Key points:

-

Bitcoin is trying to break $118,000 for the first time since mid-August.

-

US labor market weakness drives crypto and risk assets higher despite the US government shutdown.

-

Any dips are “buy opportunities,” BTC price analysis says.

Bitcoin (BTC) sought six-week highs after Wednesday’s Wall Street open as markets shrugged off the US government shutdown.

Bitcoin starts October with range breakout attempt

Data from Cointelegraph Markets Pro and TradingView showed that BTC/USD reached $117,713 following weak US jobs data.

The pair came within $150 of beating its September maximum — doing so would lead it to its highest levels since Aug. 17.

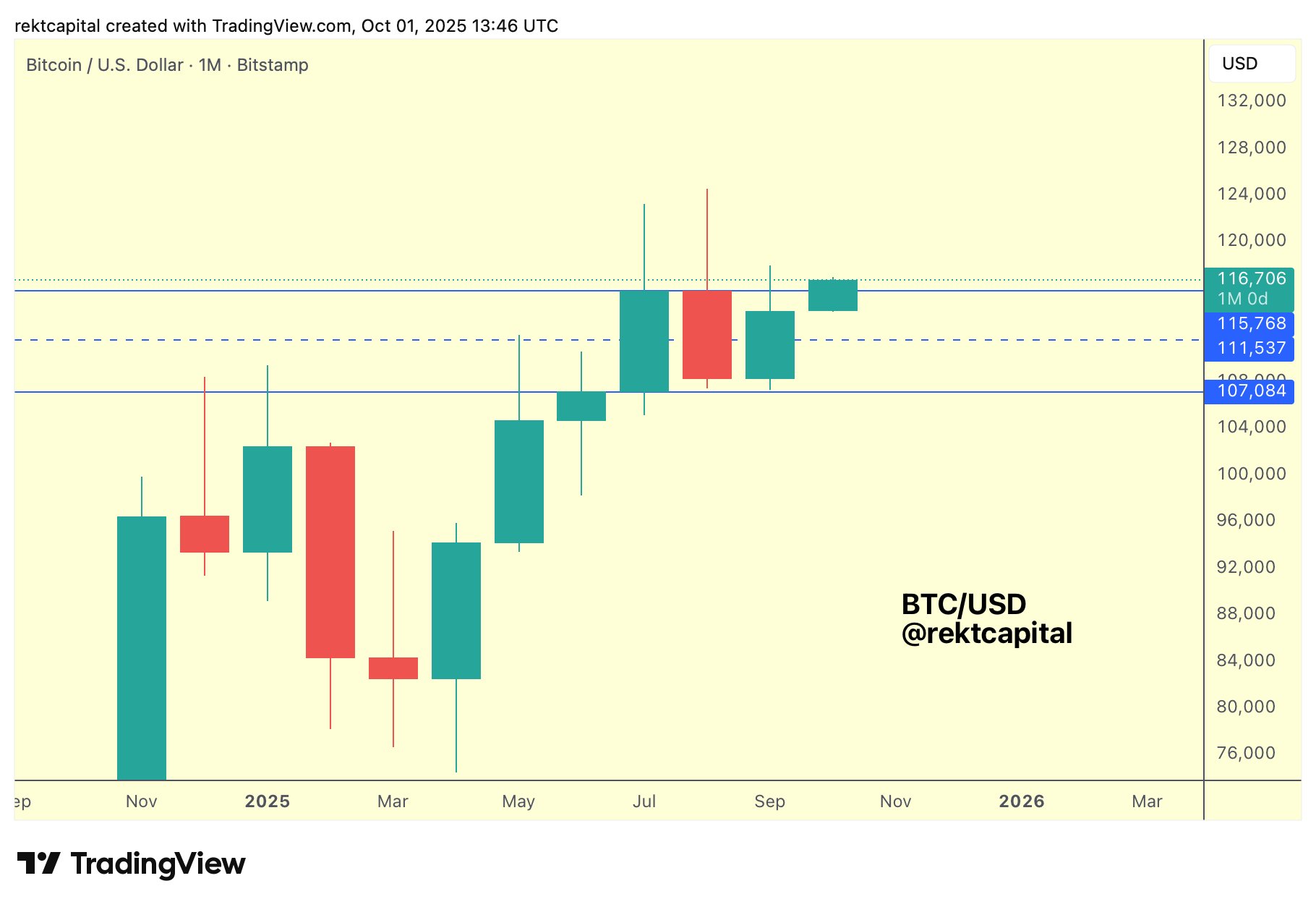

“Bitcoin is trying to breakout from its Monthly Range already on the first day of the new month of October,” popular trader and analyst Rekt Capital summarized in his latest commentary on X.

