Viral U cards drive stealth stablecoin adoption in China

Stablecoins are finding an indirect path into China via payment cards going viral on social media.

Locally referred to as “U cards,” overseas Visa or Mastercards linked to stablecoin balances such as USDT, have surged in popularity on Chinese social platform Xiaohongshu, AKA Little Red Book. Posts explain how to obtain the cards with ease and use them for everyday overseas payments, such as subscriptions to services.

Such cards allow users to spend dollar-denominated stablecoins while merchants receive fiat currency, meaning Chinese businesses never directly touch crypto. Conversion is handled by overseas banks or licensed payment institutions, placing the transaction outside China’s domestic financial rails.

The trend recently drew attention from Caixin, one of China’s most influential finance outlets, which examined the rise of U cards and the legal questions surrounding their use.

According to the report, many users initially approach U cards as a workaround for cross-border payments rather than as a crypto product. Social media tutorials often focus on opening a foreign bank card and linking it to Apple Pay or Visa networks, with little emphasis on digital assets themselves.

Direct cryptocurrency payments are banned in China, alongside key crypto activities such as trading and mining.

Liu Honglin, founder of Shanghai Mankun Law Firm, said on X that users making consumer payments face relatively limited exposure to crypto, as asset conversion occurs offshore and settlement stays within conventional card networks.

In July, US President Donald Trump signed the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act into law, accelerating global interest in regulated stablecoin issuance. Hong Kong followed with its own stablecoin rule, which has been enforced since August.

Pundits argued that the growing momentum behind stablecoins could pressure China to revisit its crypto ban. However, PBOC Governor Pan Gongsheng dismissed such speculation in October, saying there would be no change to existing policy.

Digital yuan shifts from cash-like design to digital deposits

China’s central bank digital currency (CBDC), or the digital yuan, will be recast as digital deposits through a new framework set to take effect from New Year’s Day, abandoning its digital cash model.

The shift was laid out by Lu Lei, vice governor of the People’s Bank of China (PBOC), who authored an article published on Dec. 29 in Financial News, a central bank-affiliated newspaper.

Lu argued that digital cash posed structural risks to the banking system as cash circulates outside the deposit system. Expanding digital cash could accelerate financial disintermediation.

Earlier experiments treated the digital yuan as a cash-like instrument held in user wallets. Under the new approach, digital yuan balances held at commercial banks will be treated as bank liabilities. Banks will be permitted to pay interest on digital yuan wallet balances.

The digital yuan is one of the most advanced CBDCs among major economies. By the end of November, it had processed about 16.7 trillion yuan ($2.37 trillion) in transactions across almost 250 million personal and corporate wallets, according to the PBOC’s figures.

Lu framed the digital yuan’s shift as a response to emerging currencies outside the traditional financial system, including cryptocurrencies and stablecoins. He rejected the idea that blockchain-only systems represent true digital currency.

Read also

How South Korea’s financial giants are maneuvering into crypto exchanges

South Korea’s largest financial groups are moving closer to the country’s licensed cryptocurrency exchanges ahead of industry regulations expected next year.

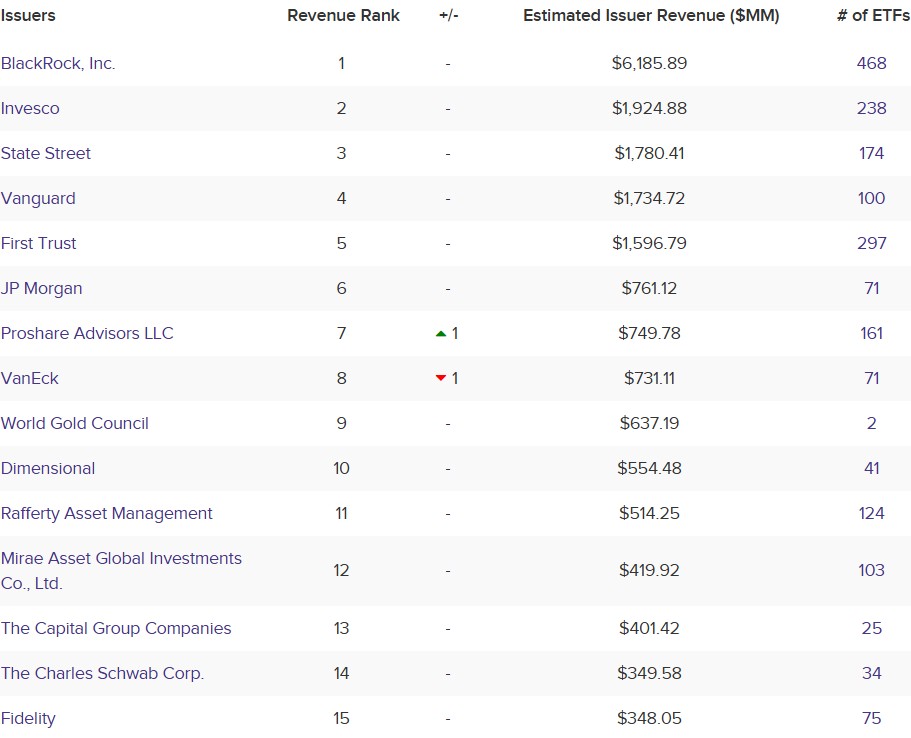

Mirae Asset Group has reportedly moved to acquire a controlling stake in Korbit — the country’s fourth-largest exchange by trading volume — through its non-financial affiliate Mirae Asset Consulting.

