Shares in Swedish health tech company H100 Group AB rose 37% after it said it purchased Bitcoin for the first time as part of a new strategy, while China’s Jiuzi Holdings revealed its plan to stack 1,000 Bitcoin over the next year.

H100 said on May 22 that it spent 5 million Norwegian krone ($490,830) buying 4.39 Bitcoin (BTC) at an average purchasing price of around $111,785.

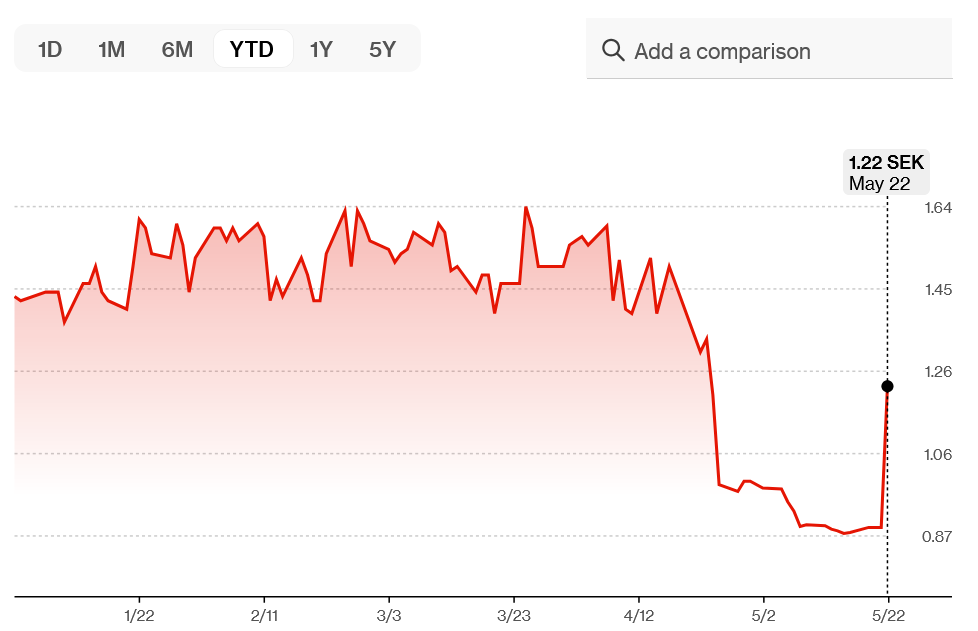

The company’s shares closed May 22 trading up 37% to 1.22 Swedish krona ($0.13) on the Nordic Growth Market following its disclosure of its Bitcoin purchase, Bloomberg data shows.

The strong trading day recovered some losses from the past two months, during which the firm’s shares have fallen by over 46%.

The firm’s CEO, Sander Andersen, said he believes “the values of individual sovereignty highly present in the Bitcoin community aligns well with, and will appeal to, the customers and communities we are building the H100 platform for.”

H100 sells health tools for individuals who don’t want to rely on the “reactive health system,” Andersen said in a separate X post.

Andersen marked the first Bitcoin announcement and purchase as “Phase 1,” hinting at further buys.

China’s Jiuzi Holdings to stack 1,000 Bitcoin

Meanwhile, on May 22, the Nasdaq-listed Chinese electric vehicle retailer Jiuzi Holdings said its board approved a plan to buy 1,000 Bitcoin over the next year through additional stock issuance and cash purchases.

Related: Bitcoin continues rally to surpass $110K for the first time

The company’s CEO, Tao Li, acknowledged the volatility that comes with investing in Bitcoin but is hopeful the move will strengthen the firm’s asset structure, risk resistance and profitability.

Jiuzi (JZXN) rose 7.3% to $3.09 on May 22, Google Finance data shows — a comparatively minor rise compared to other public companies that have recently announced Bitcoin buys.

Adopting Bitcoin as a treasury asset has become an increasingly popular trend of late, with 109 public firms now holding the cryptocurrency on their balance sheets, according to BitcoinTreasuries.NET data.

Magazine: Crypto fans are obsessed with longevity and biohacking: Here’s why