Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Eric Trump laid out a bluntly bullish, supply-and-demand case for why Bitcoin can reach $1 million, arguing that accelerating institutional access collides with Bitcoin’s fixed 21 million-coin cap, during a “Bitcoin Takes Over the World” session with David Bailey at the Bitcoin Asia conference in Hong Kong on August 29.

Bitcoin’s Path To $1 Million Is ‘No Question’

“Everybody wants Bitcoin. Everybody is buying Bitcoin. And that’s uh that’s an incredible thing. And that’s why I’ve always said that I really believe that in the next several years, Bitcoin will hit a million dollars. There’s no question Bitcoin hits a million dollars,” Trump told the audience, adding that “every person who wants an asset class and you have a very limited supply… it doesn’t take a genius to figure out where that goes.” He urged long-term accumulation over timing: “Buy right now. Shut your eyes. Hold it for the next five years and you are going to do terrifically well.”

Trump also recounted his private discussions with high-level investors in the lead-up to the conference: “When you’re in the room with certain people and and I had breakfast this morning with, you know, a couple of the most powerful people in the region and the hospitality space and you’re literally sitting there trying to explain to them what digital currency is, you realize how early we all are to this race […] I hear from people all the time, you know, should I get into cryptocurrency? Did I miss it? Am I too late? And I literally start laughing at them. I go, we haven’t even scratched the surface of what Bitcoin is going to be.”

Related Reading

Trump’s core thesis combined two pillars: finite issuance and broadening distribution rails. He repeatedly emphasized Bitcoin’s provable scarcity—“There’s only 21 million coins… It’s finite. And that’s what makes it so damn powerful”—while asserting that channels for ownership have widened to large pools of capital. “In America, people are buying it for their retirement plans for the first time… you’ve got trillions of dollars of liquidity that’s opening up,” he said, citing custody at “major financial institutions,” as well as uptake by “the biggest banks,” “the biggest families,” “Fortune 500 companies,” and “sovereign wealth funds.” According to Trump, those cohorts are long-term holders: “Those retirement accounts are not letting Bitcoin go. Those companies are not letting Bitcoin go. Those sovereign wealth funds are not letting Bitcoin go.”

Pressed on what he is hearing in high-level rooms globally, Trump offered another anecdote—without naming the country—about a leader who “literally [takes] the entire energy supply of a major city in the middle of a winter and uses it to mine Bitcoin because that’s how much they believe in the asset.” He added, “You realize how early we all are […] more and more people are finding their inroads,” pointing to improving exchange usability and new consumer on-ramps. “We’re literally trying to get cryptocurrency to the masses,” he said about World Liberty Financial.

Related Reading

Trump also highlighted his own commercial exposure to the sector. He described American Bitcoin as “one of the biggest Bitcoin mining companies on Earth,” claiming it produces “about 3% of the world’s Bitcoin every single day,” operates from “some of the cheapest energy in the world… in Texas,” and targets a “rough cost per… mining of Bitcoin… about $37,000,” with plans to list on Nasdaq “very soon.” Beyond mining, he praised his involvement with MetaPlanet alongside Simon Gerovich—whom he dubbed “the Michael Saylor of Asia”—saying the company had “single-handedly changed… the way [Japan and] a lot of Asia” view Bitcoin.

The conversation returned repeatedly to Bitcoin’s evolving utility narrative. While calling Bitcoin “digital gold” and “the greatest store of value that’s arguably ever been created,” Trump argued its use cases are broadening: “Every single day they’re figuring out new ways to kind of stake it, to get yield on it, to use it for everyday purchases […] you’re taking this digital gold […] and you’re putting massive utility behind Bitcoin.” He framed volatility as an ally for long-term buyers—“Volatility is our friend”—and, with a wink to Michael Saylor’s famous extremism, quipped, “I know obviously he jokes when he says that, but he’s right. Buy it, hold it, and I think you’re going to do extremely well.”

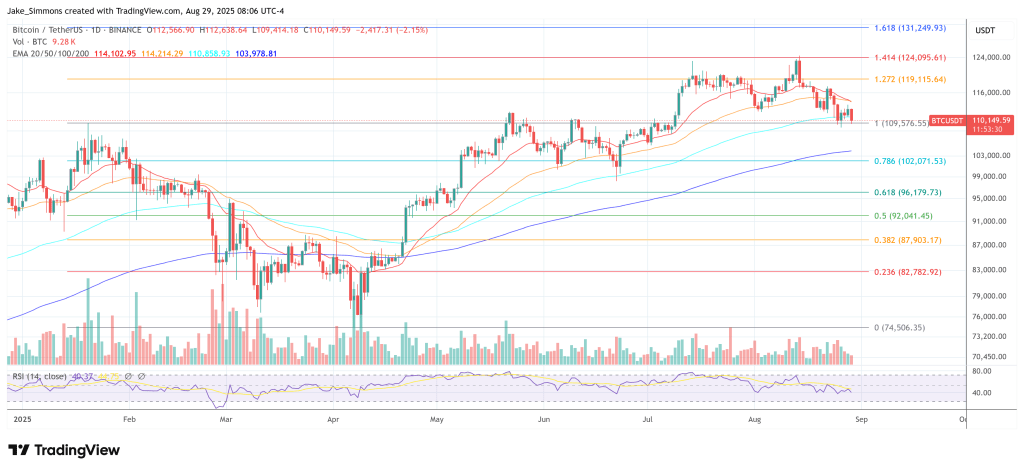

At press time, BTC traded at $110,149.

Featured image created with DALL.E, chart from TradingView.com