Bitcoin’s price climbed back above $97,000 this week, supported by a sustained return of capital into US spot Bitcoin exchange-traded funds, data and market watchers say, suggesting a structural shift in demand after months of sideways trading.

Since the start of the year, US spot Bitcoin (BTC) ETFs have collectively attracted nearly $1.5 billion in net inflows, according to data cited by Bloomberg ETF analyst Eric Balchunas. That total reflects a multi-day stretch of positive creation activity amid renewed interest from larger allocators, following a period of muted ETF flows at the end of 2025.

Balchunas said in a post on X that the pattern of ETF demand “suggests that maybe the buyers have exhausted the sellers,” a reference to Bitcoin breaking out of a prolonged consolidation around the $88,000 level.

ETF buyers accounted for $843.6 million in net inflows on Wednesday alone, bringing the weekly total to $1.07 billion and lifting the year-to-date figure. While single-day inflows have grabbed attention, the broader narrative is one of steadier demand returning after earlier rotation within the products.

Related: Five Bitcoin narratives analysts are watching beyond price

Will institutions flip the Bitcoin script?

Bitcoin is rallying at the start of a period that has historically been more challenging for the asset. Market observers often point to Bitcoin’s four-year cycles, which are loosely aligned with its halving events and have typically seen prices peak 12 to 18 months after each supply reduction, a pattern that would suggest the market may already be past its cyclical high.

While the four-year cycle is not a rule, past market behavior has led many analysts to approach this phase with caution.

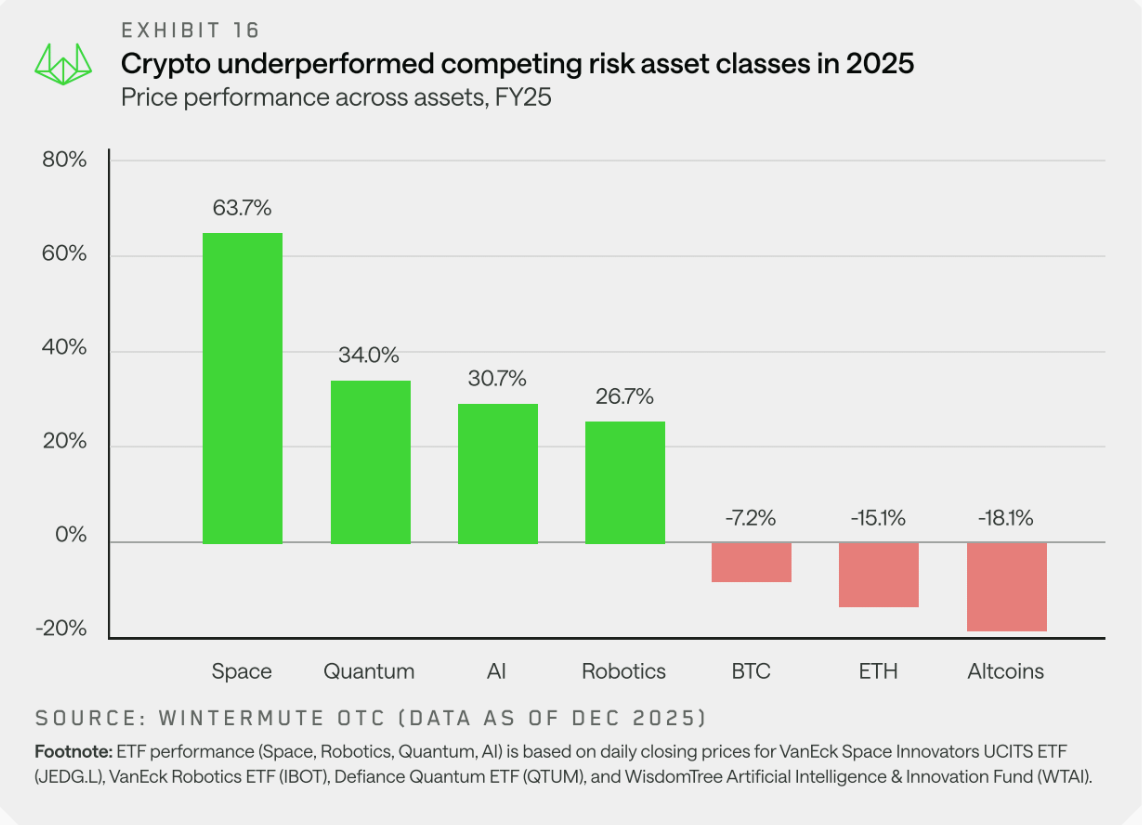

The current rebound follows a mixed performance in 2025, when Bitcoin reached new all-time highs but failed to sustain momentum across the broader crypto market. Despite headline price gains, the rally did not translate into a prolonged “altcoin season,” leaving many investors disappointed by the lack of follow-through.

According to Wintermute, a structural shift in Bitcoin markets may be required to support a broader recovery heading into 2026. In a recent outlook, the market maker said a market-wide rebound would likely depend on continued accumulation by exchange-traded funds and digital asset treasury companies, or an expansion of their mandates beyond Bitcoin to other digital assets.

Wintermute also pointed to the need for stronger, more consistent performance across major cryptocurrencies, including Bitcoin, to generate a broader wealth effect.

Related: Crypto’s 2026 investment playbook: Bitcoin, stablecoin infrastructure, tokenized assets