Corporate cryptocurrency treasuries are emerging as a new class of public companies bridging traditional finance and digital assets, signaling rising institutional interest in crypto.

Corporate cryptocurrency treasury firms including Strategy, Metaplanet and SharpLink have collectively amassed $100 billion worth of digital assets, according to a Galaxy Research report released Thursday.

Bitcoin (BTC) treasury firms hold the lion’s share, with over 791,662 BTC worth around $93 billion on their books, representing 3.98% of the circulating supply. Ether (ETH) treasury firms hold 1.3 million ETH tokens, worth more than $4 billion, representing 1.09% of the Ether supply, the report states.

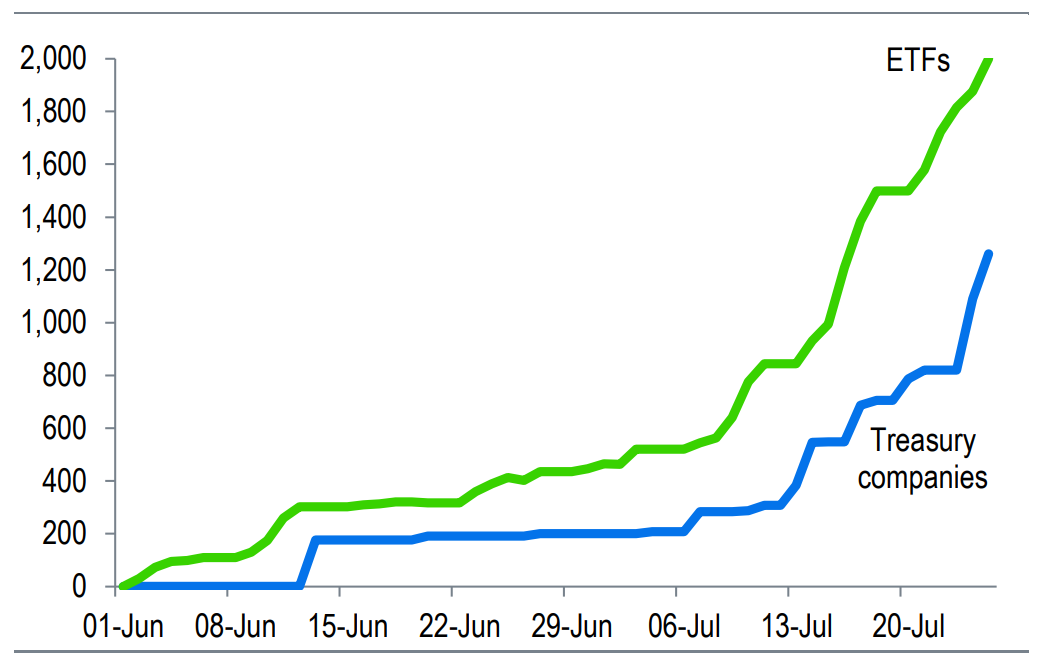

Corporate buyers are becoming a key source of Ether liquidity alongside US spot ETH exchange-traded funds, which recently posted 19 consecutive days of net inflows, a record for the products.

Since July 3, the Ether ETFs amassed $5.3 billion worth of ETH as part of their record winning streak, Farside Investors data shows.

More corporate buying and continued ETF inflows may help Ether surpass the $4,000 psychological mark, which is also the year-end price target of Standard Chartered, the bank said in a Tuesday research report.

“We think they may eventually end up owning 10% of all ETH, a 10x increase from current holdings,” the bank said, adding that Ether treasury firms have more growth potential compared to Bitcoin treasuries, from a “regulatory arbitrage perspective.”

Related: Ethereum at 10: The top corporate ETH holders as Wall Street eyes crypto

Cryptocurrency treasury firms a global phenomenon beyond the US

Ether’s growing corporate acquisition signals a shift in institutional recognition for Ether as the next emerging treasury asset class.

The top 10 corporate holders amassing 1% of Ether’s supply marks an institutional “shift” in perception, according to Enmanuel Cardozo, market analyst at Brickken asset tokenization platform.

“These companies aren’t just passively holding ETH, they’re staking it, leveraging it, and integrating it into broader treasury strategies,” he told Cointelegraph.

“It’s happening faster than with Bitcoin during its early treasury adoption phase,” since Ether enables corporations to tap into staking yields and “actively generate value,” he added.

Related: Bitcoin becomes 5th global asset ahead of “Crypto Week,” flips Amazon: Finance Redefined

Despite the significant inflows, Ether’s price remains 21% below its all-time high of $4,890 recorded four years ago in November 2021, Cointelegraph data shows.

While Ether’s long-term perspectives remain promising, recapturing the all-time high before the end of the summer would require near “perfect conditions,” including sustained inflows and a favorable macro backdrop.

While the all-time high may only occur toward the end of 2025, the sustained corporate and ETF inflows are setting the foundation for the “early stages of a longer-term revaluation” for the world’s second-largest cryptocurrency, Cardozo said.

Magazine: High conviction that ETH will surge 160%, SOL’s sentiment opportunity