Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The market technician known on X as Dr Cat (@DoctorCatX) has published a post that condenses years of his XRP/BTC work into one number—2,041 satoshis—and a set of time-stamped price targets that reach as high as $30 per XRP once Bitcoin hits $270,000.

In the post, the analyst begins with a sharp rebuke of critics who, in his words, “pretend to be idiots just to troll” before pivoting to a rigorously structured roadmap. He breaks price action into five nested horizons—intraday, daily, weekly, monthly and quarterly—and assigns each its own decision-making role.

XRP Moon Scenario: $30 Target Needs One Final Signal

The crux of the argument is that monthly price candles must be read in isolation from what he calls the “noise” of the lower frames if traders want to understand where serious accumulation or distribution is taking place. “Bullish target: ~$4–4.5 (3.5 K sats on 120–130 K BTC). Very bullish target: ~$18–30 (7 K–12 K sats / 270 K BTC).”

Those levels are not merely numeric goals; they are the by-product of a ratio he views as structural. A monthly close below 2,041 satoshis would, paradoxically, increase his confidence in the “very bullish” path—but only “very long term (2026+),” because such a breakdown would probably trigger what he calls a flush toward 1,800, 1,500 or even 700 sats first. Conversely, a defense of that shelf preserves a less spectacular—but cleaner—advance toward 3,500 sats (~$4–4.50 at current six-figure Bitcoin prices) and keeps alive the 7,000-to-12,000-satoshi objective for the extended cycle top.

Related Reading

The thread’s most practical value may lie in its explanation of why no immediate weekly up-trend should be expected even in the “most bullish” scenario. Dr Cat points to classic Ichimoku conditions—Chikou Span under price, a downward-angled Kijun-sen and a bearish Tenkan/Kijun cross—arguing that history shows it can take “~26 weeks at least” for those signals to unwind. Any rally toward 2,700 sats in the next couple of months would therefore be viewed as a Kijun retest ripe for rejection rather than the start of a sustained breakout.

The analyst also clarifies a point that has caused confusion among casual readers: his $270,000 Bitcoin estimate is a macro-cycle cap, not a near-term forecast. He explicitly states that he expects the current market cycle to “extend to 2026 and beyond,” which is why the loftiest XRP numbers sit at the far right of his timeline. Everything, he insists, flows from the ratio between the two assets, not from dollar-denominated targets considered in isolation.

Related Reading

Context comes in the form of a brief exchange with a skeptic posting under the handle “Woo tard of Wall St”, who mocked the notion of a $7 XRP at 270,000 BTC. Dr Cat’s reply—delivered without diluting his language—underscores how strongly he views the time-horizon mismatch between traders who obsess over daily candles and those who plot quarterly swings.

Technicians may quibble with the assumption that one static ratio can govern a three-year outlook, but the post offers a coherent, internally consistent playbook: watch the monthly close against 2,041 sats. Hold it, and the roadmap favors an eventual attack on 3,500 sats and, later, 7,000-plus. Lose it, and the pair probably capitulates before any “monster move” can emerge in the second half of the decade. Either outcome, Dr Cat argues, will resolve whether the XRP narrative of under-performance finally gives way to what would be its most spectacular out-performance against Bitcoin since 2017.

For market participants seeking a single data point to anchor their risk management, 2,041 satoshis now functions as that fulcrum. Until the monthly candle prints, every tick above or below the line will feed the debate over whether XRP is coiling for a generational breakout—or simply rehearsing another round of disappointment.

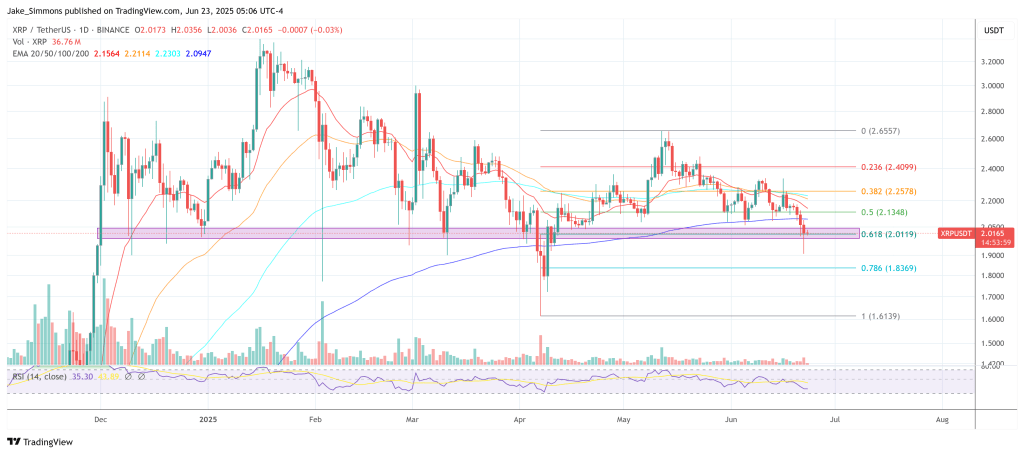

At press time, XRP traded at $2.01.

Featured image created with DALL.E, chart from TradingView.com