Two-year Bitcoin hodlers “absorbed” seller pressure in recent weeks, according to new research, but most analysts still expect new macro BTC price lows.

New analysis suggests that Bitcoin (BTC) is “relying” on early 2024 buyers as its price action stalls below $70,000.

Key points:

-

Bitcoin buyers from early 2024 are in focus as a giant potential safety net for BTC price.

-

Their cost basis extends down to $60,000, and a major capitulation has not yet happened.

-

New macro BTC price lows remain a popular near-term bet.

2024 Bitcoin hodlers have “absorbed” new sellers

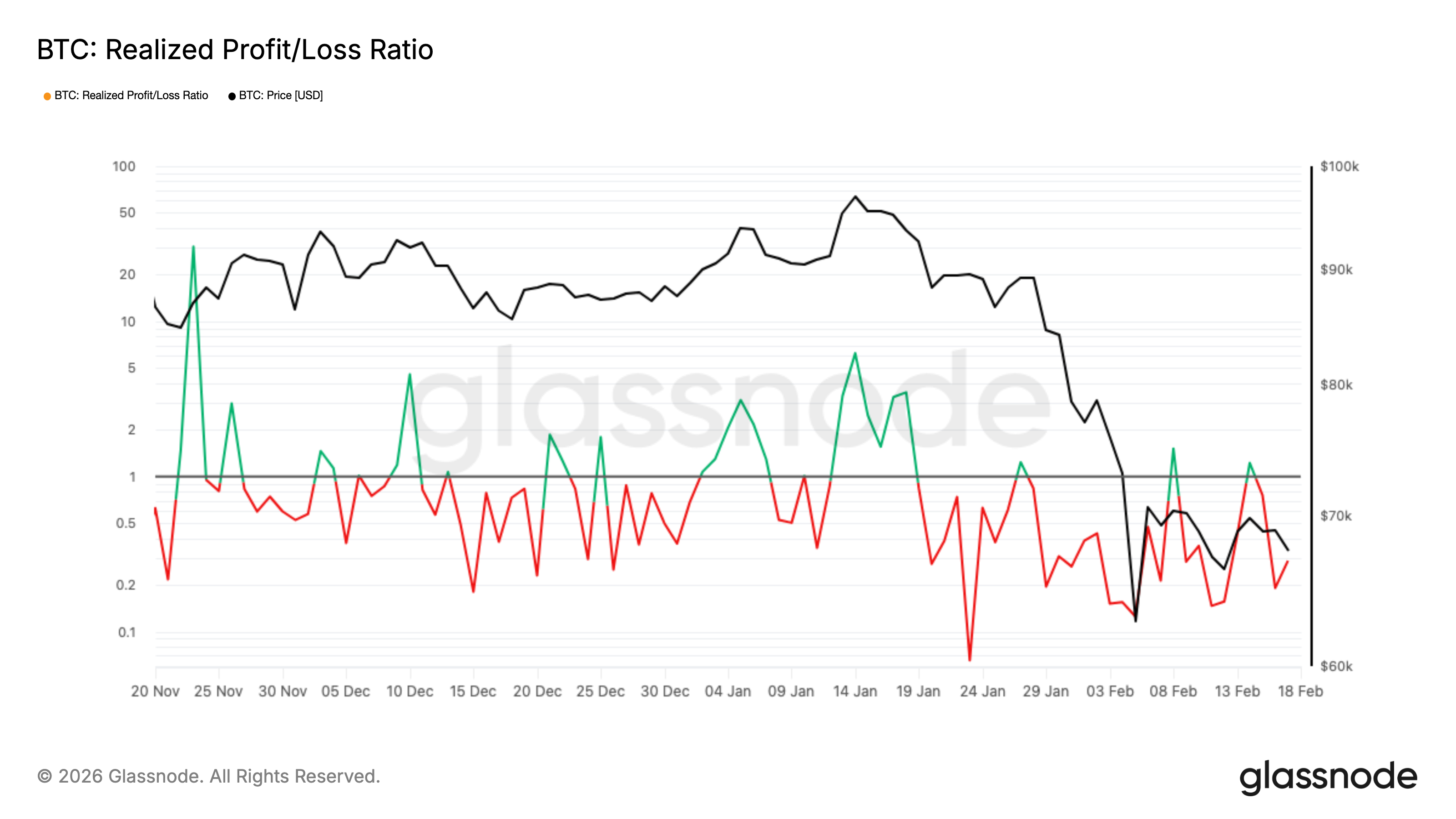

In the latest edition of its weekly newsletter, “The Week Onchain,” crypto analytics platform Glassnode said that BTC price was in a “dense demand zone.”

As BTC/USD treads water around 45% below its October 2025 all-time highs, buyers from long before that event are holding up the market.

Their importance has become much more noticeable since Bitcoin dropped below its true market mean price near $80,000.

“A closer inspection of price behavior since the breakdown below the True Market Mean indicates that downside pressure has largely been absorbed within a dense demand zone between $60k and $69k,” Glassnode summarized.

“This cluster was primarily established during the H1 2024 consolidation phase, where investors accumulated within a prolonged range and have since held their positions for over a year.”

Researchers referenced the seven-month consolidation structure that characterized much of 2024, and which itself placed old all-time highs of $69,000 from late 2021 in focus.

Now, those buyers face falling into unrealized loss, but are so far avoiding capitulation.

“The positioning of this cohort near breakeven levels appears to have moderated incremental sell pressure, contributing to the development of another sideways structure since late January 2026,” “The Week Onchain” continued.

“The defense of the $60k–$69k range suggests that medium-term holders remain resilient, allowing the market to transition from impulsive decline into range-bound absorption.”

New BTC price lows in “next week or so?”

The presence of hodler resilience comes at a crucial time as market participants still expect new macro lows to come next.

Related: Bitcoin price ignores $168M Strategy BTC purchase as Iran tensions escalate

As Cointelegraph reported, Bitcoin traders have little faith in the current range holding as support, with $50,000 now a popular target.

“Expected a quick bounce to reset indicators then straight back down. I still believe 52-53k is coming in the next week or so,” one such forecast from trader Roman stated this week.

An accompanying chart suggested that the indicator “reset” would affect the relative strength index (RSI) and moving average convergence/divergence (MACD) on four-hour time frames.

Earlier, Cointelegraph noted rare lows for weekly RSI, with analysis hinting that such levels were a once-per-cycle phenomenon.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.