Key Notes

- ETH is trading near $2,895, down about 9.5% over the past week.

- Large holders continue adding ETH despite short term seller control.

- ETH spot trading volume jumped 250% to about $350 billion on January 26.

Ethereum

ETH

$2 885

24h volatility:

1.6%

Market cap:

$348.05 B

Vol. 24h:

$33.04 B

is trading below major key levels, but large holders are aggressively buying the dip.

At the time of writing, ETH is trading near $2,895, down about 9.5% over the past week.

On-chain data shows steady whale buying even as price action remains weak. An over the counter whale address recently bought another 20,000 ETH worth about $56.13 million.

Over the past five days, the same wallet accumulated 70,013 ETH, valued roughly $203.6 million.

As the market dips, whales continue buying $ETH on the drop.

OTC Whale (0xFB7) bought another 20K $ETH($56.13M) 6 hours ago.

Over the past 5 days, this whale has bought 70,013 $ETH($203.6M).https://t.co/nPIYRppUzIhttps://t.co/rkxsWww7Gz pic.twitter.com/BYRetbiYJ4

— Lookonchain (@lookonchain) January 26, 2026

World Liberty Financial, a project backed by the Trump family, also rotated exposure from Bitcoin

BTC

$87 656

24h volatility:

0.7%

Market cap:

$1.75 T

Vol. 24h:

$53.64 B

into Ether.

According to LookOnChain, the project swapped 93.77 WBTC worth about $8.08 million for 2,868 ETH earlier on Jan. 26.

WLFI(@worldlibertyfi) is rotating from $BTC into $ETH.

About 6 hours ago, @worldlibertyfi swapped 93.77 $WBTC($8.08M) for 2,868 $ETH.https://t.co/kaRan1WMwF pic.twitter.com/yQj8OVHZ8U

— Lookonchain (@lookonchain) January 26, 2026

Another wallet “buy high, sell low,” known for its poor timing, sold 5,500 ETH over the past three days.

Data shows that the sales were worth about $16.02 million at an average price near $2,912. The same address bought 2,000 ETH five days earlier at around $2,984.

The “buy high, sell low” whale 0x3c9E panic-sold 5,500 $ETH($16.02M) at $2,912 over the past 3 days.

Just 5 days ago, he bought 2,000 $ETH($5.97M) at $2,984.

Once again: buy high, sell low.https://t.co/wRWlzsjrj9 pic.twitter.com/iegUS3xh4s

— Lookonchain (@lookonchain) January 26, 2026

On Jan 26, a long dormant wallet linked by analysts to Bitfinex moved 50,000 ETH worth $145.25 million to Gemini after nine years of inactivity.

Such transfers often raise concerns about potential selling, though no follow up sales were confirmed.

An #Ethereum OG whale wallet, 0xb5Ab (possibly linked to Bitfinex), deposited 50K $ETH($145.25M) into #Gemini today after being dormant for 9 years.https://t.co/ICuLCIf57U pic.twitter.com/e02SNbaNWQ

— Lookonchain (@lookonchain) January 26, 2026

Amid this rising whale activity, Ether’s trading activity has spiked on Jan. 26. CoinMarketCap data shows ETH 24-hour spot trading volume has jumped 250% to $350 billion.

Ethereum Whale Activity Signals Potential Price Upside

ETH is trading below its main moving averages. The 20-day moving average sits near $3,050, while the 50-day moving average is around $3,100.

This keeps short term control with sellers. Despite the weakness, large holders continue to add ETH.

CryptoQuant data shows whales accumulated more than 350,000 ETH in a single day last week.

The realized price of major accumulation addresses sits close to the current market price. ETH has only traded near this level once before, in late 2025.