South Korea enforces a strict separation between finance and industry by limiting regulated financial institutions from owning non-financial businesses. Even licensed crypto exchanges are still classified as non-financial entities. If Mirae Asset pursued the acquisition through its securities or asset-management arms, regulators would likely have blocked the deal or subjected it to a lengthy approval process.

Other financial groups have opted for looser arrangements. On Friday, Korea Investment & Securities, also among the nation’s top firms by assets, signed a cooperation agreement with Bithumb — the nation’s second-largest exchange — to develop asset management services for high-net-worth clients.

Even Upbit, South Korea’s dominant exchange and a frequent target of monopoly criticism from lawmakers, is attracting traditional backing. Naver Financial, the fintech arm of internet giant Naver, plans to acquire Upbit operator Dunamu in a stock-swap deal valued at around $10.3 billion.

Read also

The rush into crypto from established financial institutions comes despite the nation’s lack of a comprehensive regulatory framework. South Korea is preparing to unveil one no later than January 2026.

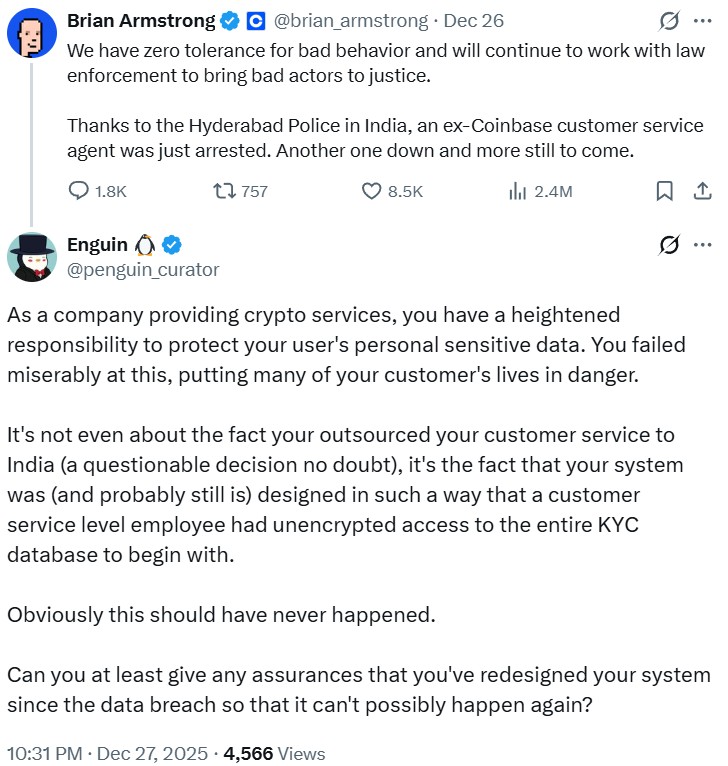

Former Coinbase customer service agent tied to data breach arrested

A former Coinbase customer service agent linked to a major data breach earlier this year has been arrested in India, according to the exchange’s CEO.

Coinbase CEO Brian Armstrong said additional arrests are expected.

The US-based exchange came under heavy scrutiny earlier this year after it emerged that illicit actors had bribed overseas customer service contractors beginning in December 2024, gaining access to the personal information of around 70,000 users.

Coinbase disclosed in May 2025 that the attackers obtained sensitive identity data, including government-issued photo IDs and home addresses. The company faced backlash after updating its user agreement before publicly acknowledging the breach.

Critics accused Coinbase of introducing an arbitration clause that would limit class-action lawsuits, although the exchange said the clause had long been included in its terms.

Legal experts told Magazine that such arbitration clauses are standard in the US, where user agreements are generally enforceable. However, they noted that the same provisions may carry less legal weight in other jurisdictions.

Subscribe

The most engaging reads in blockchain. Delivered once a

week.

Yohan Yun

Yohan Yun is a multimedia journalist covering blockchain since 2017. He has contributed to crypto media outlet Forkast as an editor and has covered Asian tech stories as an assistant reporter for Bloomberg BNA and Forbes. He spends his free time cooking, and experimenting with new recipes.

Read also

Bitcoin breaks $60K, US gov’t moves seized BTC, and more: Hodler’s Digest, Feb. 25 – March 2

Bitcoin’s price reaches two-year high, Sam Bankman-Fried seeks near seven-year sentence, and U.S. government moves millions in BTC after price crosses $60K.

Bitcoin’s comeback, XRP doubles in a week, Coinbase’s big profits: Hodler’s Digest, April 4–10

The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — one week on Cointelegraph in one link!