Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

In a market update on August 19 titled “Key Altcoins To Watch Right Now,” crypto analyst Cryptoinsightuk argues that conditions are improving for a fresh leg higher in altcoins as Bitcoin dominance shows signs of easing. “The last few days and in the newsletter I’ve discussed my long-term thesis around Bitcoin dominance dropping [and] that altcoins are going to take the next leg up,” he said, adding that, at current levels across majors, “risk–reward for long positions is very good here.”

He anchors the view in a recurring intraday structure he says is visible across Bitcoin and multiple large caps: a range forms, the lows are swept, the highs are swept, price returns to the range lows, and momentum begins to base. On Bitcoin specifically, he notes that “RSI on [the] 4-hourly looks like it could turn up,” while acknowledging that short-term direction could still be shaped by the US equity open and broader macro headlines.

Top Altcoins To Watch In Crypto Right Now

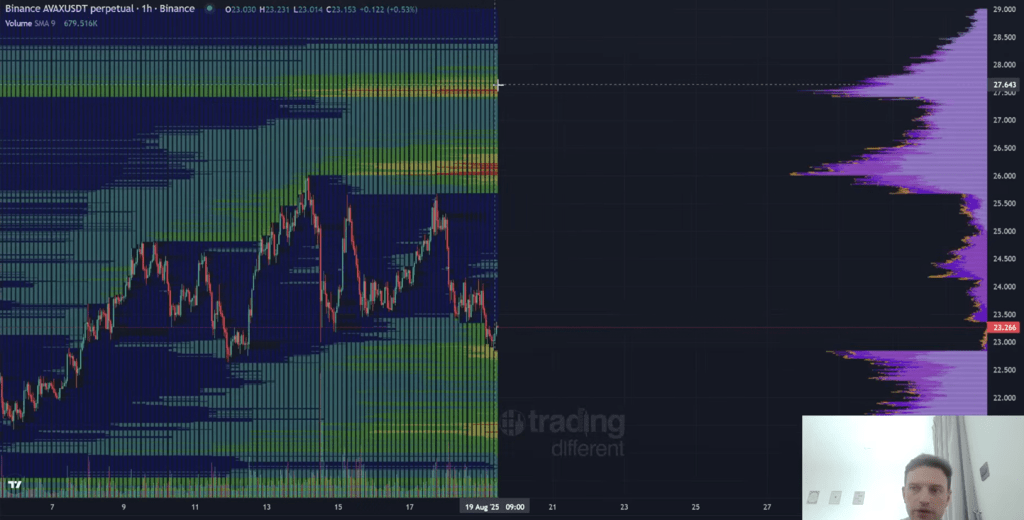

Avalanche (AVAX) tops his tactical list. He outlined a limit-bid plan at $22.75, citing a local liquidity pocket down to roughly $22.70, while emphasizing that the more material liquidity sits overhead: “There’s more dense liquidity above us all the way up to $27… on the daily… up to about $28.4, even towards $30 for AVAX.” He framed the trade as asymmetrical because “if we don’t get [the fill] then that’s fine,” whereas a push into the upper liquidity bands could accelerate.

