Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

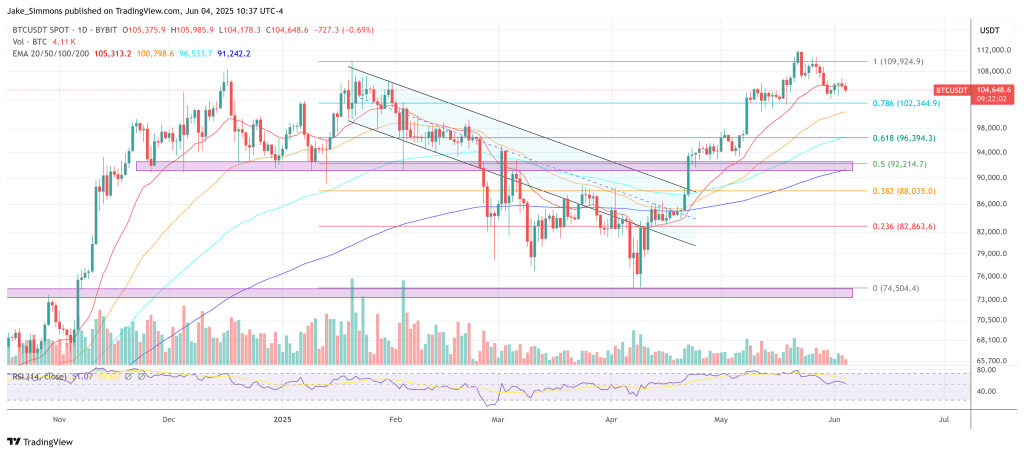

Singapore-based trading desk QCP Capital says the options market is sending an unmistakable signal: large players are quietly positioning for a break to $130,000 by the end of Q3, even as spot Bitcoin languishes near $105,000.

$130,000 Bitcoin Bets Heating Up

In a note to clients on Wednesday, the firm highlighted “a surprise uptick in job openings” that lifted risk appetite across equities, nudging the S&P 500 toward the psychologically charged 6,000 mark. “A steady NFP would cement the Fed’s narrative of a resilient labour market, reinforcing expectations that rates will remain on hold,” QCP wrote, adding that front-end Bitcoin volatility has already “slipped below 40 vol” as traders park on the sidelines before Friday’s payroll print.

Despite the calm surface, options flows tell a livelier story. “September $130K calls were lifted at 47 vol,” QCP observed, pointing to “pockets of topside interest heading into Q3.” With the one-month volatility term structure now flatter than at any point since May, opportunistic funds have found it inexpensive to buy long-dated vega while selling short-dated gamma. The dynamic mirrors a broader decline in equity volatility—VIX is plumbing its own three-month lows—and has left Bitcoin’s implied curve looking “wholly normalised,” QCP noted, with skew suggesting “little directional conviction” in the near term.

Related Reading

That benign backdrop may not last. The desk warned that tariff frictions and Washington’s so-called “Big Beautiful Bill” could roil macro data just as the US debt-ceiling saga re-enters the headlines. “In the absence of a clear catalyst, BTC is unlikely to break materially out of its current range,” the note said, but Q3 “could prove more challenging” as fiscal risks and trade tensions “introduce potential headline volatility.”

China has already flashed early signs of stress: futures volumes in 10- and 30-year Chinese government bonds have fallen to their lowest levels since February, a fact QCP attributes to “broader risk aversion and sidelined positioning.” Meanwhile, markets await any progress on an anticipated Xi-Trump dialogue—an event that could shift sentiment on tariffs.

For now, however, Bitcoin remains pinned. Spot has hugged the $105,000 handle for five straight sessions, open interest is light, and realized volatility has compressed into a mid-teens annualized band—conditions that historically precede a sharp expansion. Whether that expansion resolves higher or lower hinges on the very catalysts traders are bracing for: payrolls data, central-bank rhetoric, and the tariff announcements that dominated headlines earlier in the year.

Related Reading

Yet the willingness of sophisticated desks to pay up for September upside is hard to ignore. A cluster of large prints in the $130,000 strike, executed at implied vols roughly seven points above the prevailing curve, suggests at least some investors expect Bitcoin to test new highs before month-end September. QCP stops short of endorsing the trade outright but underscores the asymmetry: “With vols crushed and skew flat, the cost of owning topside gamma has rarely looked this attractive,” the firm writes.

That calculus—cheap optionality against a potentially volatile macro backdrop—explains the growing divergence between spot lethargy and options optimism. If the payroll report arrives soft, the Fed pivot narrative could re-ignite; if tariff negotiations sour, Bitcoin’s digital-gold appeal may resurface. Either path feeds volatility, and volatility is precisely what long-vega buyers are banking on.

At press time, BTC traded at $104,648.

Featured image created with DALL.E, chart from TradingView.com