Bitcoin (BTC) fell to two-month lows Thursday as crypto joined stocks and precious metals in a snap sell-off.

Key points:

-

Bitcoin dives below $85,000 as macro assets suddenly tumble from record highs.

-

Gold and silver shock market watchers as nerves over global financial stability grow.

-

BTC price action faces an uphill struggle to avoid “Bearadise” at the monthly close.

Gold meltdown catches Bitcoin in its wake

Data from TradingView captured new 2026 lows for Bitcoin, which reached $83,156 on Bitstamp to bring daily losses to nearly 6%.

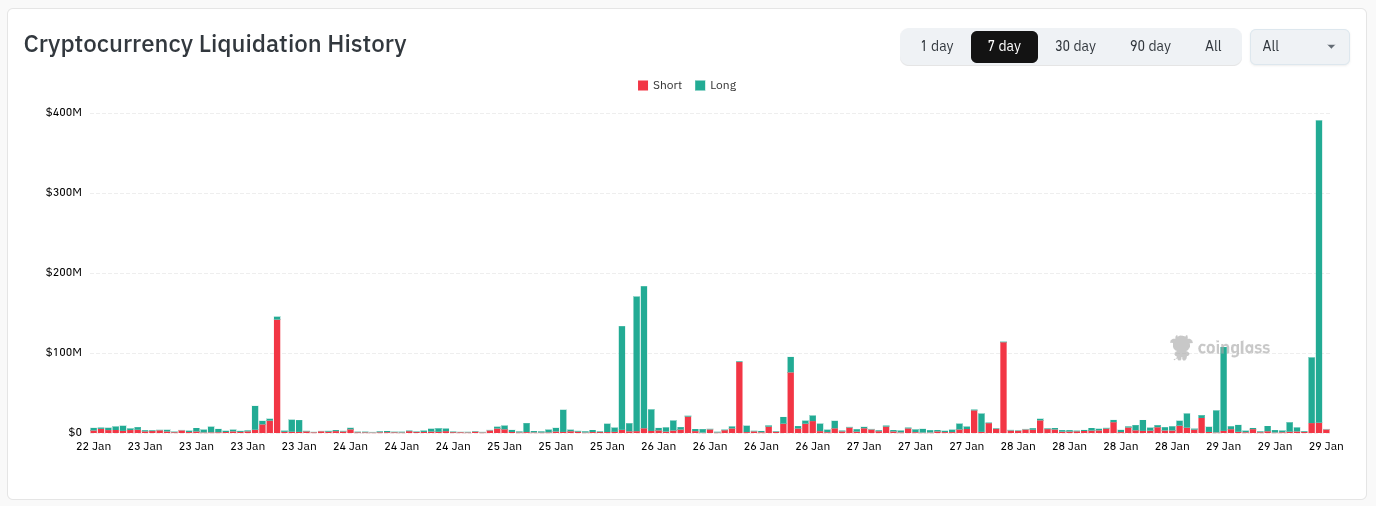

Support at the 2026 yearly open, as well as nearby moving averages, failed to hold back sellers as crypto liquidations passed $500 million in four hours.

Bitcoin and altcoins were not alone in their sudden drop, reacting to global asset jitters that caught traders by surprise. Gold, which hit $5,600 for the first time in history earlier on the day, tumbled $400 in just 30 minutes.

In doing so, the precious metal erased more value than Bitcoin’s entire market cap.

Reacting, Bitcoin market participants balanced macro volatility with hope that a reset may finally give bulls a break.

Rate cuts can’t pump BTC.

Pro-crypto President can’t pump BTC.

Weak dollar can’t pump BTC.

Institutional adoption can’t pump BTC.

Rising Global liquidity can’t pump BTC.

Fed injecting liquidity can’t pump BTC.

Stocks new ATH can’t pump BTC.Is there anything that could pump BTC… pic.twitter.com/GK5OAHHP4m

— BitBull (@AkaBull_) January 29, 2026

“Wild markets today as Gold and Silver erase trillions in minutes. Yes, $BTC goes down during that panic flush, and we’ll probably see some lower levels,” crypto trader, analyst and entrepreneur Michaël van de Poppe wrote in a post on X.

“ time for Bitcoin to shine is coming.”

Nic Puckrin, CEO of crypto education resource Coin Bureau, was among those warning that the erratic moves on precious metals were abnormal.

“Gold and silver just don’t do this,” he told X followers, calling the latest price action “insane.”

Puckrin argued that the US dollar, the world’s reserve currency, faced “confidence erosion” and that global gold and silver demand was a sign of investors and central banks bracing for turbulence.

“They are prepositioning,” he concluded.

“Get excited about metals, but realise these buys are essentially insurance. And, when gold and silver actually ‘do this,’ we need to pay attention.”

All eyes on BTC price monthly close

Earlier, Cointelegraph reported on manipulatory moves on Bitcoin exchange order-books involving an unknown whale entity “suppressing” price.

Related: Bitcoin trend line cross mimics 2022 amid ‘insane’ BTC vs. silver breakdown

Keith Alan, cofounder of trading resource Material Indicators, which reported the phenomenon, later reiterated the need to reclaim the 2026 open by the monthly candle close.

“$BTC is once again testing support at what I consider to be the most important level on the chart. The Monthly candle close rapidly coming into focus makes this an inflection point for the trend,” he wrote on X.

“A monthly close above the Yearly Open will fuel hopium for bulls. A close below that Timescape Level ($87.5k) will puts us on a path to Bearadise.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.