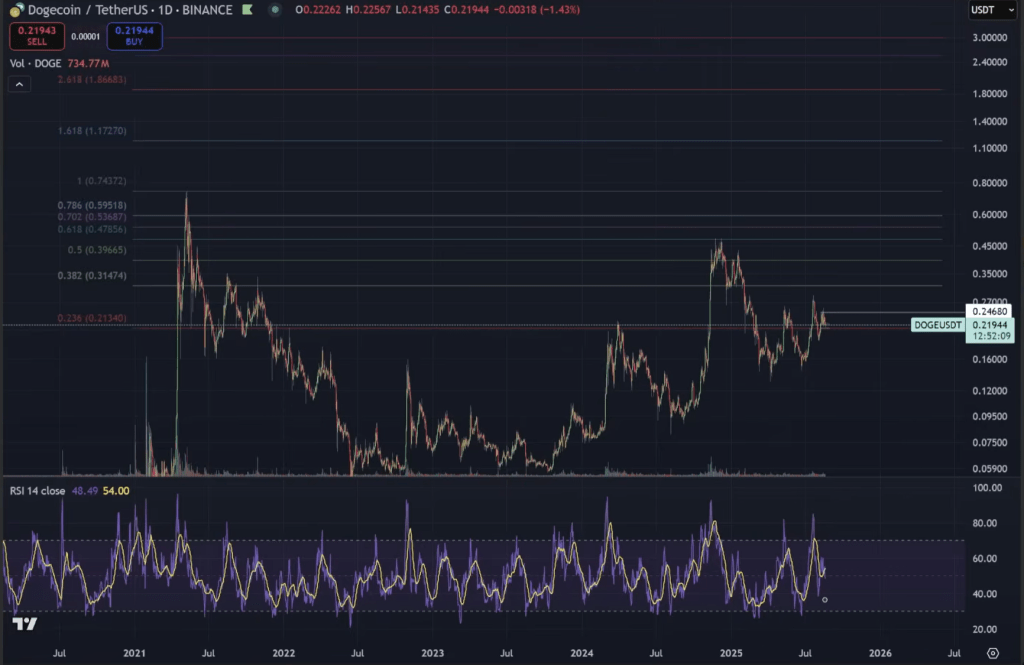

Dogecoin (DOGE) is his highest-conviction swing. He disclosed two concurrent longs—one in a DOGE perpetual and one versus USDT—with an average entry around $0.225–$0.227 and modest leverage on the larger position. The technical map, he argued, has already progressed through the stop-sweep and retest phase: “We had this range… we swept the lows and… back-tested this… little cluster here, bounced off it as support so far.”

Related Reading

In the near term, the crypto analyst is watching the reclaimed range floor as resistance that must flip; beyond that, he sees “much more dense” resting liquidity above current price “all the way up to about 30 cent,” with a broader discussion zone in the mid-$0.40s: “We’ve got red liquidity all the way up to 47 cent, and when we’re up to that level, I’ll start to consider maybe deleveraging.”

His longer-term target framework references Fibonacci extensions: “My take profits [are] at the 1.618 fib… all the way at like $1.19,” while stressing he would adjust sizing “depending on what the market looks like at some of these different levels.”

Cryptoinsightuk also flagged what he called a sentiment-sensitive Fartcoin long carried with higher leverage. The stake is intentionally small given volatility—“we’re 10x on Fartcoin, so we could get liquidated if we come down to like 86 cent… 81 cent I think is a liquidation”—and intended only for a move back to range highs.

On XRP, the crypto analyst describes a similar range-construction to DOGE and AVAX with an initial target at the top of the band. “Primary target would be like this top of the range… structure is similar,” he said, noting that his focus there remains on reactions as prior highs and visible liquidity are approached.

Cardano also made the list with visible liquidity around prior swing highs “up here at this $1–$1.10,” implying a first checkpoint near the $1.10 area, with continuation risk skewed to the upside “once you get to that swing high.”

Related Reading

He devoted more structural nuance to Flare (FLR), calling out a potentially completed or developing corrective sequence that could seed a stronger impulse. “This could be the start of an impulsive move. This could be one, two, three, four, five. This could be like an ABC correction or W-X-Y-Z… triangle… in wave twos… which could then obviously lead to a wave three which would be quite aggressive,” he said, framing FLR as an “interesting structure” rather than a call for immediate participation.