US private-sector employment numbers came in significantly below expectations, turning negative when estimates had projected a gain of 45,000 jobs for September.

Labor market weakness is considered a tailwind for crypto as it heightens the odds of interest-rate cuts and thus increased capital inflows.

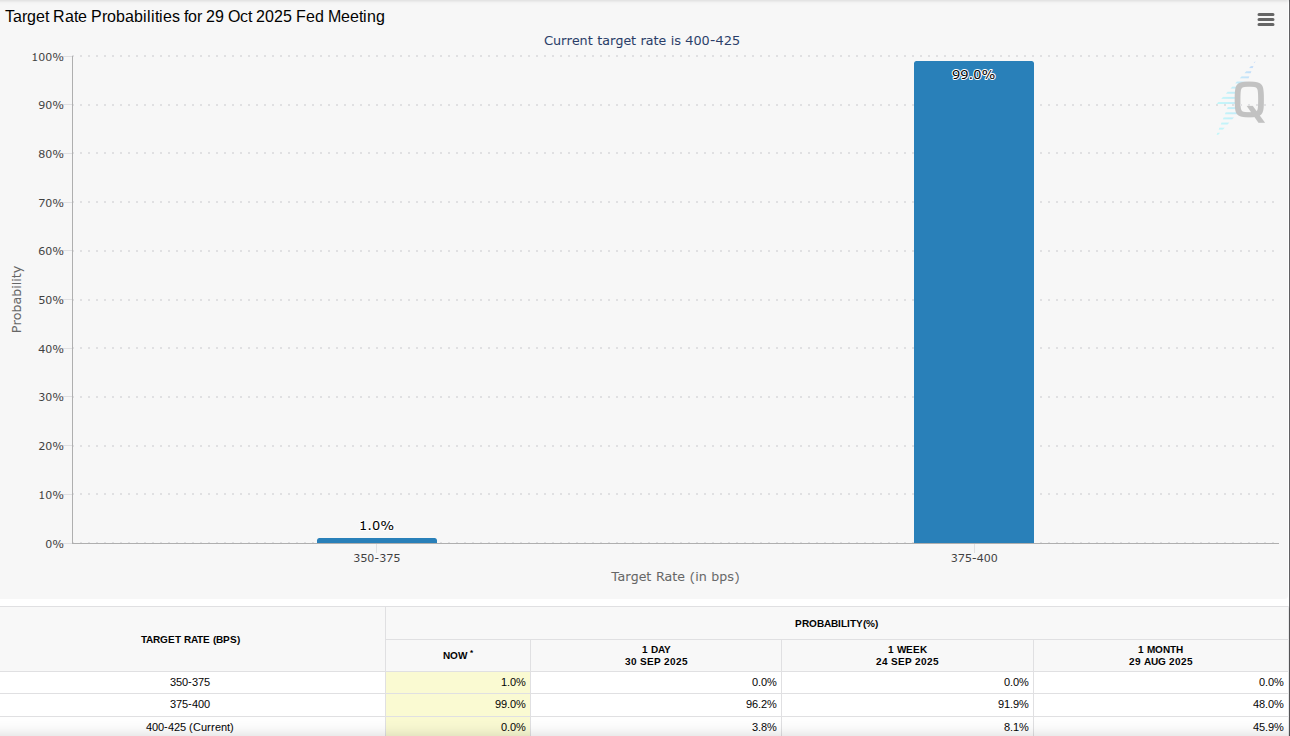

The latest data from CME Group’s FedWatch Tool showed that markets were overwhelmingly betting on the Federal Reserve cutting rates by 0.25% at its October meeting.

Continuing, fellow trader Jelle described BTC price action as “pushing through the resistance like it isn’t even there.”

“One last thing to ‘worry’ about: a sweep of the September highs. Clear those, and the bears will have very little leg to stand on. Higher,” he told X followers.

