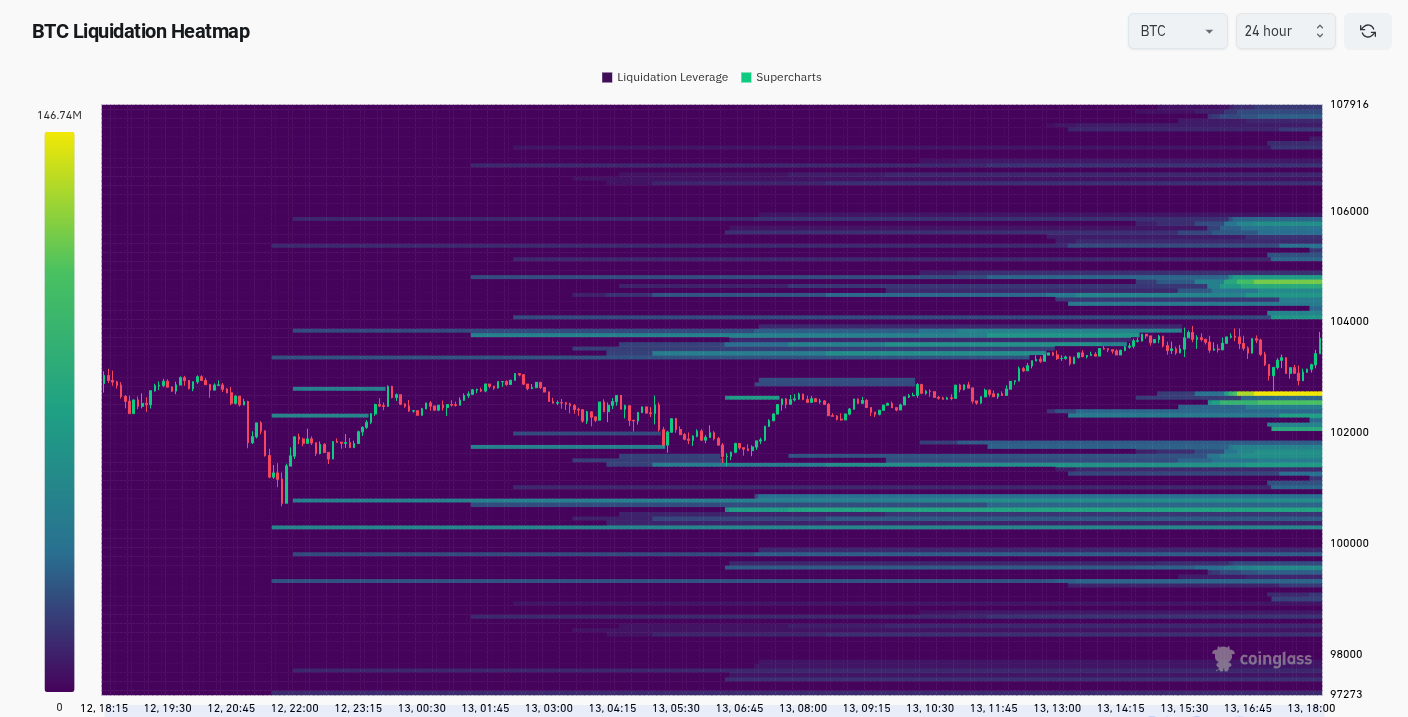

BTC/USD meanwhile surfed nearby order book liquidity around spot price. For popular trader Daan Crypto Trades, the stage was now being set for fresh volatility.

“That’s all the big clusters above and below taken out now. Good liquidity grab on both sides,” he summarized alongside data from monitoring resource CoinGlass.

“From here on out we’ll just have to wait and see as the market ranges a bit and figures out what it wants to do. No massive liquidity levels nearby so spot will have to be leading.”

The day prior, Daan Crypto Trades had forecast a retest of $102,000 based on liquidity clusters, a move which subsequently played out.

“Bitcoin is stalling here for a little bit, which is completely fine,” crypto analyst and entrepreneur Michaël van de Poppe continued.

“Even if it goes back to $97.5-98K, we’ll still be in an uptrend and building up for new ATHs.”

Teng: Bitcoin momentum “undeniable”

Assessing the ongoing macro implications for BTC price action, trading firm QCP Capital considered the chances of the market trending sideways in the short term.

Related: Bitcoin illiquid supply hits 14M BTC as hodlers set bull market record

“BTC remains caught in a tug-of-war between its identity as ‘digital gold’ and its function as a risk-on proxy. This tension continues to obscure its directional conviction,” it wrote in its latest bulletin to Telegram channel subscribers on the day.