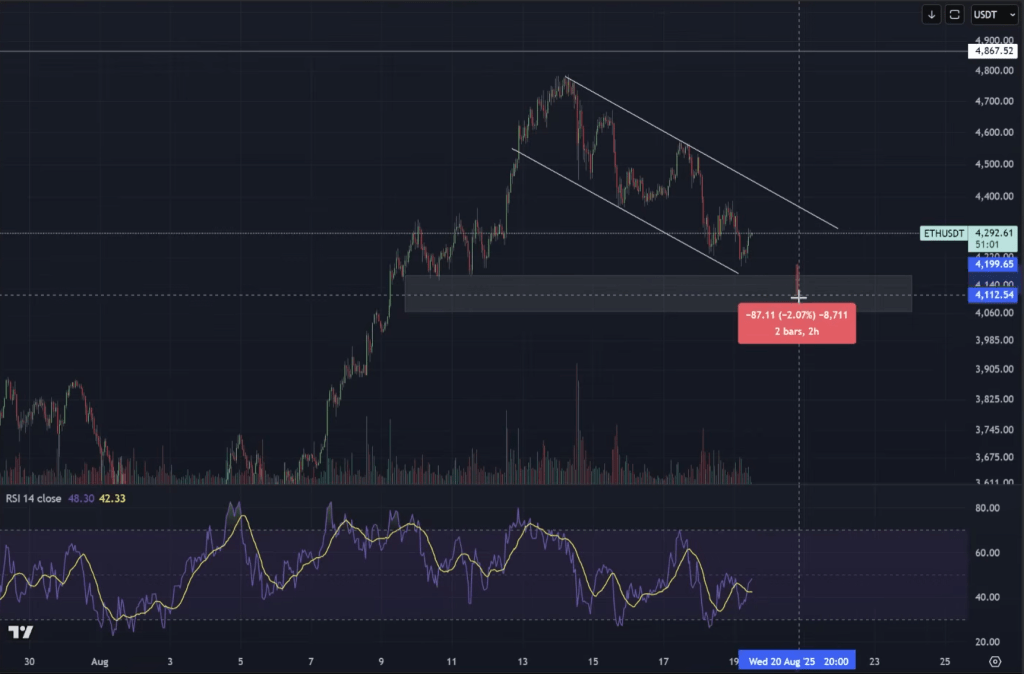

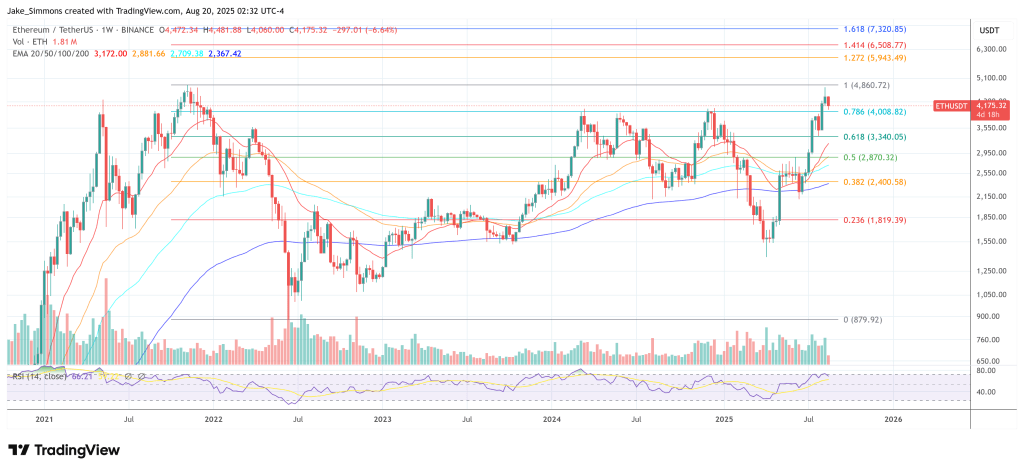

Ethereum, he argued, is trying to repair short-term trend signals even as a nearby liquidity pocket lurks below. “ETH is trying to break this short-term downtrend… challenging this key cluster… You can see… bullish divergences on the hourly time frame,” he said, citing a sequence of lower lows in price against higher lows on RSI. That constructive micro-setup underpins his broader positioning stance: if Bitcoin rotates to the top of its range and retests all-time highs, “you’re probably going to see the most aggressive part of the cycle move when you enter price discovery.”

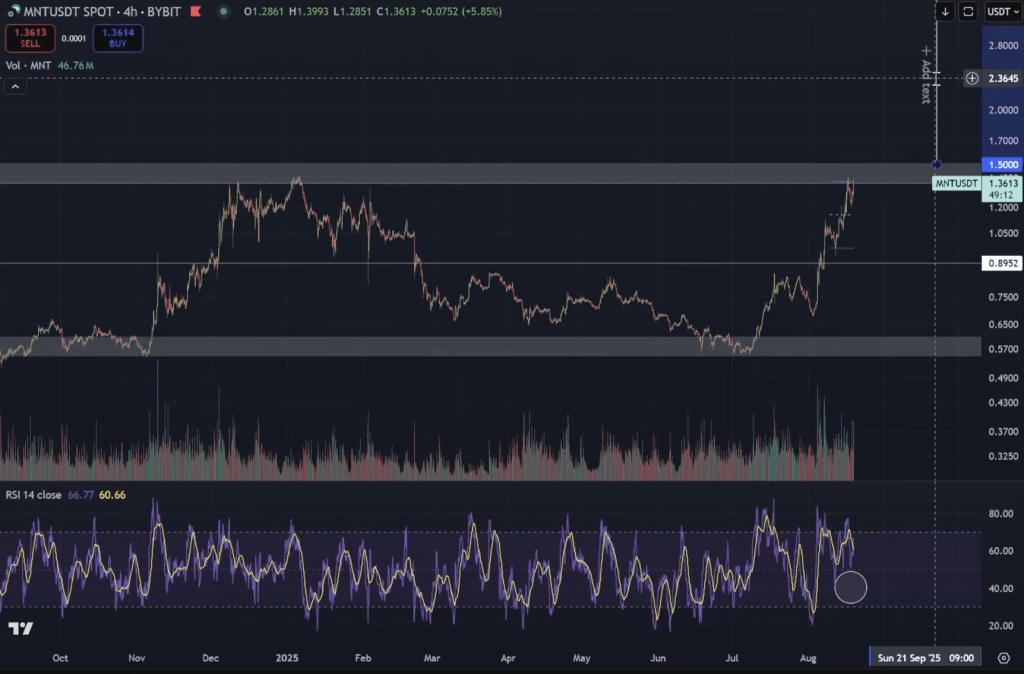

He rounded out the watchlist with Mantle (MNT), noting he holds a spot allocation and would consider taking profits near $2 if a clean range break materializes. “MNT is at the top of a range… if we do get that range break, it could be quite an aggressive move to the upside. I will be taking profits maybe around the $2 mark,” he said.

At press time, ETH traded at $4,175.

Featured image created with DALL.E, chart from TradingView.com