Ethereum’s realized price for accumulation addresses. | Source: CryptoQuant

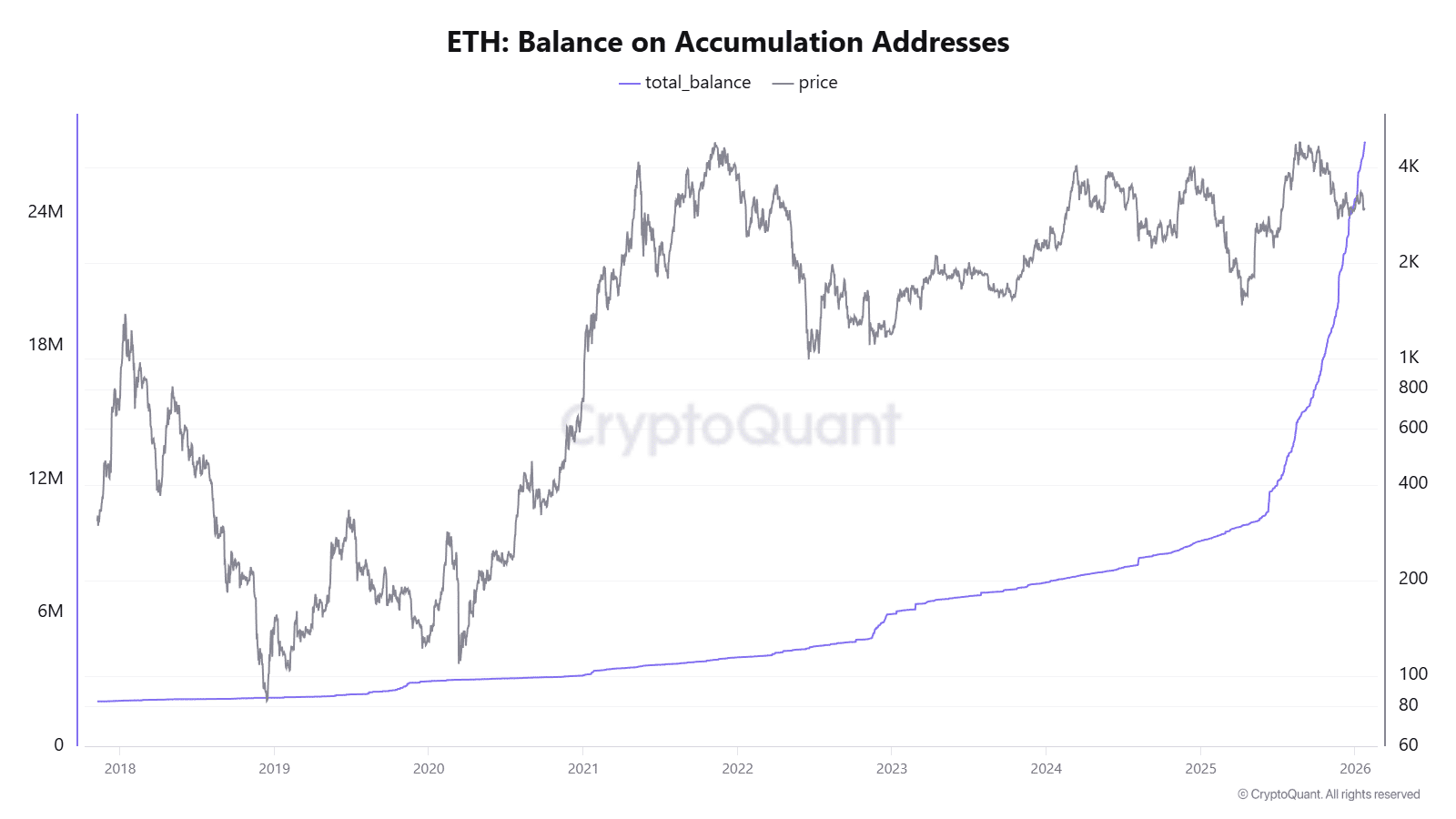

Meanwhile, balance on these addresses continue peaking to new highs.

Ethereum’s balance on accumulation addresses. | Source: CryptoQuant

According to a CryptoQuant analyst, this pattern suggests that whales are getting ready for an ETH price rally while retail remains cautious.

Bitcoin Hyper Secures Over $31M During Presale

Meanwhile, investors are also looking for early-stage high-potential projects, like Bitcoin Hyper (HYPER). The project has recorded strong inflows during its ongoing presale and already raised $31 million at the time of writing.

Bitcoin Hyper focuses on fixing several known limits of the Bitcoin network, such as slow transaction processing, high transfer costs, and the lack of native smart contract support.

Tokenomics of Bitcoin Hyper

- Funds Raised So Far: $31M

The project introduces a Layer 2 network built to handle higher throughput. Transactions on Bitcoin Hyper are handled through this execution layer that allows faster and cheaper transfers. Once processed, these transactions are settled back onto the Bitcoin base chain.

During the current crypto presale phase, Bitcoin Hyper offers a staking APY of 38%. Investors looking to get in early can take advantage of this opportunity. Check out our guide on how to buy Bitcoin Hyper.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

A crypto journalist with over 5 years of experience in the industry, Parth has worked with major media outlets in the crypto and finance world, gathering experience and expertise in the space after surviving bear and bull markets over the years. Parth is also an author of 4 self-published books.