Key points:

-

Bitcoin risks hitting $102,000 again as support higher up looks increasingly weak.

-

Analysis suggests the bull market may be at risk as a result.

-

Gold hits a fresh all-time high, with BTC price action left far behind.

Bitcoin (BTC) selling increased at Wednesday’s Wall Street open as BTC price metrics showed little signs of a rebound.

BTC price forecasts see $102,000 as pivotal

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD acting around $111,000, down nearly 2% at the time of writing.

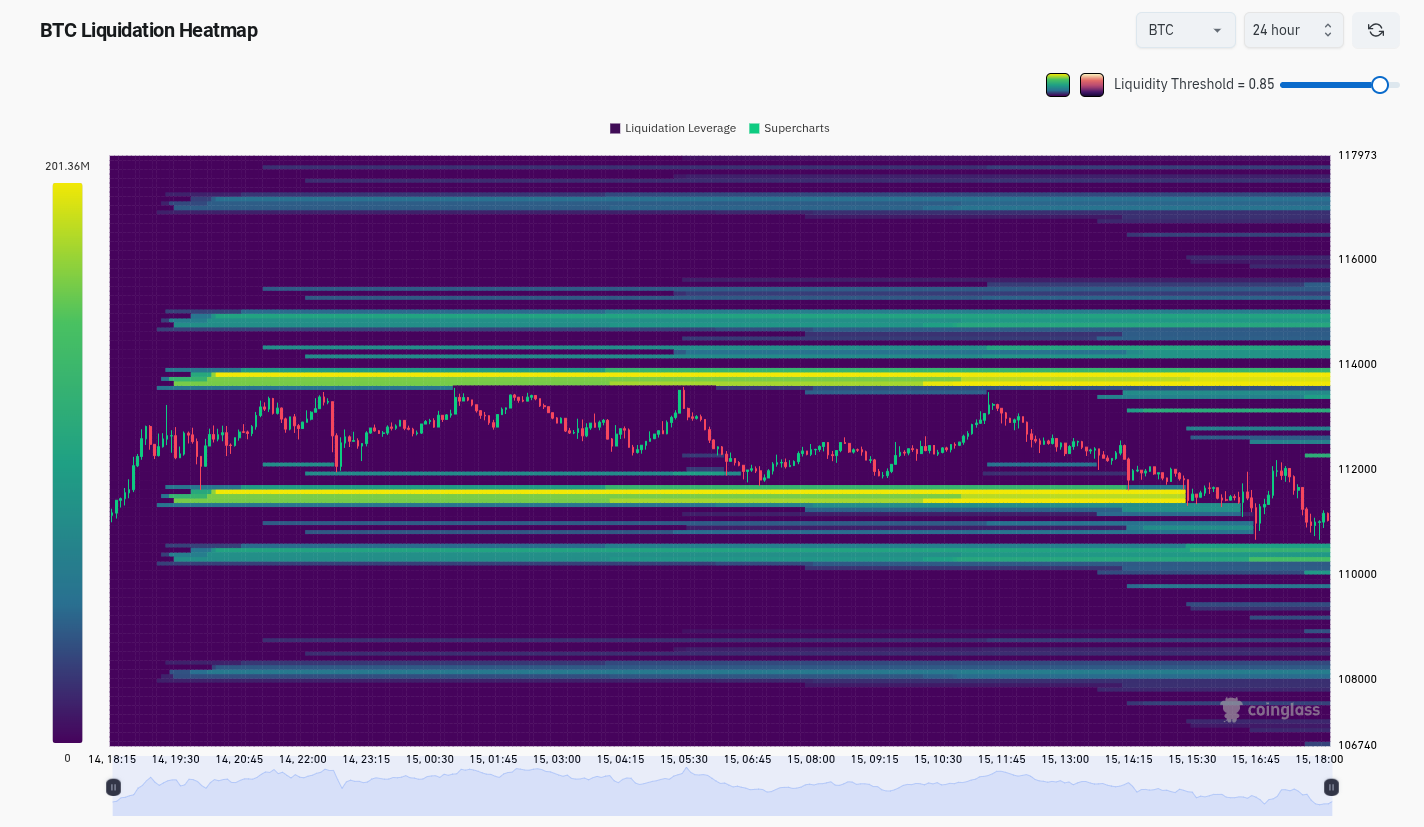

Downside liquidity was taken earlier in the day, with bulls still unable to reach resistance overhead at just below $114,000, per data from CoinGlass.

Discussing current BTC price action, trader Roman warned that $102,000 lows seen on Binance last week could come back into play.

“Now it’s starting to look like a failed reversal setup,” he wrote in an X post about the four-hour chart.

“Again I have fears that we fill that wick all the way down to 102k. Any lower and this setup invalidates but likely already has. Looking like consolidation to fill the wick.”

A drop to $102,000 would represent a 19% drawdown from Bitcoin’s latest all-time highs — something commonplace during the current bull market which began in early 2023.

“$BTC long-term structure is still looking good. As long as the $102,000 level holds, Bitcoin will be in a bull run,” crypto analyst and entrepreneur Ted Pillows added.

“If BTC closes a monthly candle below the $102,000 support level, I would be concerned.”

Fellow trader Crypto Tony, meanwhile, said that the daily low of $110,500 “should hold” for the time being.

Gold all-time highs leave Bitcoin behind

Bitcoin thus failed to capitalize on potential macroeconomic tailwinds now forming for risk assets.

Related: Bitcoin metric shows ‘euphoria’ as $112.5K BTC price squeezes new buyers

In a speech Tuesday, Jerome Powell, Chair of the US Federal Reserve, boosted hopes of another interest-rate cut at its October meeting.

This helped gold to produce a fresh all-time high on the day, now at over $4,200 per ounce.

“Despite the weekend volatility, the Bitcoin–gold correlation has climbed above 0.85, highlighting synchronized flows between traditional and digital stores of value,” trading company QCP Capital wrote in its latest “Asia Color” market update.

“While gold continues to post fresh highs, Bitcoin briefly touched a new record just before the weekend. With institutional treasuries accumulating positions and ETF inflows remaining robust ($102.7 million into BTC ETFs and $236.2 million into ETH ETFs yesterday), the setup for a renewed rally may already be forming.”

QCP still queried whether Bitcoin could maintain its “digital gold” utility going forward.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.