Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Jack Mallers, founder and CEO of Strike, ignited fresh debate over Washington’s still-undisclosed Bitcoin balance on Wednesday night, arguing that the US government is withholding the numbers because its position is “too small to lead” the digital-asset economy.

“The US won’t disclose their BTC holdings. Why? Because they realized they don’t own enough,” Mallers posted on X, adding that the Strategic Bitcoin Reserve (SBR) race is “far from over” and “I expect this to heat up.”

US Bitcoin Silence Hints At Bigger Problem

In a video attached to the post, the 30-year-old entrepreneur expanded on the point. He praised the administration’s decision in March to create an SBR but said the follow-through has fallen short: “The US government has kind of let us down in not giving us the full audit of how much Bitcoin the US government owns. … Clearly that information is sensitive or else they would disclose it. … I think that the US government is ashamed of its Bitcoin position.”

Related Reading

President Donald Trump’s Executive Order 14233 on 6 March formally established the Strategic Bitcoin Reserve alongside a broader Digital Asset Stockpile, framing Bitcoin as a “unique store of value in the global financial system.” A follow-up White House fact sheet stressed the goal of “positioning the United States as a leader among nations in government digital-asset strategy.”

Yet when the administration unveiled its 163-page digital-assets strategy on 30 July, the document offered only a fleeting reference to the SBR and no hard figures. Robert “Bo” Hines—executive director of the President’s Council of Advisers on Digital Assets—noted, “I can’t discuss that right now … There are several reasons we’re not disclosing that at this time.”

Over the past months, Hines’ tone was not apologetic. “We want as much Bitcoin as we can possibly get, and we’re going to continue to work on that,” he said in a separate interview, describing Bitcoin as “digital gold”.

For years analysts believed the US government controlled well over 200,000 BTC thanks to Silk Road, Bitfinex-hack and other forfeitures. But a Freedom of Information Act response released in mid-July showed the US Marshals Service holding just 28,988 BTC—about $3.3 billion at today’s prices—rekindling speculation that earlier administrations quietly liquidated a large share of the trove.

Separate on-chain data confirm that federal wallets sent 30,175 BTC to Coinbase Prime as early as April 2024, with additional transfers worth $1.9 billion following in December 2024.

Related Reading

Mallers seized on those numbers. “I think the Democrats sold off a bunch of that Bitcoin, and they don’t want to announce anything until they can build the position back,” he said, calling the audit delay “a branding problem” for a country that bills itself as the future Bitcoin super-power.

Market Backdrop

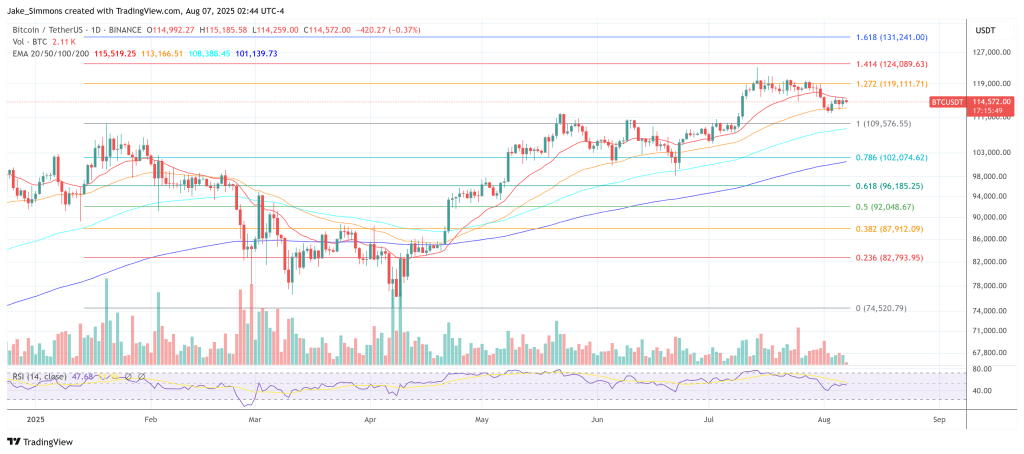

Bitcoin is trading above $114,000 after peaking at $123,000 last week, up more than 100 percent year-on-year. The float is already constrained: roughly 92 percent of all coins are mined, and large swaths sit in dormant or long-term-holder wallets. Should the Treasury accelerate SBR purchases—as Mallers predicts—the incremental buy-side pressure could tighten supply further.

From Mallers’ vantage point, the political embarrassment he describes is ultimately price-positive: “If the US wants to plant its flag as the crypto capital, it has no choice but to accumulate. That’s the bullish takeaway. We’re talking about a buyer with the deepest pockets on Earth.”

Whether Congress will backstop those purchases is another matter. Senator Cynthia Lummis has re-introduced a bill directing the Treasury to acquire up to one million BTC over five years, but appropriations committees have yet to schedule hearings.

At press time, BTC traded at $114,572.

Featured image created with DALL.E, chart from TradingView.com