What to Know:

- MicroStrategy purchased an additional $90M in Bitcoin during the market crash, signaling strong institutional conviction despite bearish retail sentiment.

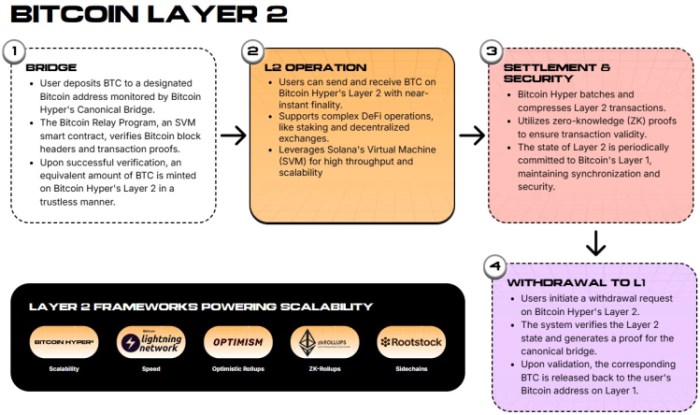

- Bitcoin Hyper utilizes the Solana Virtual Machine (SVM) to bring high-speed smart contracts and sub-second finality to the Bitcoin network.

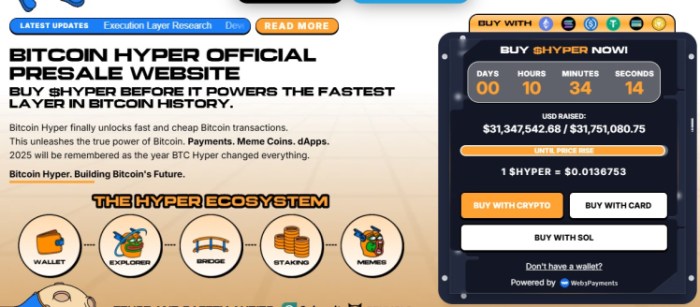

- Despite the broader market downturn, Bitcoin Hyper has raised over $31.3M, with verified whale wallets accumulating significant positions.

- The divergence between falling asset prices and rising infrastructure investment suggests the market is prioritizing utility and scalability solutions.

The crypto market is acting schizophrenic right now. On one side of the screen, retail traders are capitulating, panic-selling into a sea of red candles that define the latest crash. On the other?

MicroStrategy’s Michael Saylor is doing exactly what he does best: buying the fear. The enterprise analytics firm just added another $90M worth of Bitcoin to its treasury, happily sweeping up coins at depressed prices.

The $90 million price tag isn’t the headline here, that’s pocket change for MicroStrategy these days. It’s the timing. Institutional accumulation during high-volatility capitulation events historically signals a localized bottom. While the crowd sees a crash, smart money sees a discount.

Saylor’s continued aggression suggests he believes short-term macro headwinds, whether regulatory noise or rate adjustments, are irrelevant compared to Bitcoin’s long-term settlement thesis.

But the most interesting data isn’t coming from the legacy Bitcoin chart. It’s in the infrastructure layer being built on top of it. While the mainnet struggles with price action, liquidity is quietly rotating into high-performance Layer 2 solutions. The disconnect between price and development is widening.

Investors are looking past the ‘digital gold’ narrative and hunting for actual utility. This capital shift explains why, even as the market bleeds, Bitcoin Hyper ($HYPER) is posting record-breaking fundraising numbers. Money isn’t leaving crypto; it’s just moving to where the tech is evolving.

Bitcoin Hyper Integrates SVM To Solve Mainnet Congestion

Bitcoin has always had a ‘trilemma’ problem: it’s the most secure network in existence, but it’s painfully slow. Previous attempts to scale it relied on sluggish sidechains or the complexity of Lightning. Bitcoin Hyper ($HYPER) is flipping the script by integrating the Solana Virtual Machine (SVM) directly as a Layer 2 solution.

Why does that architecture matter? By using the SVM for execution while relying on Bitcoin L1 for settlement, the project aims for transaction speeds theoretically faster than Solana itself, all anchored to Bitcoin’s security. For developers, this opens the door to writing smart contracts in Rust. It enables high-frequency trading, complex DeFi protocols, and gaming dApps that were previously impossible on the Bitcoin network.

Traders seem interested in this ‘best of both worlds’ approach. The protocol features a Decentralized Canonical Bridge for seamless $BTC transfers and a modular structure where a sequencer handles execution. This isn’t just about faster payments; it represents a shift toward making Bitcoin a programmable asset class (finally).

Learn more about Bitcoin Hyper here.

Presale Momentum Builds As Whale Wallets Accumulate $1M

While the broader market struggles, capital inflows into the Bitcoin Hyper presale are decoupling from the general sentiment. According to the official presale page, the project has raised $31.3M a figure that stands in stark contrast to the low volume seen in legacy altcoins this week.

You can actually see the smart money trail on-chain. Sophisticated actors are positioning themselves early, likely anticipating that the ‘Bitcoin DeFi’ narrative will outperform in the next cycle. Specifically, Etherscan records show that two whale wallets have accumulated $1M in recent transactions. The largest individual purchase, $500K, occurred on Jan 15, 2026, signaling high-conviction entry at these levels.

With tokens currently priced at $0.0136753, the risk-reward ratio seems to be pulling volume that would otherwise sit in stablecoins. The project also incentivizes holding through a staking model that offers high APY immediately after TGE, with a modest 7-day vesting period for presale stakers. This structure is designed to mitigate the post-launch sell pressure that plagues many infrastructure launches.

For investors watching MicroStrategy buy the L1 dip, the logical hedge seems to be allocating to the L2 infrastructure that makes that L1 usable.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments, particularly presales and new Layer 2 protocols, carry significant risk and volatility. Always perform your own due diligence.