“As the macro narrative moves from protectionism toward renewed trade optimism, BTC could remain range-bound.”

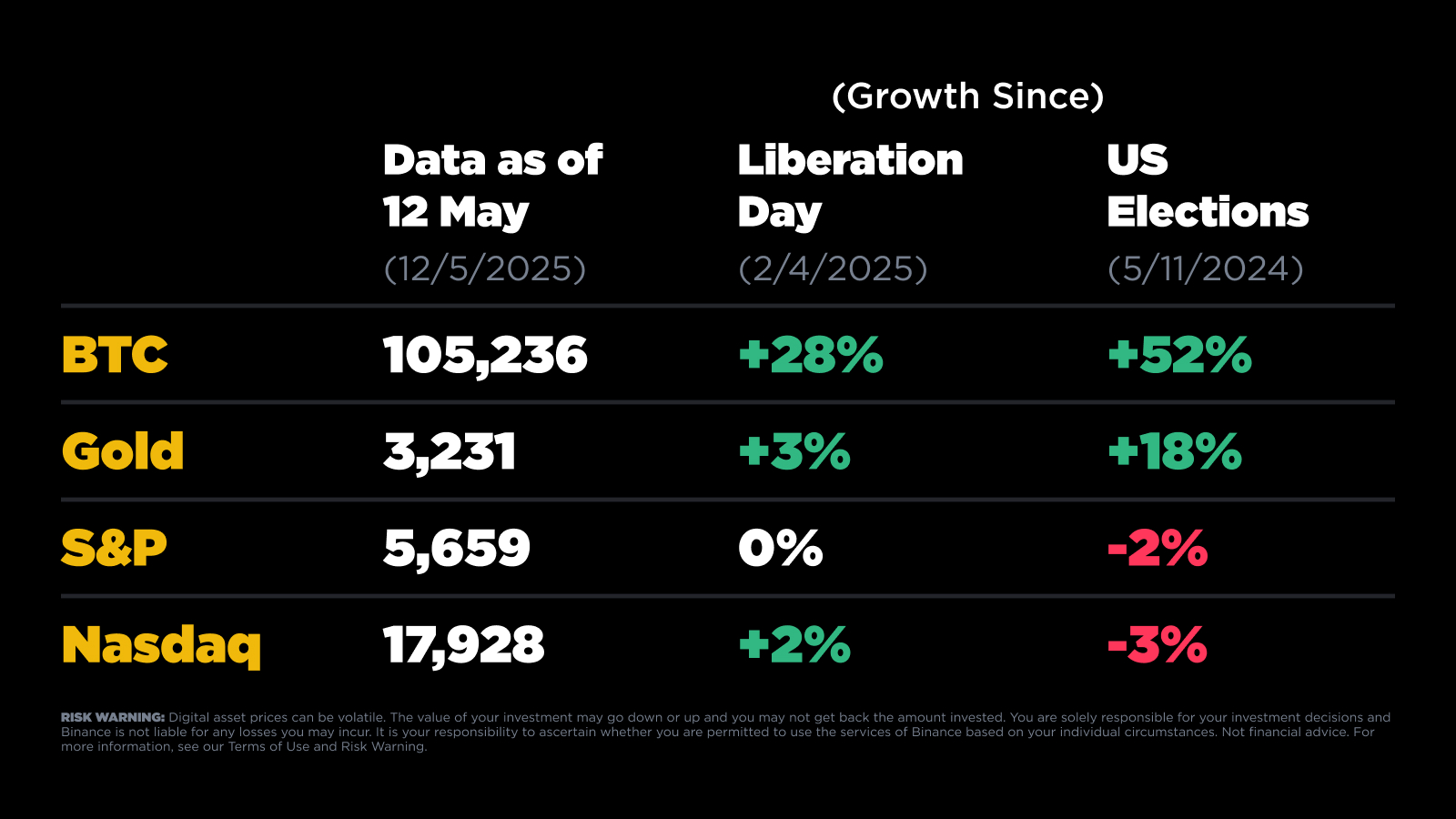

Others remained strong in their conviction over the general market trajectory, including Richard Teng, CEO of crypto exchange Binance.

“While traditional markets recover, Bitcoin’s already leading the pack,” he told X followers while comparing returns since the April 2 “Liberation Day” enacted by US President Donald Trump as he unveiled reciprocal trade tariffs.

“With double-digit gains following key global events, BTC is reinforcing its position as a resilient alternative asset—outperforming gold, the S&P 500, and the Nasdaq year-to-date. The momentum is undeniable.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.