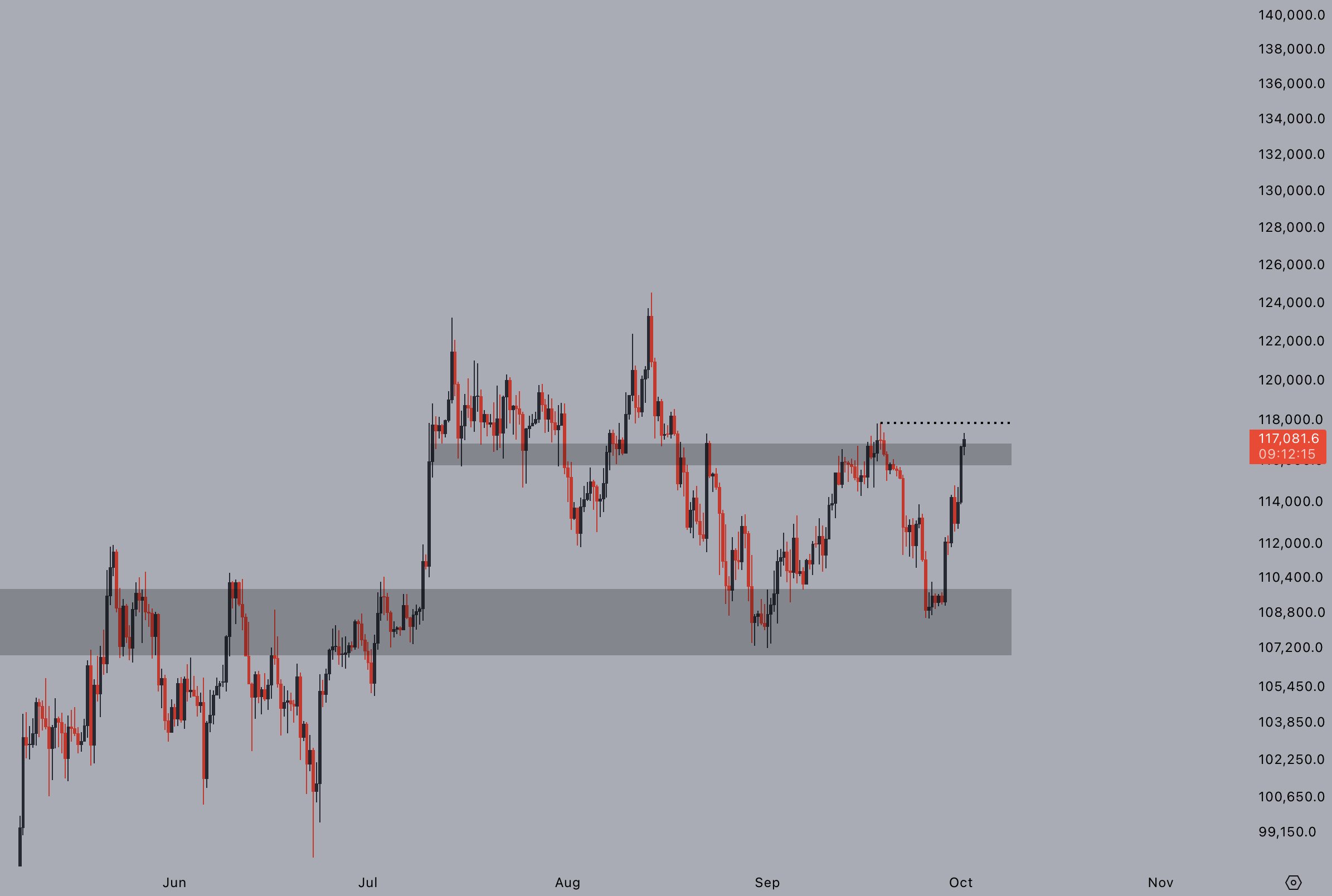

Others focused on potential support retests, with trading account Daan Crypto Trades flagging $112,000 as “key short-term support.”

“Ideally don’t want to see price re-visit that,” he wrote alongside a chart showing a channel that price was attempting to break through.

“Up to the bulls to take it from here, a proper breakout & some daily closes above the channel would signal this is ready for a move to new highs to me.”

The new US government shutdown, meanwhile, failed to impact the buoyant mood across risk assets.

Related: BTC price due for $108K ping pong: 5 things to know in Bitcoin this week

Both the S&P 500 and Nasdaq Composite Index opened modestly higher, while gold consolidated after hitting its latest new all-time highs earlier in the day.

Commenting, trading company QCP Capital stated that the shutdown should be of little importance.

“On fiscal theatre, a U.S. government shutdown should be a market non-event beyond data delays and headline noise,” it argued in its latest “Asia Color” research post.

“Essential services continue, back-pay limits income effects, and past episodes have not derailed risk assets.”

QCP noted that during the 2018 shutdown, the S&P 500 ended 10% higher.

“Given BTC’s elevated beta to equities, we see shutdown-related dips as buy opportunities rather than chasing gap-ups,” it concluded.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.