Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

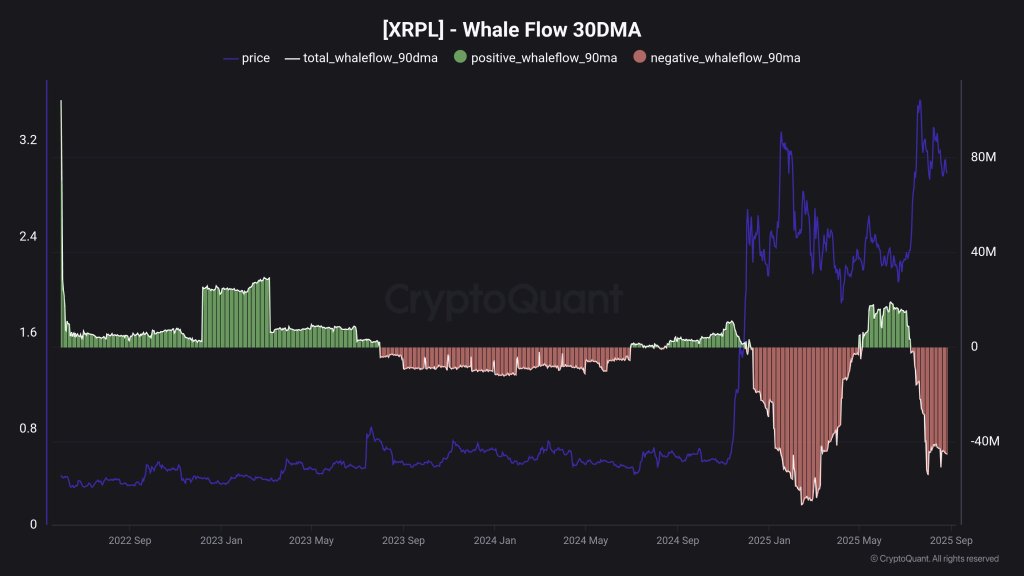

A fresh readout of CryptoQuant’s “Whale Flow (30-day moving average)” for the XRP Ledger points to renewed distribution by large holders, according to on-chain analyst Maartunn. Sharing the chart, he summed up the signal on X: “🚨XRP Whales are selling heavily. It’s clear distribution. On-chain data tells the story. In data, we trust.”

XRP Whales Unload Millions

The dataset decomposes large-holder activity into positive and negative whale flow and smooths it with a 30-day average to reduce noise. On the latest print, the histogram is dominated by deep, sustained negative bars, signaling net outflows from whale cohorts rather than accumulation.

Related Reading

The timing aligns with price behavior: after XRP vaulted above $1 in late December 2024 and accelerated toward roughly $3.40 by mid-January 2025, the 30-DMA of whale flow flipped decisively negative. Through February–March 2025 the negative leg deepened, with the smoothed net flow bottoming around approximately −60 million to −70 million XRP, a trough among the most pronounced on the multi-year chart.

That heavy distribution abated only briefly. From April through June 2025 the whale-flow 30-DMA turned positive for about three months, topping in the vicinity of +10 million to +20 million XRP. Importantly, that respite coincided with a cooler tape: price slid below $2.00 in April, then oscillated largely between ~$2.00 and a ~$2.60 ceiling into late June.

As soon as XRP reclaimed roughly $2.60 in mid-July, the negative histogram returned, and by August the smoothed net flow had retreated again toward approximately −40 million to −50 million XRP. Price meanwhile ran back above $2.60 in mid-July and spiked to a new high at $3.66 by end of the month. While XRP consolidates near $3, the whale-flow 30-DMA remains firmly negative at roughly −40 million XRP.

Two structural takeaways stand out from this sequence. First, the heaviest negative prints in early Q1 2025 clustered immediately after the late-2024/early-2025 breakout from ~$1.00 to above $3.00, consistent with large-balance profit-taking and supply returning to market as price momentum stretched.

Related Reading

Second, the only sustained positive-flow window—April to June—overlapped a period when spot weakened below $2.00 and could not sustain moves beyond ~$2.60, suggesting whales were less inclined to distribute into a soft market and more inclined to add or at least reduce selling pressure during consolidation. The return to sizable negative flow once price pushed back through ~$2.60 in mid-July supports Maartunn’s characterization of renewed “distribution.”

As ever, there are caveats. Whale-flow heuristics aggregate transfers from large addresses and cannot perfectly separate exchange internalization, custodian rebalancing, or OTC settlement from directional selling. And a 30-day smoothing window introduces lag: a sharp behavior change by whales will take time to surface. Even so, the breadth and persistence of the negative bars—near −70M/−80M XRP at their Q1 depths, sliding back toward −40M XRP in August—tilt the balance of evidence toward a market still digesting supply from big holders.

For now, the on-chain picture is straightforward: large-balance entities remain net suppliers on a smoothed basis. If that regime persists, trend continuation likely demands either a fade in the negative flow back toward neutral/positive or enough external demand to absorb the overhang. As Maartunn put it, “It’s clear distribution… On-chain data tells the story.”

At press time, XRP traded at $3.00.

Featured image created with DALL.E, chart from TradingView.com