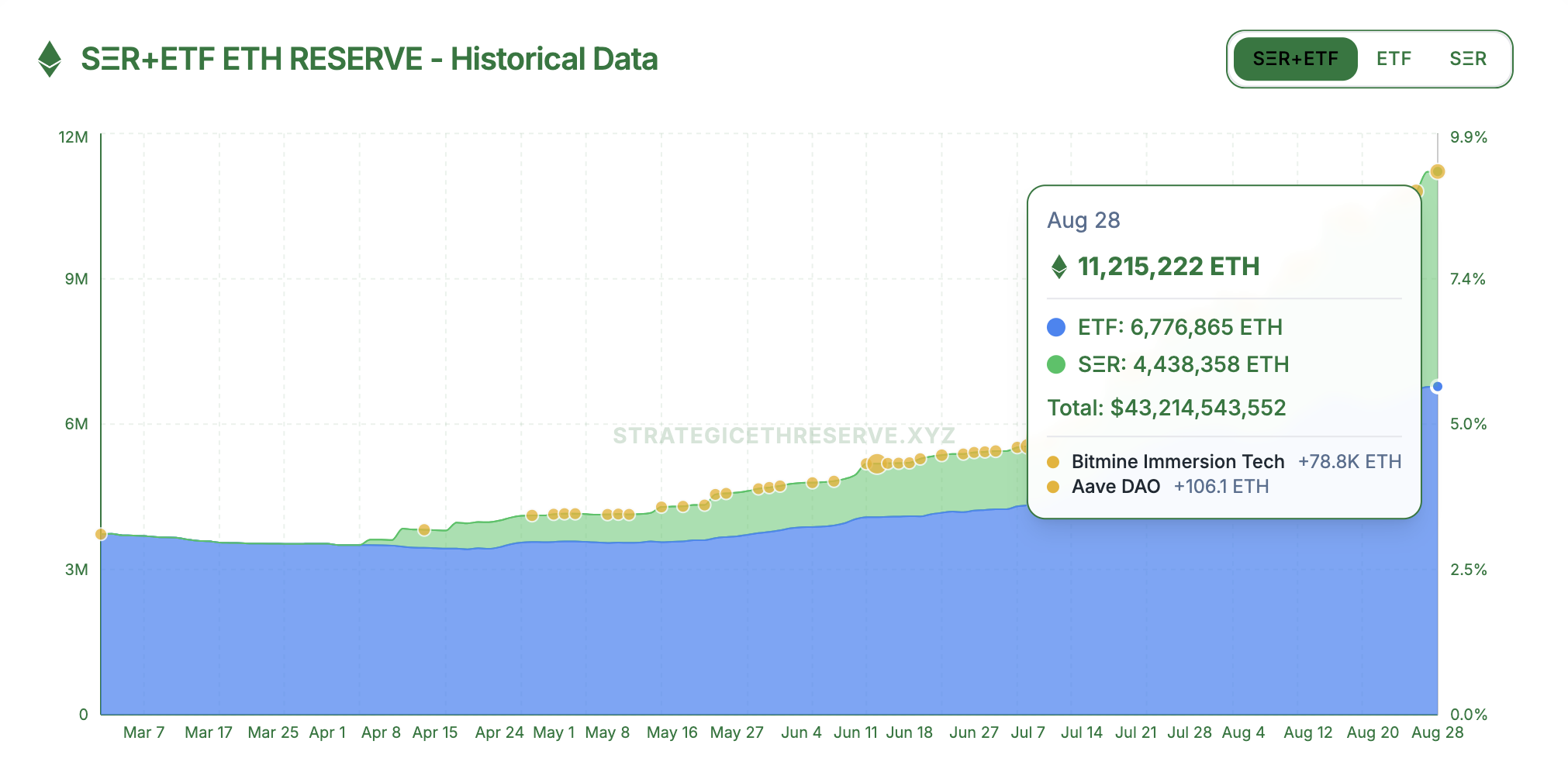

Ether spot exchange-traded funds (ETFs) have seen steady growth since their US debut in July 2024, while corporate treasuries tied to the token are also on the rise.

Inflows into Ether (ETH) funds climbed 44% this month, rising from $9.5 billion on Aug. 1 to $13.7 billion on Aug. 28, according to cryptocurrency research platform SoSoValue. Market participants say renewed institutional demand is fueling the momentum.

“After an extended period of underperformance relative to Bitcoin and a souring investor sentiment, Ethereum has recently experienced a significant revival in the recognition of both its adoption rate and value proposition,” Sygnum Chief Investment Officer Fabian Dori told Cointelegraph.

Behind investors appetite is a growing number of companies adopting ETH based corporate treasuries. While Bitcoin (BTC) is the cryptocurrency most associated with treasury companies, Ether treasuries among corporations are gaining steam.

According to StrategicETHReserve, companies now hold 4.4 million ETH or 3.7% of the supply, worth $19.18 billion at this writing.

“A strong driver for that is regulation such as the Genius Act that provides traditional investors with the comfort to build infrastructure and use cases on this new technology,” said Dori.

Supported by investors’ demand through corporate treasuries and ETFs, Ether’s price gained nearly 27% in August, to $4,316 on Friday, from about $3,406 on Aug. 1, according to Cointelegraph Markets Pro.

“Treasury companies are a massive buyer,” Standard Chartered’s global head of digital assets research, Geoffrey Kendrick, told Cointelegraph. “They won’t sell. So, yes, the impact will stay,”

Related: ETH possibly bullish ‘for years’ as megaphone pattern to $10K emerges: Analyst

Ethereum roadmap entering ‘critical inflection point’

Industry watchers are optimistic about Ethereum’s prospects but say the coming months will be critical for the network’s ecosystem. “Ethereum’s roadmap is entering a critical inflection point,” a Bitfinex analysts told Cointelegraph.

“The upcoming upgrades are set to significantly improve smart contract efficiency and validator usability advancing Ethereum’s competitiveness as an institutional settlement layer,” they said, adding:

“Meanwhile, restaking via EigenLayer and the growth of L2 rollup activity are generating real protocol revenues and attracting developer attention back to the ecosystem.”

Ethereum is steadily advancing its upgrade cadence, with key milestones toward scalability and long-term global utility.

The Pectra upgrade in May expanded validator caps and introduced account abstraction, with the Fusaka hard fork set for Nov. 5, which will implement PeerDAS to ease node workloads and improve data availability.

Meanwhile, Ethereum’s revenue generation has yet to catch up with the momentum. In the past 30 days, the network generated $41.9 million in fee revenue, a fraction of Tron’s $433.9 million over the same period.

Magazine: Dummies’ guide: Ethereum’s roadmap to 10,000 TPS using ZK tech